Top Financial App Development Companies in 2026

Last updated:5 August 2025

We did some research, so you don't have to. Check the list of top financial app development companies and insights on how to choose one.

In today's digital age (yeah, we know that sounds worn out, but how would you start that thought?), financial technology (fintech) applications are revolutionizing how we manage our finances, from banking services and investing to insurance and personal finance.

As the demand for these apps grows, so does the need for skilled development partners, obviously. Here, we highlight the top financial app development companies that got a spotlight in one way or another in this competitive landscape.

Top Financial Software Development Companies

We've crafted this list based on open-source information about companies' specialties, years on the market, experience, and technical expertise.

TechMagic

TechMagic is generally renowned for its comprehensive approach to app development. After buying Dynamo Development in 2022, its FinTech direction was significantly enforced with talented FinTech-focused engineers.

They combine technical expertise with a deep understanding of the financial industry. Its services cover the entire development lifecycle, ensuring high-quality, secure, and user-friendly applications.

TechMagic has a proven track record of delivering scalable fintech solutions, making it a preferred partner for many startups and enterprises.

Main focus: Building scalable and secure financial software for various financial institutions and startups.

Services:

- Custom financial software development

- Mobile banking app development

- Integration with third-party financial APIs

- Security and compliance consulting

- Post-development support and maintenance

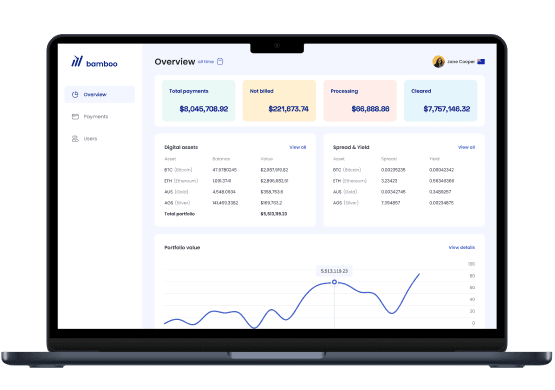

Learn how we built macro-investing app with its own token and reward system

DeepInspire

DeepInspire is a fintech product development company with 25 years of experience, partnering primarily with clients across Europe and the Middle East. The team builds a range of fintech products, from trading platforms and exchanges to core banking systems and KYC solutions. DeepInspire is known for its product-thinking approach and focus on long-term partnerships.

Main focus: Transforming bold ideas into exceptional fintech products, designed around real user needs.

Services:

- Сustom fintech software development

- UI/UX design for financial products

- FinTech consulting & advisory

- Technical due diligence

Zazz

Zazz is a digital product agency that’s all about crafting custom software and mobile apps designed around the client’s vision. They are focused on user-friendly design and creating custom digital products. The company claims that they have experience in industries like fintech, healthcare, and e-commerce. They offer digital products tailored for each sector.

Main focus: Creating impactful digital products with a focus on quality, innovation, and client satisfaction.

Services:

- Custom mobile app development

- Web and software development

- UI/UX design and branding

- Product strategy and consulting

Goji Labs

Goji Labs is a full-stack digital product agency providing start-to-finish mobile application development services – from strategy and design to deployment. They work in building custom web and mobile applications aligned with each client’s business goals and user needs. The company offers specialized expertise in UX/UI design, product growth, and digital marketing and takes a holistic approach, helping clients bring their best ideas to life.

Main focus: Building user-focused digital products with an emphasis on scalability and business alignment.

Services:

- Product strategy and consulting

- UX/UI design for web and mobile

- Product growth and continuous improvement

MentorMate

MentorMate is a global digital consultancy that handles the full project management and development. from initial ideas to deployment. They specialize in custom web and mobile applications and promise alignment with client goals, ensuring each development project meets business and user needs. The company offers expertise in enterprise architecture, cloud solutions, and data analytics and develops scalable, secure, and effective digital products.

Main focus: Building flexible, user-centered digital products that drive real business value.

Services:

- Product strategy and consulting

- Custom mobile and web app development

- Enterprise architecture and systems integration

- Cloud Solutions and DevOps

Baytech Consulting

Baytech Consulting provides custom software development services with a complete approach – handling everything from strategy and business analysis to design to deployment and ongoing support. They create tailored solutions for various industries. Baytech’s skills in AI, cloud, and user-centered design make for a thorough development.

Main focus: Building scalable, high-quality software with a strong commitment to client success and business growth.

