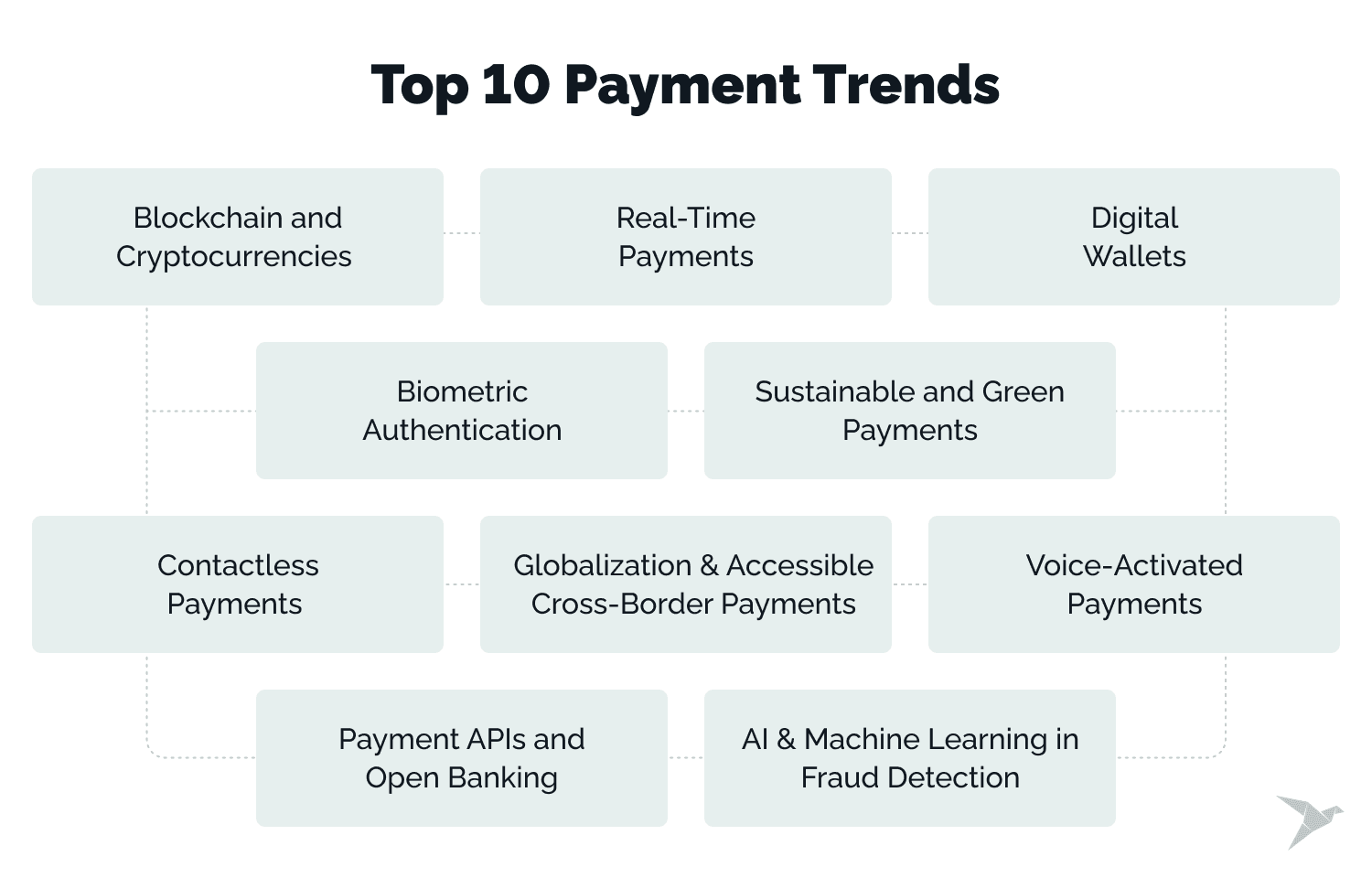

Payments Innovation: Top 10 Payment Trends That Can Make or Break Your Service

Last updated:2 August 2024

Today, payment technologies are evolving faster than you can say the word "bitcoin."

We've witnessed an era of innovation in recent years, with new technologies changing how we pay for everything from our morning coffee to that dream vacation.

