Insurtech Insights: Top Insurtech Trends and Technologies in 2026

Last updated:18 September 2025

Insurtech, the combination of insurance and technology, has been reshaping the way we consider and interact with insurance.

In this article, we explore the dynamic landscape and share insurtech insights into the most relevant technologies and trends.

Before discovering what changes insurtech brings and how they affect the industry, let's have a look at a brief history overview.

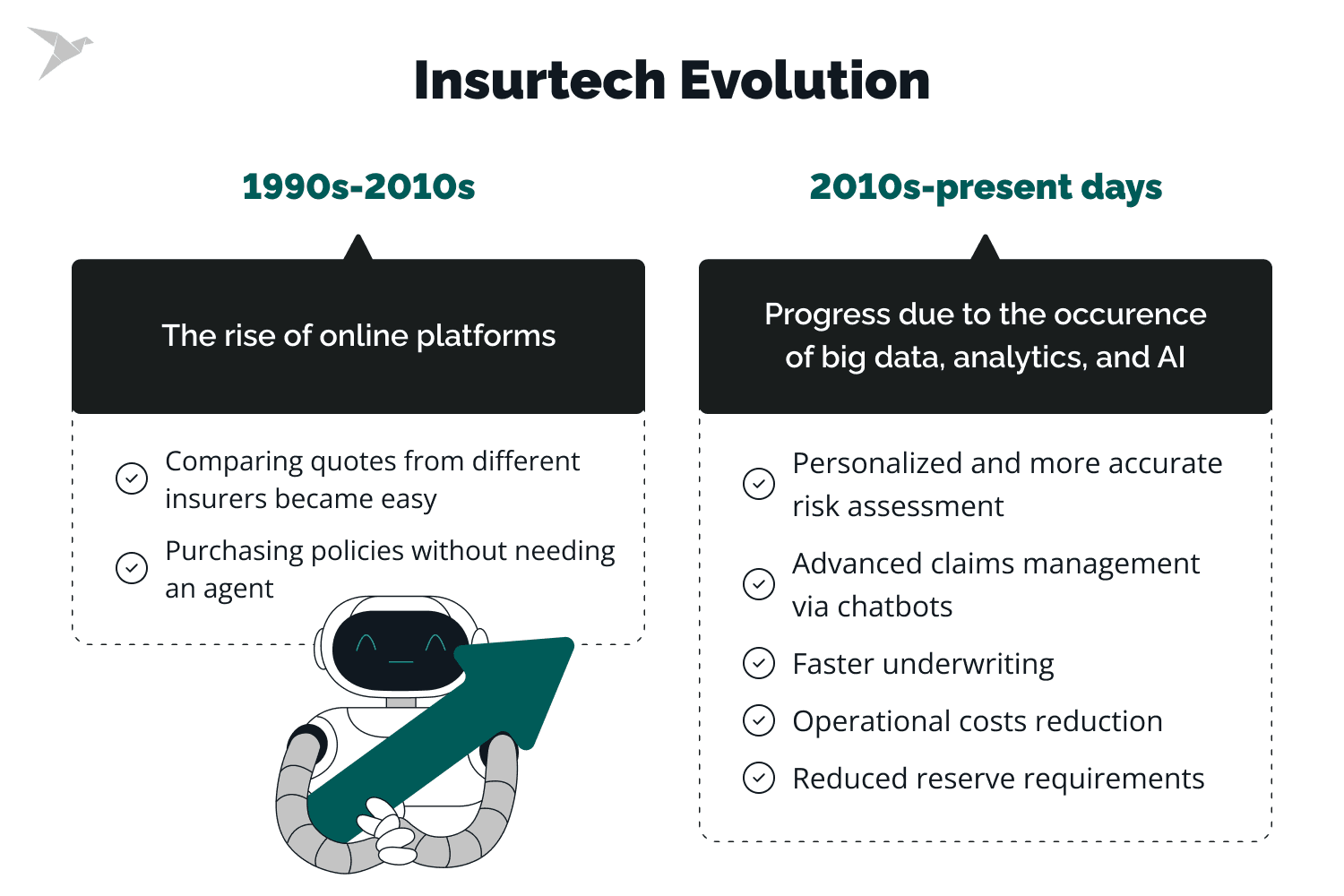

Insurtech Evolution: Innovations Matter

The insurance industry, earlier known for its traditional methods, has faced a significant transformation in recent years with the rise of insurtech. Here's a brief look at its evolution:

1990s-2010s

The focus was on making insurance more accessible. The rise of online platforms allowed customers to:

- Compare quotes from different insurers easily

- Purchase policies directly without needing an agent

2010s-present days

With the occurrence of big data, analytics, and artificial intelligence (AI), insurtech has achieved significant progress, resulting in:

- Personalized & more accurate risk assessment

- Faster underwriting

- Advanced claims management via chatbots

- Operational costs reduction

- Reduced reserve requirements

Why Is Understanding the Future of Insurtech So Important?