Services:

- Product strategy and consulting

- Custom software development for web and mobile

- DevOps and operational efficiency

- Ongoing support and maintenance

Empat

Empat is a Ukrainian startup studio offering end-to-end product and custom software development. They specialize in tailored software solutions that meet each client’s unique goals and user expectations. The company works with web and mobile apps, data analysis, and AI.

Main focus: Developing scalable software and customized solutions with a focus on user experience and business impact.

Services:

- Product strategy and consulting

- Web and mobile app development

- Artificial intelligence and machine learning

- IT support and maintenance

Dogtown Media

Dogtown Media is a full-service mobile app development company providing everything from strategy to deployment. They specialize in custom iOS and Android apps built around clients’ goals and user needs. Their strengths in UX/UI, IoT, and AI-powered features create a comprehensive approach, bringing impactful mobile products to life.

Main focus: Building user-driven mobile applications with a focus on alignment with client goals and advanced technology.

Services:

- Product strategy and consulting

- Custom iOS and Android app development

- Ongoing support and maintenance

Softeq Development

Softeq Development, based on public information, provides end-to-end fintech app development services, from concept to deployment. They specialize in creating custom financial applications tailored to their client's specific needs.

Softeq's IoT and blockchain integration expertise adds an extra layer of innovation to their financial solutions.

Main focus: Creating innovative and reliable software solutions for the financial sector, with a strong focus on security.

Services:

- End-to-end mobile app development

- IoT and embedded financial solutions

- Custom software development for finance

- Blockchain and secure payment systems

- UI/UX design and development

Fueled

Fueled is a leading name in app development known for its cutting-edge fintech applications. It combines design and technology to create seamless, engaging user experiences.

Fueled's portfolio includes a variety of successful financial apps, from mobile banking solutions to investment platforms.

Main focus: Building cutting-edge mobile apps with an emphasis on user experience and innovative design.

Services:

- Custom mobile app development

- Financial software and fintech solutions

- Digital transformation consulting

- UI/UX design and development

- Post-launch analytics and optimization

Appinventiv

Appinventiv is a top-tier app development company that excels in the fintech sector. They offer many services, including mobile app development, blockchain development, and AI integration.

Appinventiv's ability to deliver secure and compliant financial applications makes it a reliable choice for financial institutions.

Main focus: Providing comprehensive digital solutions for the financial industry, focusing on innovation and quality.

Services:

- Mobile banking and financial apps

- Blockchain and cryptocurrency app development

- Custom software solutions for financial institutions

- AI and machine learning integration

- Post-development support and maintenance

ELEKS

ELEKS is a global software development company known for providing custom software engineering, technology consulting, and IT services.

With over 1,500 professionals, ELEKS serves a wide range of industries, including finance, healthcare, logistics, and retail. It delivers innovative solutions and helps businesses enhance their digital transformation efforts.

Main focus: Providing end-to-end software development services, specializing in complex financial software solutions. Services:

- Financial data analytics and reporting

- Development of trading platforms

- Mobile banking solutions

- Compliance and risk management software

- Cloud-based financial software development

10Pearls

10Pearls specializes in building secure and scalable fintech applications. They integrate advanced technologies to enhance functionality and user experience.

10Pearls has a strong reputation for delivering projects on time and within budget, making it a trusted partner in the fintech industry.

Main focus: Delivering high-quality digital transformation solutions with a focus on security and innovation.

Services:

- Custom financial software development

- Mobile app development for finance

- Blockchain and AI integration

- Data analytics and BI solutions

- Cybersecurity and compliance consulting

Zco Corporation

Zco Corporation offers comprehensive fintech app development services, including mobile banking apps, payment solutions, and financial management tools.

It is known for its attention to detail and commitment to quality, ensuring that its financial applications are both reliable and innovative.

Main focus: Developing robust and secure financial software solutions tailored to client needs.

Services:

- Mobile app development for financial services

- Custom financial software development

- Integration with third-party financial systems

- Data security and compliance solutions

- Post-launch support and maintenance

WillowTree

WillowTree is a prominent app development name known for creating high-quality financial applications. Their team of experts focuses on user-centric design and robust functionality.

WillowTree's fintech solutions are designed to meet the specific needs of their clients, ensuring a seamless user experience.

Main focus: Creating user-centric digital solutions with a focus on enhancing customer experience in the financial sector.