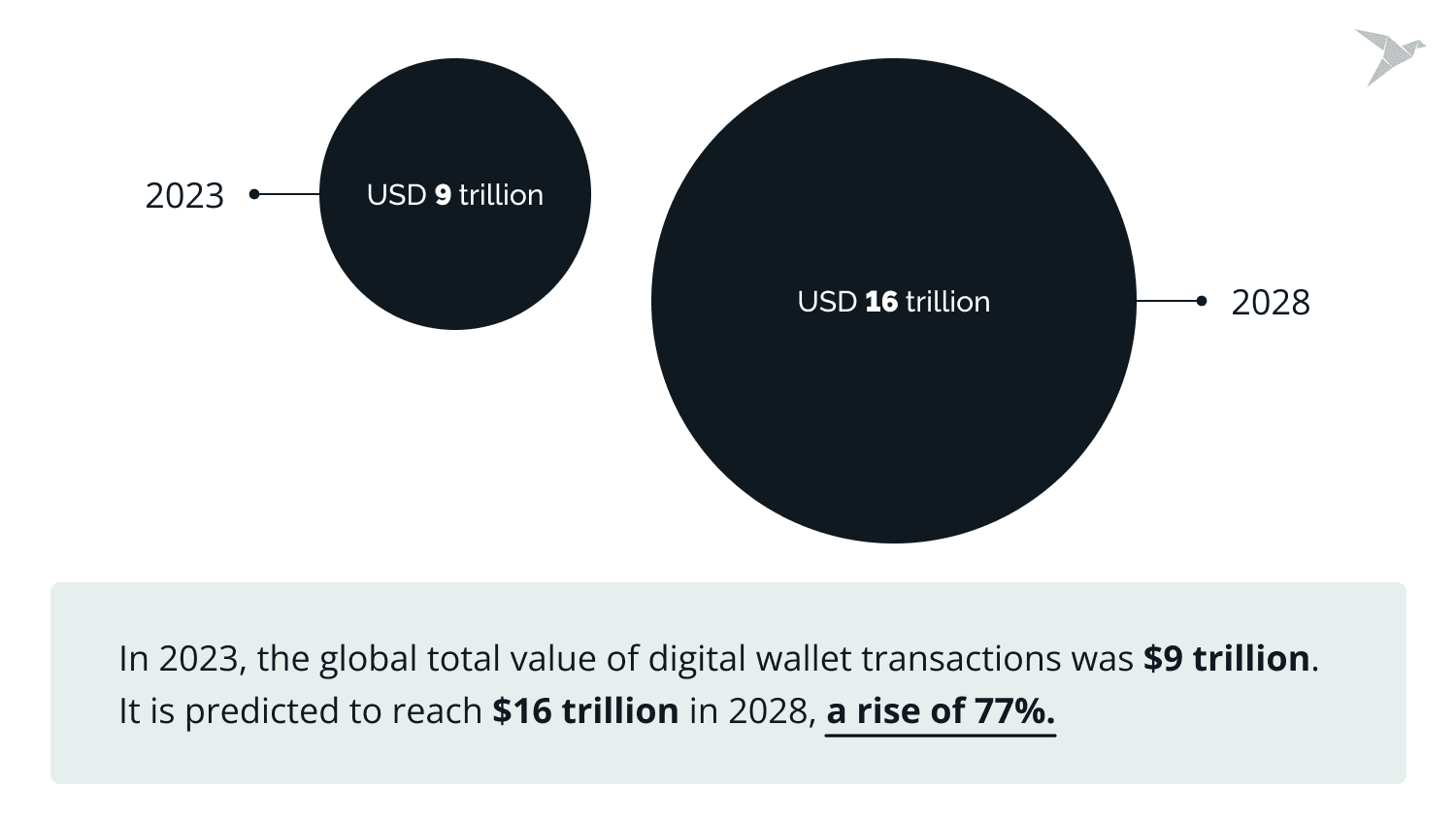

The total transaction value in the digital payments market is expected to reach $11.55 trillion in 2024 and continue to grow to $16.59 trillion by 2028. This rapid evolution introduces both challenges and opportunities for businesses.

Judging from our experience, we can confidently say that customers, without any exceptions, expect a seamless and secure payment experience. That’s why being aware of innovations is crucial for success.

This article dives into the top trends shaping the dynamic world of payments. We'll explore how these trends can impact your service and ensure your business thrives in the face of innovation.

So, let's explore innovations that can elevate your service!