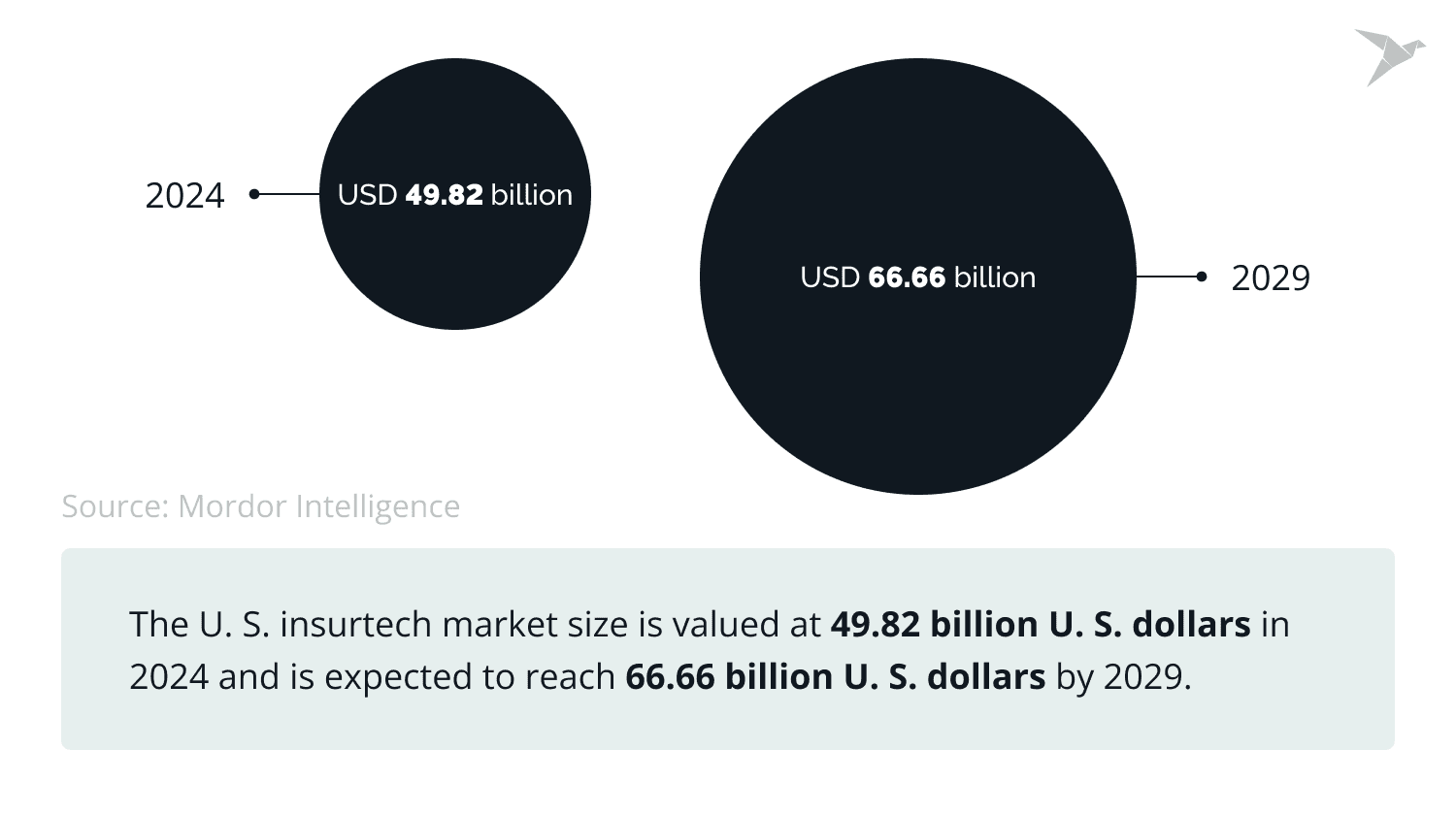

The insurtech industry is persistently developing, and traditional insurance players must adapt to remain relevant. The U. S. insurtech market size was valued at 49.82 billion U. S. dollars in 2024 and is expected to reach 66.66 billion U. S. dollars by 2029.