Services:

- Mobile and web app development

- Custom fintech software solutions

- AI and machine learning integration

- UI/UX design and development

- Ongoing support and optimization

Intellectsoft

Intellectsoft provides custom fintech app development services, specializing in creating secure and scalable financial solutions.

Their expertise in blockchain and AI technologies allows them to deliver innovative applications that meet the evolving needs of the financial sector.

Main focus: Delivering innovative fintech solutions with a strong emphasis on user experience and cutting-edge technologies.

Services:

- Mobile app development for financial services

- Blockchain solutions for secure transactions

- AI and machine learning integration

- Custom software development for financial institutions

- Fintech consulting and strategy development

Dotsquares

Dotsquares offers various fintech app development services, from mobile banking apps to investment platforms. They focus on delivering secure, user-friendly applications that enhance their clients' financial operations.

Dotsquares' commitment to quality and innovation makes them a strong contender in the fintech app development space.

Main focus: Providing cost-effective and high-quality financial software development services.

Services:

- Custom mobile app development

- Financial software and fintech solutions

- Blockchain and cryptocurrency integration

- Data analytics and reporting tools

- Compliance and risk management software

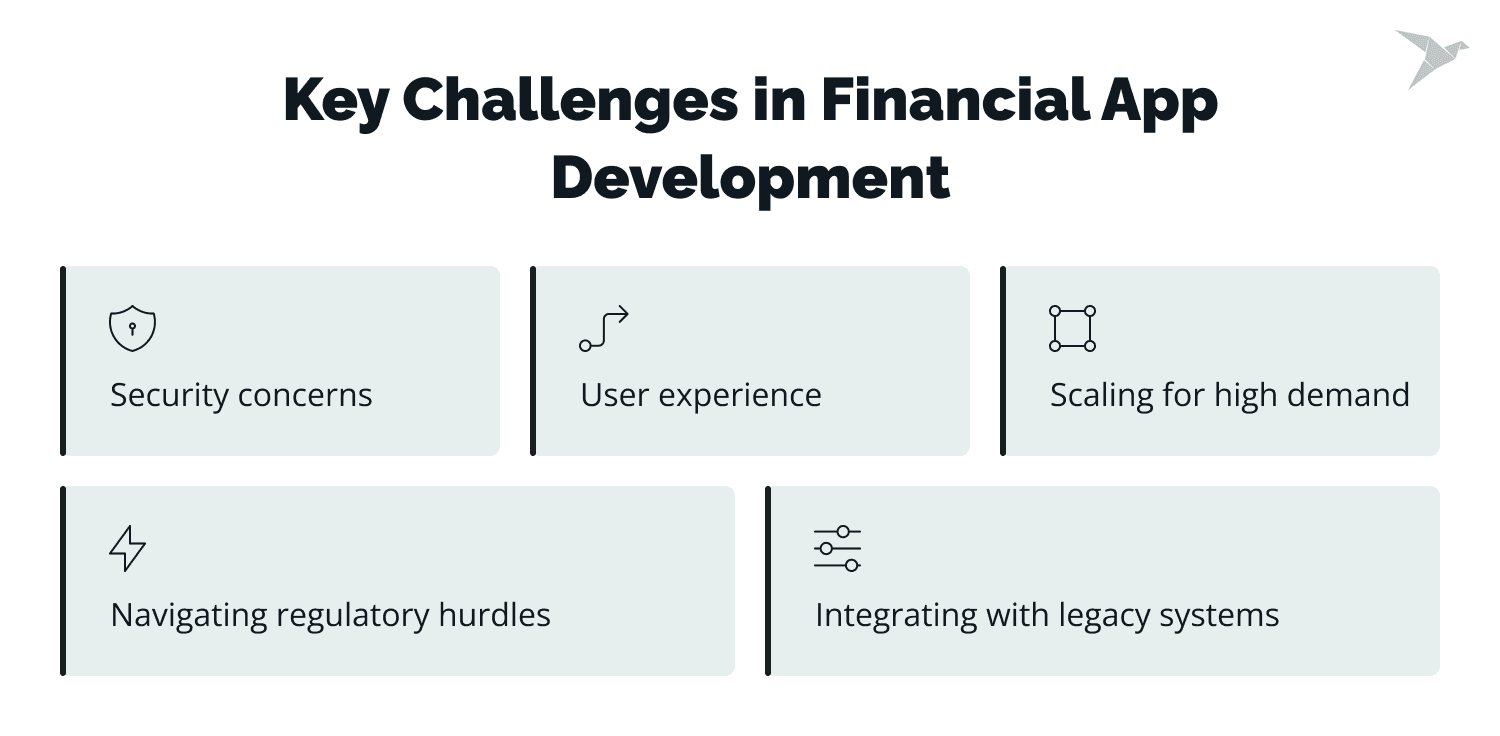

Key Challenges in Financial App Development

Building financial apps is a process full of unique challenges that require experience and a lot of finesse. Here’s a look at the biggest hurdles in fintech app development and how top companies like TechMagic are tackling them head-on.