Trend 1: Blockchain and Cryptocurrencies

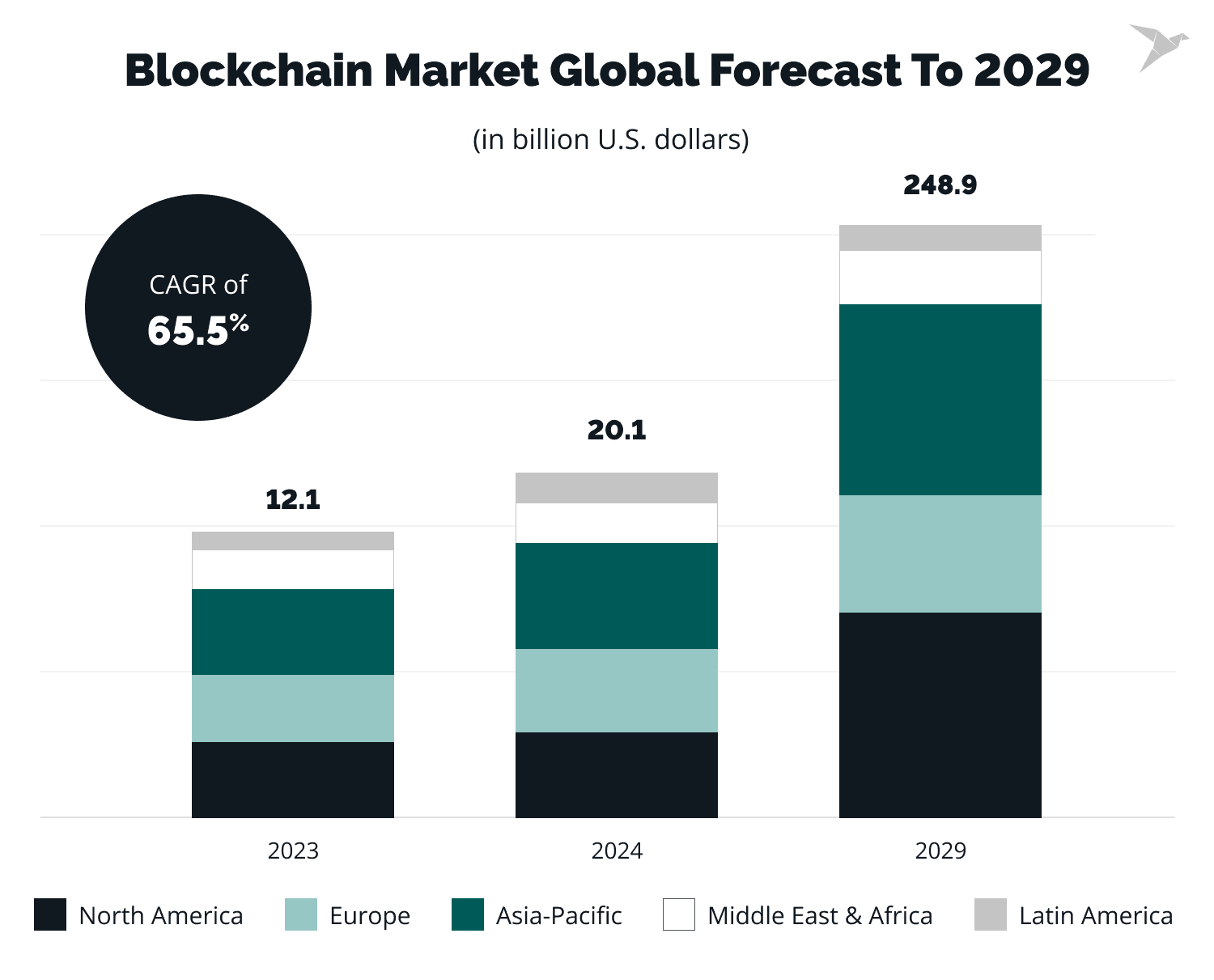

As you may have noticed, the tendency to use cryptocurrencies for money transfers is growing. This happens due to recent advancements in blockchain technology and increasing trust from both consumers and companies. According to the report by Marketsandmarkets, the global blockchain market size is expected to grow from $20.1 billion in 2024 to $248.9 billion by 2029. Such increasing investment proves the necessity to be aware of this innovation.

Let's now explore the factors contributing to this innovation trend in detail.

What makes cryptocurrency an important innovation in payments

Firstly, consumer demand organically resulted in wide cryptocurrency implementation, as cryptocurrency provides better protection and privacy, which is attractive for consumers who are looking for alternative ways of payment.

The second factor is adoption by huge corporations. Organizations like Microsoft, Overstock, and AT&T now accept Bitcoin. This way, they benefit from low transaction fees and involve tech-savvy customers. As of July 2024, the market cap of Bitcoin is at $1.33 trillion, which means it makes up 52.72% of the total value of the crypto market.

In third place, regulatory support plays an important role. Innovative laws in countries like Switzerland and Japan boost the wider adoption of cryptocurrency transactions.

Businesses embracing Blockchain for secure payments

Blockchain, as the foundation of cryptocurrencies, is attractive due to its safe and transparent payments. Its benefits lead to the rising implementation by companies:

- IBM. IBM's World Wire blockchain optimizes cross-border payments. It allows near real-time clearing and settlement and saves time and costs.

- Visa. The Visa B2B Connect network integrates blockchain to simplify direct cross-border B2B transactions and increase transparency and security.

- Walmart. Walmart uses blockchain to enhance supply chain transparency and optimize payments to suppliers.

While fairly praised for their payment innovations, blockchain and cryptocurrencies have some pitfalls. Let's sum them up.

- Regulatory uncertainty presents a major obstacle as inconsistent rules across regions create legal and compliance risks.

- The instability of cryptocurrencies can produce unpredictable financial outcomes for both consumers and enterprises.

- The scalability problems of blockchain networks often lead to slow transaction speeds and high charges during busy times.

- The energy consumption tied to blockchain operations raises environmental and sustainability worries.

- Security weaknesses and the risk of cyberattacks can undermine trust and stability in these systems.

Trend 2: Real-Time Payments

A real-time payment (RTP) provides immediate money transfers between bank accounts. Such digital payments function independently of the time or day of the week. Unlike traditional methods characterized by time-consuming processing times, RTP delivers funds within seconds. This innovation transforms the financial landscape as it enables seamless, efficient, and secure financial transactions.

Have you heard that 19.1% of all electronic transactions in 2023 were real-time ones? The demand for immediacy and ease of use within the digital era is driving the demand for RTP. As both consumers and organizations strive for faster and more secure payment alternatives, RTPs are rapidly becoming a cornerstone of the financial system.

The recent report by ACI Worldwide predicts that real-time transaction volume will reach $575.1 billion by 2028. This swift adoption underscores the crucial role that RTPs play in modernizing financial services and their capacity to fulfill ever-evolving expectations.

One example of an RTP platform is FedNow, an instant payment system for US banks. Another example is SEPA, which allows immediate euro payments across 36 European countries.