Here's why understanding its future is essential:

Customer demands are growing

Customers today want more analytics on their data and demand a seamless digital experience, from obtaining quotes to filing claims. Insurers need to compete in the market and embrace technology to meet these expectations.

New technologies are emerging

From AI-powered underwriting to blockchain-based security, insurtech is continuously innovating. Understanding these trends enables insurers to identify potential possibilities and risks.

Greater competition

The insurtech space is attracting new entrants, which is putting traditional players under pressure. Being informed about the competitive landscape is vital for existence.

Understanding the evolvement of insurtech empowers traditional insurance companies to:

- Develop innovative products and services

- Improve operational efficiency

- Enhance customer experience

- Reduce costs and time to market

So, without further ado, let’s discover the trends of the insurtech future together!

What Are the Top Insurtech Trends and Technologies for 2026?

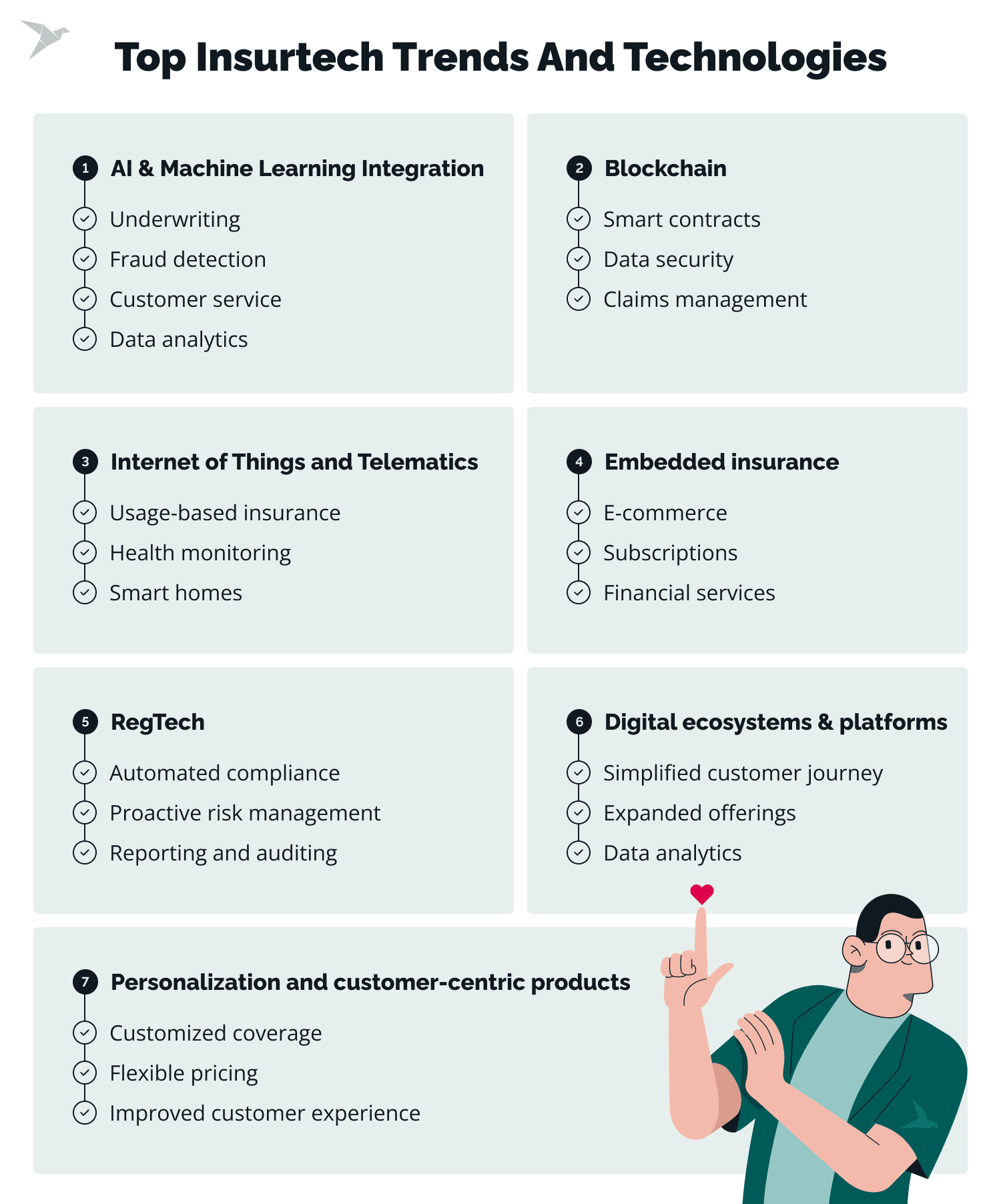

AI and Machine Learning Integration

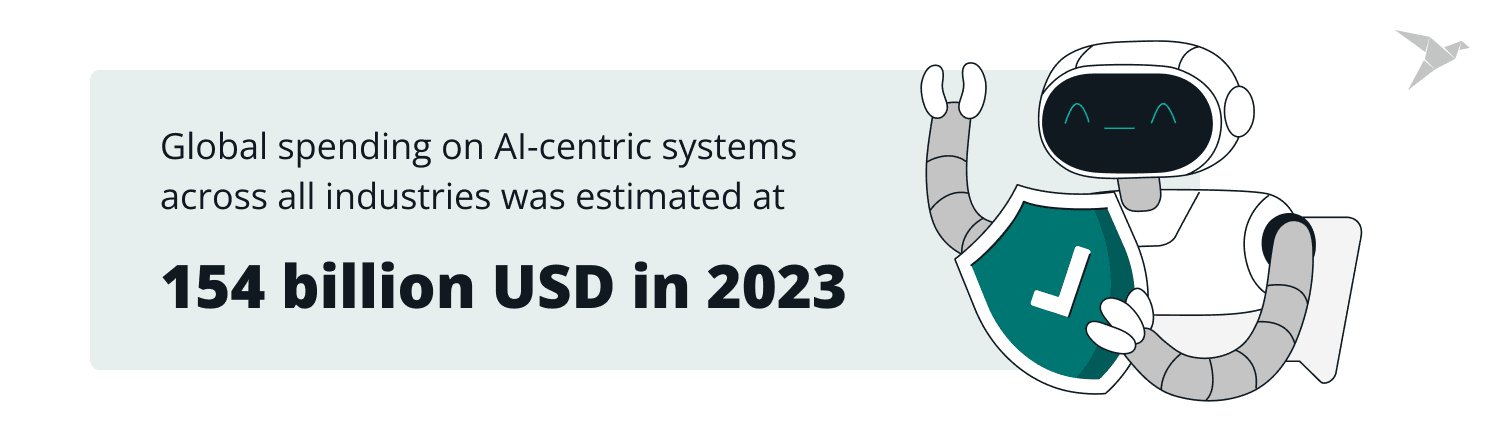

One of the most valuable insurtech insights is the awareness of AI's significance. Insurtech innovation is considerably affected by the continuous development of artificial intelligence and machine learning (ML). Global spending on AI-centric systems was estimated at 154 billion U. S. dollars in 2023 across all industries.

AI and ML technologies are enhancing different parts of the insurance process, such as:

Underwriting

AI's prognostic power enables more accurate risk evaluations and customized pricing models for insurance policies. AI is revolutionizing underwriting processes by uncovering inconspicuous patterns and risk indicators through analyzing voluminous datasets from varied sources. This results in more exact risk assessments and bespoke insurance products that better align with individual customer requirements.

Fraud detection

Machine learning algorithms can spot unusual patterns and actions, and help reduce fake claims. These advanced systems constantly check and analyze information to find suspicious activity right away. This not only stops fraud but also saves insurance companies a lot of money and keeps the insurance process honest.

Customer service

AI-powered chatbots and virtual assistants give customers support right away and make interactions more efficient. These tools can handle a wide range of inquiries, from answering basic questions to assisting with policy applications and claims processing. This enhances the overall customer experience by offering quick, accurate responses and freeing up human agents to handle more complex issues.

Data analytics

AI empowers insurers to uncover hidden usage and billing trends in customer data. This enables more personalized, efficient services and improves risk assessments and product offerings. Predictive analytics allow insurers to foresee claims and address issues before they snowball. As data's value grows, these advanced tools reshape insurance into a more responsive, customer-centric realm.