Security concerns: keeping user data safe

Security is the name of the game in financial apps. When users trust an app with their personal and financial information, there’s zero room for error. Any breach can cause massive losses and destroy user trust. Developers need to stay on top of security with everything from encryption and multi-factor authentication to ongoing vulnerability checks.

How top companies overcome this:

Leading companies like TechMagic and Softeq take security seriously. They build apps with end-to-end encryption, biometric authentication, and continuous security monitoring. TechMagic, for instance, runs regular penetration tests to find and fix weak spots before they become problems. This dedication to security helps users feel safe and builds long-term trust.

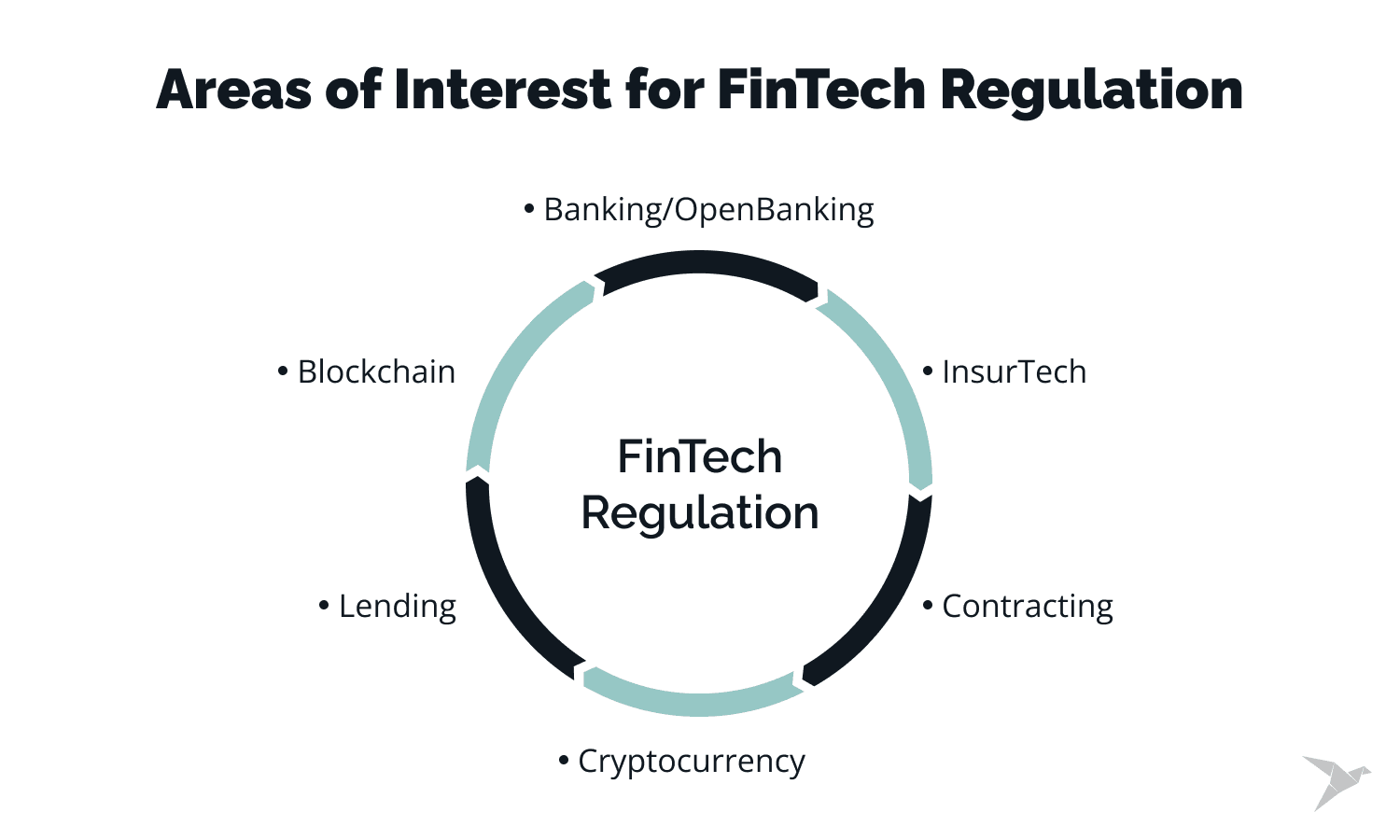

Navigating regulatory hurdles: compliance is key

Finance is one of the most regulated industries out there, and compliance isn’t just a box to check – it’s essential. With rules like GDPR, PCI-DSS, and KYC in play, companies have to stay up-to-date and compliant across regions. Missing the mark here can lead to fines, legal issues, and reputation damage.

How top companies overcome this:

Top fintech software developers, like TechMagic, MentorMate, and ELEKS, keep compliance front and center in their development process. TechMagic brings in regulatory experts to make sure every app they build checks off the necessary legal standards. Regular audits and solid documentation help clients keep pace with regulations and stay out of hot water.

Integrating with legacy systems: bridging the old and new

Many financial institutions rely on old-school systems that don’t play nicely with today’s mobile tech. Integrating new, modern apps with these outdated systems is no small feat, as they often lack APIs and require custom solutions to work together smoothly. Poor integration can lead to data silos and inefficient workflows.

How top companies overcome this:

Companies like TechMagic, Zazz, and Baytech Consulting have the flexibility and technical chops to bridge the gap between old and new. TechMagic, for example, uses custom APIs and middleware solutions to ensure that new apps can talk to legacy systems without a hitch. By tailoring their approach to each client’s setup, they make modernization possible without starting from scratch.

User experience in a high-stakes environment

Making financial apps functional and easy to use is no small challenge. Complex features need to be accessible to everyone, from tech novices to advanced users. If the design is clunky or hard to navigate, users may jump ship quickly.

How top companies overcome this:

Companies like TechMagic put serious effort into UX/UI design to create smooth, user-friendly experiences. The company focuses on extensive user testing and feedback collection at every stage to make sure the app is intuitive and efficient. With teams dedicated to UX in fintech, they know how to turn complicated financial data into a clear and approachable design.