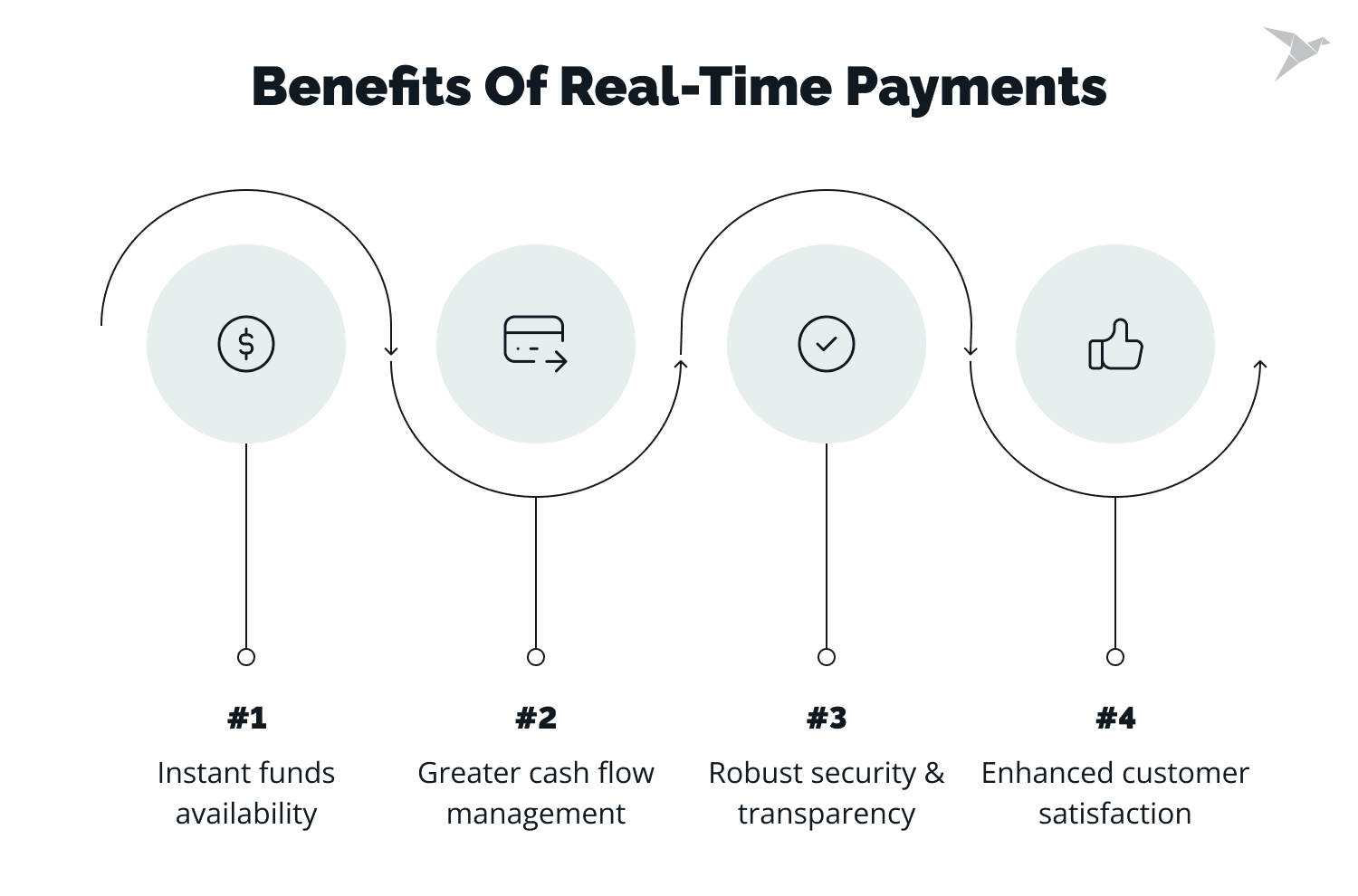

Benefits of real-time payments

The paramount advantage of RTP is its speed, or, in other words, instant funds availability. Whether these are bills, transfers to friends, or commercial invoices, all experience immediacy. This is particularly beneficial in the circumstances demanding urgency.

RTPs provide greater cash flow management for organizations, as they guarantee instant access to funds. This is essential for small and medium-sized enterprises that depend on timely payments. Minimized delays between invoicing and receiving payments empower companies to optimize financial planning and mitigate liquidity risks.

One of the key benefits is robust security and transparency of a real-time payment. RTP systems incorporate robust cybersecurity measures to safeguard against fraud. Additionally, their transparency affords both parties the ability to monitor payments in real-time. These foster peace of mind and minimize disputes.

Of course, the advantage of RTPs is enhanced customer satisfaction. RTP offers a significant edge over competitors. Consumers consider immediate financial transactions as a high value, as it results in increased satisfaction and loyalty. Organizations that implement RTP are more likely to attract and retain customers seeking efficiency and reliability in financial services.

Industries and companies successfully implementing real-time payments

E-commerce

A forerunner in RTP adoption, the electronic commerce sector boasts established companies like Amazon and Alibaba, providing seamless and immediate checkout experiences. This not only elevates customer satisfaction but also boosts sales by reducing the number of abandoned carts.

Gig economy

Platforms such as Uber and Upwork have enthusiastically embraced RTP to deliver immediate payments to their workforce. For gig workers who rely on quick payments to manage daily expenditures, RTPs represent a transformative development. This integration has enhanced worker satisfaction and retention and contributed to the expansion of the gig economy.