Blockchain for transparency and security

Blockchain technology is drawing attention due to its ability to guarantee transparent, secure, and unalterable transactions. According to MarketsandMarkets, the global blockchain market was valued at approximately 7.4 billion U. S. dollars in 2022 and is projected to exceed 94 billion U. S. dollars by 2027. In the insurtech insights main stage, it is essential to highlight that blockchain technology results in reinforcing such processes as:

Smart сontracts

These self-executing agreements automate claims processing and policy management. Smart contracts operate on the blockchain, executing automatically when predefined conditions are met. This reduces the need for intermediaries, speeds up processes, and minimizes the potential for human error.

Data security

Blockchain strengthens protection for sensitive customer data and guarantees adherence to data privacy rules within the insurance technology industry. Its decentralized nature makes tampering extremely hard for unauthorized parties. Every piece of information is encrypted and chained to prior transactions, which creates a robust security system that safeguards personal data.

Claims management

Blockchain creates a transparent and unalterable record of claims history, so that it reduces disputes and accelerates settlements. Every claim processed is recorded on the blockchain, which introduces a clear and immutable audit trail. This transparency helps with quick claims verification, fraudulent activities reduction, and ensuring that settlements are handled promptly and fairly.

Internet of Things (IoT) and Telematics

Internet of Things (IoT) devices and telematics are transforming the way insurance companies assess risk and interact with customers. The worldwide automotive IoT market reached a revenue of 251.9 billion U. S. dollars in 2024. These technologies empower insurers to design more customized and dynamic insurance products.

Here are the examples of how IoT can be applied:

Usage-based insurance (UBI)

Devices installed in vehicles (telematics) enable insurers to design personalized auto insurance proposals. These devices track different aspects of driving behavior, including speed, braking, and mileage. Insurers can offer policies that fit an individual's actual driving habits, potentially rewarding safe drivers with lower premiums and encouraging better driving practices.

Health monitoring

Wearable devices can monitor health info, which lets insurers offer custom health insurance plans and provide wellness rewards. These devices track metrics such as heart rate, activity level, and sleep patterns. Insurers can use this data to assess an individual's health risks more precisely and create insurance plans that encourage healthier lifestyle.

Smart homes

IoT sensors that monitor home environments can help avoid damage and optimize property insurance policies. These sensors can detect conditions such as temperature fluctuations, humidity, and possible water leaks. This technology warns homeowners about potential issues before they become major problems. Insurers can use this data to offer more proactive and custom coverage options. This leads to reducing claims and enhancing customer satisfaction by helping to prevent property damage.

Digital ecosystems and platforms

Digital ecosystems and platforms are receiving major focus from insurtech organizations. These platforms aim to provide a holistic approach for customers and integrate various services and technologies into a seamless user experience. Here are the key points:

Simplified customer journey

One platform to buy, manage, and update insurance policies. Digital ecosystems simplify the insurance process by letting customers handle all their insurance needs in one place. This reduces complexity, enhances convenience, and makes it easier for customers to buy, review, and change their policies as needed.

Expanded offerings

Partnerships and integrations with fintech, healthtech, and other technology areas broaden the service spectrum. Working together with companies across various industries lets insurers offer a wider variety of products and services beyond traditional insurance offerings.

Data analytics

Advanced data analytics lets insurers build a network where information flows smoothly. Digital platforms, fueled by data crunching, boost teamwork between insurers, customers, and other companies.

As these ecosystems expand, data analysis is becoming a vital tool for simplifying operations and improving customer experiences. The future of insurance is more and more data-focused, interconnected, and puts the customer first.

Embedded insurance

Embedded insurance is a growing trend that involves integrating insurance products directly into other services and products. This seamless integration provides customers with convenient access to insurance exactly when and where they need it.

Let’s have a look at the ways how it can be applied:

E-commerce

Customers can buy insurance for items like gadgets or travel bookings right at the checkout. For example, when buying a new smartphone or booking a holiday, they can pick insurance coverage in just a few clicks. This not only improves the customer experience by offering extra protection but also increases the chances of insurance uptake because of its convenience.

Subscriptions

Insurance can be tied together with existing subscription services, like car rental or home maintenance plans. For instance, users of car-sharing services can automatically get insurance coverage as part of their subscription, or homeowners can combine insurance with home maintenance services. This integration makes it easier to obtain and manage insurance.