Banking

Financial institutions are leveraging RTP to maintain competitiveness and satisfy customer demands. Entities like JPMorgan Chase and HSBC have introduced RTPs to provide their customers with efficient payment solutions. This introduces them as leaders in financial innovation.

Retail

Retail leaders like Walmart and Target are adopting RTP to optimize their supply chain payments and improve relationships with vendors. They guarantee immediate payments to suppliers so that these retailers can negotiate more favorable terms and enhance inventory management processes.

Be careful: drawbacks of real-time payments

While RTPs offer numerous benefits, their implementation introduces certain challenges.

- Сostly infrastructure upgrades. Shifting to RTP necessitates substantial investments in technology, cybersecurity, and staff training. These costs can be a significant barrier for smaller financial institutions and organizations.

- Cybersecurity risks. While one of RTPs key benefits is robust safety, there are still some hurdles. RTP transactions speed limit time for fraud detection so that they become attractive targets for cybercriminals. Reliable protection measures and real-time fraud detection are vital, but they add complexity and expenses.

- Navigating regulatory complexities. The regulatory landscape for RTP varies by region. Different regulations and standards require constant monitoring and adaptation, consuming resources. Get more valuable insights by reading our blog post about RegTech.

- Limited interoperability. Seamless financial transactions across diverse RTP platforms necessitate standardized protocols and collaboration. Without interoperability, the full potential of RTP remains unrealized.

- Demanding operational requirements. RTP necessitates constant availability and real-time processing, which require operational resources. Financial institutions and organizations necessitate reliable infrastructure and ongoing monitoring to ensure constant system uptime.

- Building consumer trust. Making clients trust you is challenging. A lot of consumers who use traditional payment methods often hesitate to try new technologies. Explaining to consumers the advantages of RTP is crucial.

Learn about our expertise in the industry and what we have to offer

Trend 3: Digital Wallets

With the era of smartphones and the demand for seamless digital experiences, digital wallets have become the top payment method. Digital wallets, or e-wallets, store financial information on mobile devices or online platforms.

In 2023, the global total value of digital wallet transactions was $9 trillion. Moreover, it is predicted to reach $16 trillion in 2028, a rise of 77%. Think of the fact that more than a half, namely 60%, of the global population is expected to use e-wallets in 2026. This proves the rising demand for their usage.

Factors contributing to e-wallet rise

- Firstly, technological advancements, such as smartphones and mobile technology, have made e-wallets accessible and easy to use.

- Secondly, consumer preferences naturally caused digital wallets popularity, as consumers seek quick, contactless payments.

- Thirdly, it was the pandemic which influenced and accelerated the adoption of touch-free payment methods.

Let's now explore the key benefits of e-wallet usage.

Digital wallets provide significant benefits for consumers and organizations. The benefit which is on the top is convenience. Such wallets enable quick transactions without physical cards, integrating loyalty programs and transaction history.

The second benefit is security. Digital wallets are safe to use, especially if advanced security measures like tokenization and biometric authentication are used to reduce fraud. One more advantage is efficiency for businesses. E-wallets enable streamlining operations and reducing transaction times. These factors enhance customer satisfaction.

Key players in the market

- Apple Pay. Offers secure, seamless payments using NFC technology and integrates with various apps and websites.

- Google Wallet. Part of Google Pay, it supports in-store, online, and peer-to-peer transactions on Android devices.

- Samsung Pay. It uses NFC and MST technologies and works with a wide range of terminals.

- Venmo. Allows for quick and easy payments between friends, with features for splitting bills, keeping track of transactions, and sharing them on social media.

- PayPal. Offers a complete platform for worldwide payments, online purchases, creating invoices, and tools for businesses.

- CashApp. Enables fast money transfers and goes beyond that by offering investment options, direct deposits, and debit card services.

- Zelle. Focuses on sending money instantly between linked bank accounts using just basic contact information.

What’s new in the digital wallet world?

The growing support for cryptocurrencies by nation-states is a big transformative shift. For instance, Argentina has recently embraced Bitcoin as a valid currency for official contracts, driving millions to adopt digital wallets to manage their crypto assets. This move is expected to accelerate the global adoption of e-wallets further.

Moreover, digital wallets are becoming more versatile, connecting not only fintech-savvy users but also reaching underbanked communities in developing markets. The natural integration of e-wallets with peer-to-peer payments, Buy Now, Pay Later (BNPL) solutions, and lending options is expanding their utility and appeal.

The usage of a digital wallet presents convenience, protection, and efficiency. With key players like Apple Pay, Google Wallet, and Samsung Pay, e-wallets are becoming central to the future of digital payments.

Trend 4: Biometric Authentication

Biometric authentication employs distinctive physical attributes such as fingerprints, facial features, and iris patterns to validate digital payments. Embedded in smartphones, ATMs, and POS systems, these technologies provide safe, seamless transactions.

Let's explore the factors that contribute to the growing adoption of biometric payments.

- Widespread integration. Major platforms like Apple Pay and Google Pay use fingerprint and facial recognition, increasing consumer trust.

- Enhanced user experience. The convenience of quick, secure payments without the need for passwords or cards drives adoption.

- Regulatory support. Today, governments and regulators are integrating biometrics into ID systems and banking regulations to enhance security standards.

Let’s sum up key cybersecurity advantages of biometric methods:

- Enhanced protection. Biometrics mitigates fraud risks, as they are unique and difficult to replicate compared to passwords or PINs.

- Real-time verification. The biometric method provides immediate authentication so that it speeds up transactions and improves user experience.

- Reduced fraud and theft. The unique nature of biometric data minimizes identity theft and unauthorized access, which is crucial for preventing card-present fraud and ATM skimming.

Trend 5: Sustainable and Green Payments

Today, both clients and companies become more and more aware of environmental issues. This awareness results in the rising demand for sustainable and green payments. This trend involves embracing such practices and ways of payment that decrease the environmental impact and promote sustainability.

We want to highlight two main driving factors for this trend. Firstly, as mentioned above, it is about consumer demand. Users are more environmentally conscious, so they prefer companies that prioritize sustainability.

The second factor is corporate responsibility. A lot of companies are implementing sustainability into their values and strategies. Of course, it involves the payment processes, with companies aiming to meet environmental goals and enhance their corporate image.

Innovations in sustainable payments

- Eco-friendly payment cards. Central banks, payment service providers and financial institutions are presenting payment cards made from sustainable materials such as recycled plastic or biodegradable materials. These cards decrease the environmental footprint associated with traditional plastic cards.

- Digital and contactless payment. There is a notable reduction in the reliance on physical cash and paper receipts. Digital and contactless payment help decrease environmental waste.

- Blockchain and cryptocurrencies. Some blockchain technologies are developed to be more energy-efficient. For example, Ethereum is a leading blockchain platform that uses the Proof of Stake system to enhance security and energy efficiency. Digital assets like Chia are designed to consume less energy compared to traditional cryptocurrencies like Bitcoin, which makes them a more sustainable option for payments.

Examples of sustainable payment initiatives

Mastercard’s eco-friendly card program

Mastercard has initiated a program motivating banks to issue cards produced from sustainable materials. This endeavor aims to reduce the environmental consequences of plastic card manufacturing and disposal.

Stripe climate

Stripe empowers its users to contribute a portion of their revenue to support carbon removal projects. This initiative backs the development of technologies and ventures focused on reducing atmospheric carbon dioxide and aligning payment processing with environmental sustainability.

Benefits of sustainable and green payments

- Environmental impact. Sustainable payment approaches help reduce waste and carbon emissions, contributing to environmental preservation.

- Corporate image. Adopting green payment solutions can enhance a company’s reputation and attract environmentally conscious consumers and investors.

- Regulatory compliance. As governments introduce stricter environmental laws, sustainable payment practices can help organizations comply with new laws and avoid penalties.