Financial services

Insurance products can be incorporated with banking and investment apps to create an all-in-one shop for financial industry solutions. Customers can access life insurance, health insurance, and other types of coverage through their bank’s mobile app or investment platform. This comprehensive approach not only provides ease of use but also helps build a more holistic financial plan for customers.

Personalization and customer-centric products

The focus on personalization and customer-centricity is gaining importance in the insurance industry. At TechMagic, we offer insurance app development services to optimize your operations and enhance the customer experience. Insurance companies are leveraging data and technology to provide more tailored and responsive services to their customers, such as:

Customized coverage

Customers can pick insurance options that match their unique needs and preferences. Individual data points analysis enables insurers to offer a range of coverage options adjusted to different lifestyles and requirements so that each customer gets the most relevant and beneficial insurance plan.

Flexible pricing

Premiums can adjust in real time based on changes in risk factors and behaviors. This adaptability can lead to more competitive pricing and improved risk management for both insurers and customers.

Improved customer experience

Tailored communication and services can lead to happier and more loyal customers. Through the use of AI and big data, insurers can provide custom interactions and support, and address individual customer needs more effectively. This fosters stronger relationships and improves overall customer involvement.

RegTech

Regulatory Technology (RegTech) is gaining significance in the insurance sector as companies face a complex regulatory environment. RegTech solutions help insurers navigate and comply with regulatory requirements more efficiently and accurately.

Here’s how RegTech optimizes the processes:

Automated compliance

RegTech offers tools that simplify adherence procedures, reduce administrative paperwork, and guarantee compliance with regulations. These tools automate the monitoring and enforcement of regulatory standards so that they ensure that insurers remain compliant without the need for extensive manual work.

Proactive risk management

Advanced data analytics are implemented to identify and mitigate potential regulatory risks. RegTech tools can warn about potential compliance issues before they become significant problems in order to take proactive measures to manage risks.

Efficient reporting and auditing

Automated solutions guarantee precise and timely regulatory reporting. RegTech tools facilitate accurate data collection and reporting. This simplifies the auditing process and makes sure all regulatory submissions are done on time.

Challenges Faced by Insurtech Startups

Regulatory compliance

For insurtech startups, staying compliant with all the regulations can be a real challenge. The insurance industry is one of the most strictly controlled, with each country - and often even regions within a country - having its own set of laws and guidelines. Being adherent to all the requirements needs significant resources and expertise, which can be especially burdensome for startups with limited resources and staff. The evolving nature of regulations also demands permanent alertness and flexibility.

At TechMagic, we provide insurtech solutions designed to navigate the evolving landscape of fintech regulation and ensure compliance and security for your innovative insurance products.

Gaining consumer trust

Building trust with customers is a big hurdle for insurtech startups. It's difficult to make people switch from well-known companies they're used to to new startups they haven't heard of. Startups must work hard to demonstrate reliability, security, and customer-centric services. Establishing a solid reputation in a short period, especially in an industry that deals with people's financial security and peace of mind, is a critical yet challenging task.

Access to capital

Securing funding is essential for the growth and development of insurtech startups, yet it remains a major challenge. The insurance industry is expensive to enter, as it requires significant investment in technology development, regulatory compliance, and customer attraction. This lack of access to funds can limit a startup's ability to create new ideas, expand, and compete effectively.

Technology integration

Integrating new technologies with existing insurance systems introduces technical and financial challenges. Many traditional insurers rely on outdated systems that are not easily compatible with modern technologies. This creates significant problems for startups looking to innovate and provide seamless, tech-based solutions. The cost and complexity of integration can slow down the deployment of new technologies and limit the potential for collaboration with established insurers.

Market competition

The insurance technology market is highly competitive, with many startups competing for market share and investment. To get noticed in a crowded field of incumbent insurance companies requires a unique value proposition and a superior customer experience. Startups must constantly innovate to tackle challenging and strategic issues, stay ahead of competitors, and meet ever-changing consumer expectations. The pressure to set themselves apart and stay competitive is intense and requires considerable strategic and operational agility.

Customer acquisition and retention

Winning and keeping customers is a long-term challenge for insurtech startups. Effective marketing strategies are key to attracting customers, but limited budgets compared to established insurers can make this difficult. Once customers are acquired, keeping them requires delivering excellent service all the time and being able to adjust to their evolving needs.

Building partnerships

Forming partnerships with traditional insurers and other stakeholders is essential for growth but often challenging. Established insurers may be hesitant to change or cautious about partnering with younger, less proven. To be successful, startups need to clearly show their worth and make sure their goals match those of potential partners.

How to Stay Ahead of the Competition in Insurtech?

To thrive in this evolving insurtech landscape, stakeholders must stay agile and proactive. Insurers, technology providers, insurance sector's foremost executives, leading insurance experts, and investors should:

- Embrace digital transformation

- Invest in innovation

- Foster collaboration and make your organization networking expand

- Prioritize customer-centric solutions

- Stay informed and adapt

Taking these steps enables stakeholders to not only navigate the challenges of the insurtech revolution but also capitalize on the opportunities it presents and ensure sustainable growth in the years to come.

One showcasing insurtech example is Lemonade Insurance. From 2021 to 2023, insurance startup Lemonade increased its revenue by almost four times. The revenue raised from 128 million U.S. dollars in 2021 to 430 million U.S. dollars in 2023.

Specializing in home and pet insurance in the U.S. and select European markets, Lemonade follows a high-tech and socially conscious business model. Lemonade has focused heavily on its AI chatbot from the very beginning, even before AI became widespread and trendy. By incorporating our insurtech insights into your strategy, you'll unlock a path to industry leadership and lasting success.

Conclusion

Insurtech insights 2026 illuminate the swift progress and groundbreaking trends reshaping the insurance technology domain. Key revelations include the growing incorporation of AI and machine learning to individualize customer interactions, the prominence of blockchain for secure and transparent dealings, and the utilization of IoT devices for real-time risk evaluation and minimization.

The future of insurtech promises further innovation with the potential for more sophisticated data analytics, expanded use of telematics, and deeper integration of insurtech solutions within traditional insurance frameworks. Inspirational industry leaders create favourable conditions for the implementation of technologies in the insurance industry.

At TechMagic, we leverage technology to empower businesses and consumers with innovative fintech solutions. Leading insurance experts equip themselves with our insurtech solutions to streamline processes and deliver a superior customer experience. Don’t hesitate to contact us and discuss your project.

FAQ

What is insurtech, and why is it important to explore its future trends in 2026?

Insurtech refers to using new technology to streamline insurance processes, making them quicker and easier to use. Looking into its future in 2026 is essential because it can reform the way we manage risks and handle claims, making insurance better for everyone.

How will regulatory changes impact the insurtech industry in 2026?

Regulatory changes in 2026 will shake up the insurtech industry by setting stricter standards for data privacy, security, and openness. These changes could either boost innovation by providing clear instructions or hinder it if the rules are too tight. In the end, keeping up with these regulations will be essential for insurtech companies to win trust and stay compliant in a fast-changing market.

What innovations can we expect in insurtech product offerings in 2026?

We can expect insurtech product offerings to include more personalized insurance plans driven by AI and machine learning, tailoring coverage to unique needs. We'll also see a rise in usage-based insurance, with premiums set by real-time data from IoT devices. Additionally, blockchain technology will improve transparency and streamline claims processing and fight fraud.

How will distribution channels in the insurance industry evolve in 2026?

Distribution channels in the insurance industry will increasingly leverage digital platforms and allow customers to purchase and manage policies online with ease. AI-powered chatbots and virtual assistants will provide one-on-one help and simplify customer interactions. Additionally, teaming up with tech companies and insurtech startups will lead to new ways of selling insurance, making it more convenient and user-friendly.

What challenges and opportunities lie ahead for insurtech startups in 2026?

Insurtech startups in 2026 will face challenges such as navigating complex regulatory environments and maintaining cybersecurity in an increasingly digital landscape. However, they also have opportunities to disrupt traditional insurance models, offer innovative solutions, and capitalize on the growing demand for personalized and efficient insurance services.

How can stakeholders prepare for the future of insurtech in 2026?

Stakeholders can get ready for the future of insurtech by staying informed about arising technologies and regulatory changes and investing in digital transformation to enhance their operations. Building strong partnerships with tech companies and fostering a culture of innovation will also be key to staying competitive and meeting evolving customer expectations.

Software Development

Software Development Security Services

Security Services Cloud Services

Cloud Services Other Services

Other Services

TechMagic Academy

TechMagic Academy