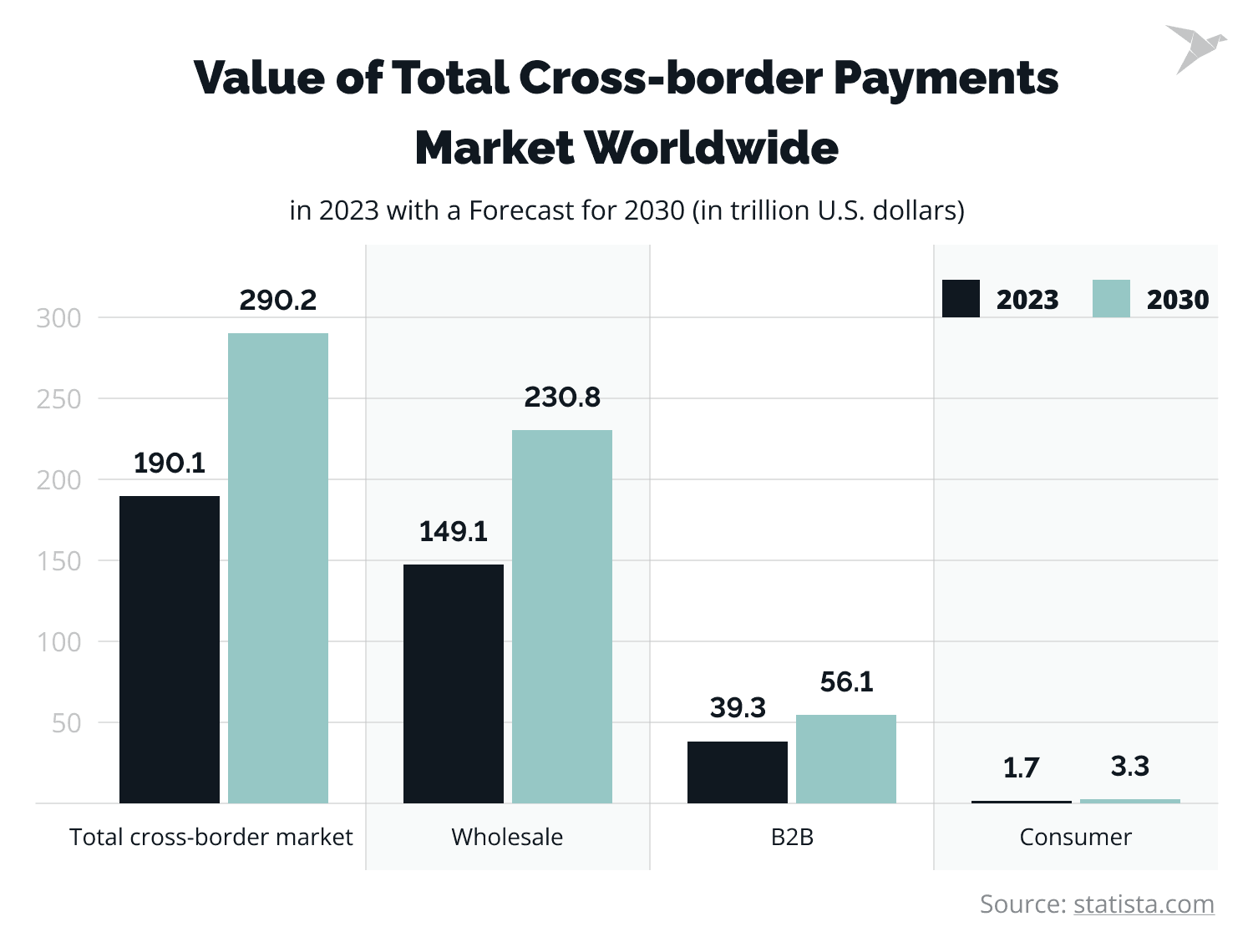

Trend 6: Globalization and Accessible Cross-Border Payments

At least once in your life, you've probably faced some difficulties while making cross-border payments. Unlike with domestic payments, users often associate cross-border payments with having troubles. The common issues users often encounter while cross-border payments are high expenses, long processing times, and complex law regulations. Traditional methods involve a lot of intermediaries, which leads to fees and delays. Currency exchange rates and compliance with global financial rules further complicate these transactions. With the development of new technologies, these obstacles are becoming easier to avoid. Some technologies were described above, but we'll sum up the innovation trends that are especially useful in cross-border payments.

Blockchain decreases the number of intermediaries while making international payments. This lowers costs and speeds up transactions. For example, Ripple's XRP offers immediate, low-fee international payments.

Platforms like PayPal and Bitcoin provide faster, cheaper digital payments as they bypass traditional banking systems. Real-time payment systems also come in handy with global payments. Instant payment solutions, like SEPA or FedNow, accelerate international transactions.

Fintech companies simplifying international transactions

Cross-border payments remain highly demanded all the time, so every world bank is trying to make international transactions easier with innovative solutions:

- Wise. Wise matches currency transfers peer-to-peer, which reduces costs and provides transparent fees and real-time rates.

- Revolut. Revolut offers multi-currency accounts for global money management at interbank exchange rates. This cuts out multiple bank accounts and conversion fees.

What is interesting, central banks are considering the idea of issuing their own central bank digital currencies (CBDC) specifically developed to execute cross-border payments more effectively.

Examples of solutions reducing costs and improving efficiency

- RippleNet. It uses blockchain to connect banks and payment providers. With RippleNet, real-time, low-fee international payments are possible.

- Visa direct. Visa enables instant, secure cross-border payments to over 200 countries through Visa's global network.

- SWIFT GPI. It enhances cross-border payment speed, transparency, and traceability while offering end-to-end transaction tracking.

Trend 7: Contactless Payments

Contactless innovations are widely used today in the payments industry. NFC (Near Field Communication) is the basis of most contactless transactions. They work this way: you just tap your card or mobile device to pay.

Let's have a look at the key benefits:

The first benefit of contactless operations is, undoubtedly, convenience. Users perform instant transactions without the necessity to enter a PIN or have cash. This greatly reduces checkout times. The immediacy and ease of use boost the overall shopping experience.

The second benefit is hygiene. The pandemic proved the importance of hygiene and triggered a transition to contactless payments. Having minimum physical contact with terminals and cash helps reduce the risk of viruses. Contactless operations are the preferred choice for health-conscious consumers.

Industries of integration

- Retail. Contactless operations are a standard in retail today. Most major chains offer this option. This trend has streamlined the checkout process, as it provides a faster and more efficient service for clients.

- Hospitality. The hospitality area has implemented contactless payments to improve guest experiences. Hotels and restaurants integrate contactless methods for room bookings, dining, and other services.

- Public transport. Many public transport systems worldwide have adopted contactless payments to allow passengers to pay fares quickly and easily without needing cash or paper tickets.

Trend 8: Voice-Activated Payments

We all know such voice assistants like Google Assistant or Apple Siri. They allow users not only to "google" information, but also complete transactions using simple voice commands.

Voice payments rely on voice recognition technology to verify transactions. Users connect their payment methods to the assistants and make payments through voice commands. The system identifies and verifies the user. Through voice biometrics, the transaction is processed securely.

Let's have a look at the key advantages of voice-activated payments:

- Hands-free convenience. Ideal for situations where manual entry is inconvenient, such as while driving or cooking.

- Enhanced accessibility. Offers an accessible alternative for individuals with disabilities or those who find traditional payment methods challenging. The technology helps promote financial inclusion.

- Seamless integration. Integrated with smart home devices and IoT ecosystems, enabling seamless transactions across various connected devices.

Let’s see some examples of voice-activated solutions:

- Amazon Alexa. It can help users buy products, pay for services, and transfer money via voice commands.

- Google Assistant. This assistant supports online shopping, bill payments, and peer-to-peer transfers through voice commands seamlessly within Google’s ecosystem.

- Apple Siri. Siri makes voice-activated payments through Apple Pay. It lets users transfer money, pay bills, and make purchases securely.

Challenges and future prospects

Although voice-activated technology introduces numerous benefits, this innovation still presents certain challenges. They relate to ensuring protection and preventing unauthorized transactions.

Technology evolves, so soon, voice-activated payments are expected to become more prevalent. They are expected to provide better convenience and accessibility in the payment landscape. This trend reflects a notable shift towards intuitive and user-friendly financial solutions driven by AI and voice recognition technologies.

Trend 9: Payment APIs and Open Banking

Payment APIs (Application Programming Interfaces) enable various software applications to communicate. They empower companies to embed payment processing directly into their platforms. This creates a seamless, integrated user experience.

Open banking refers to banks sharing customer information with third-party developers via APIs, all with the customer's consent. This way, the development of innovative financial solutions and products becomes possible. Hiring professional FinTech developers is crucial for success. Read our comprehensive guide on how to hire professional FinTech developers.

The number of open banking API calls is expected to grow from 102 billion in 2023 to 580 billion in 2027. Why is it gaining popularity? It happens as payment API technologies introduce major benefits. Let's see them.

Firstly, this is about seamless integrations. Payment APIs help organizations integrate various payment methods directly into their websites or apps. It greatly enhances the user experience.

Secondly, these are innovative financial services provided. Open banking enables the development of new financial services by providing third-party developers access to banking data. This leads to custom financial products like budgeting apps and competitive loan products.

Companies leveraging payment APIs

- Stripe. Stripe's reliable APIs empower organizations to embed payment processes into their platforms smoothly. Companies like Shopify and Amazon use Stripe’s APIs to handle transactions and boost the customer experience with an easy payment process.

- Plaid. Plaid connects applications to users’ bank accounts. It powers financial services like Mint and Robinhood. Plaid enables a personalized and comprehensive experience.

- PayPal. PayPal’s APIs allow companies to accept various payment services methods through a single integration. This provides multiple payment options within a unified interface.

What's new in the payment APIs and open banking trend?

Recent advancements in payment APIs focus on enhancing protection, expanding functionality, and improving user experience:

- Enhanced security. New security protocols, such as OAuth 2.0 and advanced encryption, protect user data and ensure safe transactions.

- Expanded functionality. APIs now offer more services, including fraud detection, currency conversion, and installment payments, providing businesses with enhanced tools.

- Better user experience. Open banking offers custom and streamlined financial services and enables financial data to be securely shared and utilized.

Trend 10: AI and Machine Learning in Fraud Detection

Artificial intelligence and machine learning provide advanced tools to detect and prevent fraud. They analyze vast amounts of information in real-time to identify abnormal patterns and anomalies that may be a signal of fraudulent activity.

AI and ML systems learn all the time to improve their accuracy and efficiency. This way, they can adapt to new fraud techniques. To learn more details, we recommend you read our blog post, which focuses on FinTech fraud prevention.

There are some examples of successful implementations. Let’s explore them:

- Visa's AI system. Visa's AI analyzes transactions in real-time and scores each transaction's fraud likelihood. This saves billions of dollars annually.

- Mastercard's decision intelligence. Mastercard uses AI to assess transaction risk. This reduces false declines and enhances security.

- PayPal's fraud detection. PayPal integrates machine learning to notice fraudulent transactions. The system scans millions of financial transactions every day, which greatly reduces fraud rates.

Let's conclude

In conclusion, the top ten payments innovation highlighted — blockchain and cryptocurrencies, biometric authentication, real-time transactions, digital wallets, sustainable and green payments, globalization and accessible cross-border payments, contactless and voice-activated payments, APIs and open banking, and AI and machine learning in fraud detection — are reshaping the financial sector.

These advancements not only reinforce the security, speed, and convenience of transactions but also cater to the growing demand for sustainability and global accessibility. At TechMagic, we keep up with all payment innovations and implement them in our solutions. If you want to stay ahead and drive customer satisfaction, let our experts in fintech development services help you create top solutions tailored to your business needs.

Your organization can provide customers with seamless, secure, and efficient payment experiences if you choose to integrate emerging payment trends. Don't hesitate to contact us and grow together!

FAQ

What are the top payment innovation trends in 2024?

The hottest trends are blockchain and cryptocurrencies, biometric authentication, real-time transactions, digital wallets, sustainable and green payments, globalization and accessible cross-border payments, contactless and voice-activated payments, APIs and open banking, AI and machine learning in fraud detection.

Why should organizations use payment innovations? What are the benefits?

Organizations should implement payment innovations to improve their services. Staying up-to-date with innovations results in enhanced customer experience, increased efficiency, security boost, and a competitive advantage. Moreover, innovations hold great potential for driving financial inclusion and economic growth in developing economies by providing access to affordable payment services. To find out the benefits specific to every innovation, check out the full article.

What are the potential risks associated with these trends? How can companies mitigate these risks?

Some of the potential risks include security and regulatory issues, volatility in cryptocurrency values, and many others. Each innovation has its own list of pitfalls (we've described them in the article). Companies can mitigate these if they implement robust protection measures, staying updated on regulations, diversifying payment options, and educating customers about potential risks.

How will the payment landscape evolve in the future?

The payment landscape will likely evolve towards a more digital, seamless, and inclusive ecosystem. As expected, emerging payment trends will be characterized by real-time transactions, increased use of cryptocurrencies and digital wallets, advanced security measures, and a greater focus on customer experience and data privacy.

Software Development

Software Development Security Services

Security Services Cloud Services

Cloud Services Other Services

Other Services

TechMagic Academy

TechMagic Academy