Scaling for high demand: preparing for growth

With financial apps exploding in popularity, they need to be ready for growth. Apps that can’t scale smoothly to handle more users and transactions end up with performance issues that can drive users away fast. Scalability is key to keeping customers happy and loyal.

How top companies overcome this:

Companies like TechMagic, Appinventiv, and WillowTree build scalability into their apps from day one. TechMagic uses cloud-based architecture, microservices, and load-balancing techniques to make sure their apps stay fast and reliable, even with heavy traffic. These strategies help apps grow smoothly alongside their user base, ensuring a great experience no matter how big they get.

Assessing Top Financial App Development Companies: A Comprehensive Guide

Selecting the right financial software development company ensures your next development and project management's success. The financial sector demands secure, efficient, and compliant software solutions. It's one of the most regulated industries. Therefore, rigorously evaluating financial software development companies is paramount to be sure of the software quality entering the market.

Here's how you may assess the top app development companies, why making the right choice is critical, and some frequently asked questions to help you navigate the process.

The assessment process

- Experience and expertise:

Look for companies with extensive experience in financial software development. This includes proficiency in mobile app development, an understanding of financial transactions, and the creation of high-performance mobile applications. To see proof of their expertise, check their portfolio for past projects in the financial services industry. Also, a good sign is to have CTO-level financial engineers on board. - Technical skills and technology stack: Ensure the company utilizes the latest technologies and tools. Their expertise should definitely cover mobile banking apps, trading platforms, and secure financial transactions. Tailored software development services should be part of their offerings as well, ensuring they can provide tailor-made solutions.

- Security and compliance: The financial sector is highly regulated. The chosen financial app development company must adhere to regulatory compliance standards and employ the latest encryption technology to protect financial data. Preferably there should be some previous experience showcasing needed skills.

- Client reviews and testimonials: Reviews from previous clients can provide insight into the company's reliability and quality of work. Look for feedback on their project management skills, transparent communication, and ability to meet business objectives. From our experience, clear communication is key to a successful project. You need to be open as well, providing your team with correct data.

- Post-development support: Financial apps require ongoing maintenance and updates to stay secure and functional. Ensure the company offers managed services and robust post-development support.

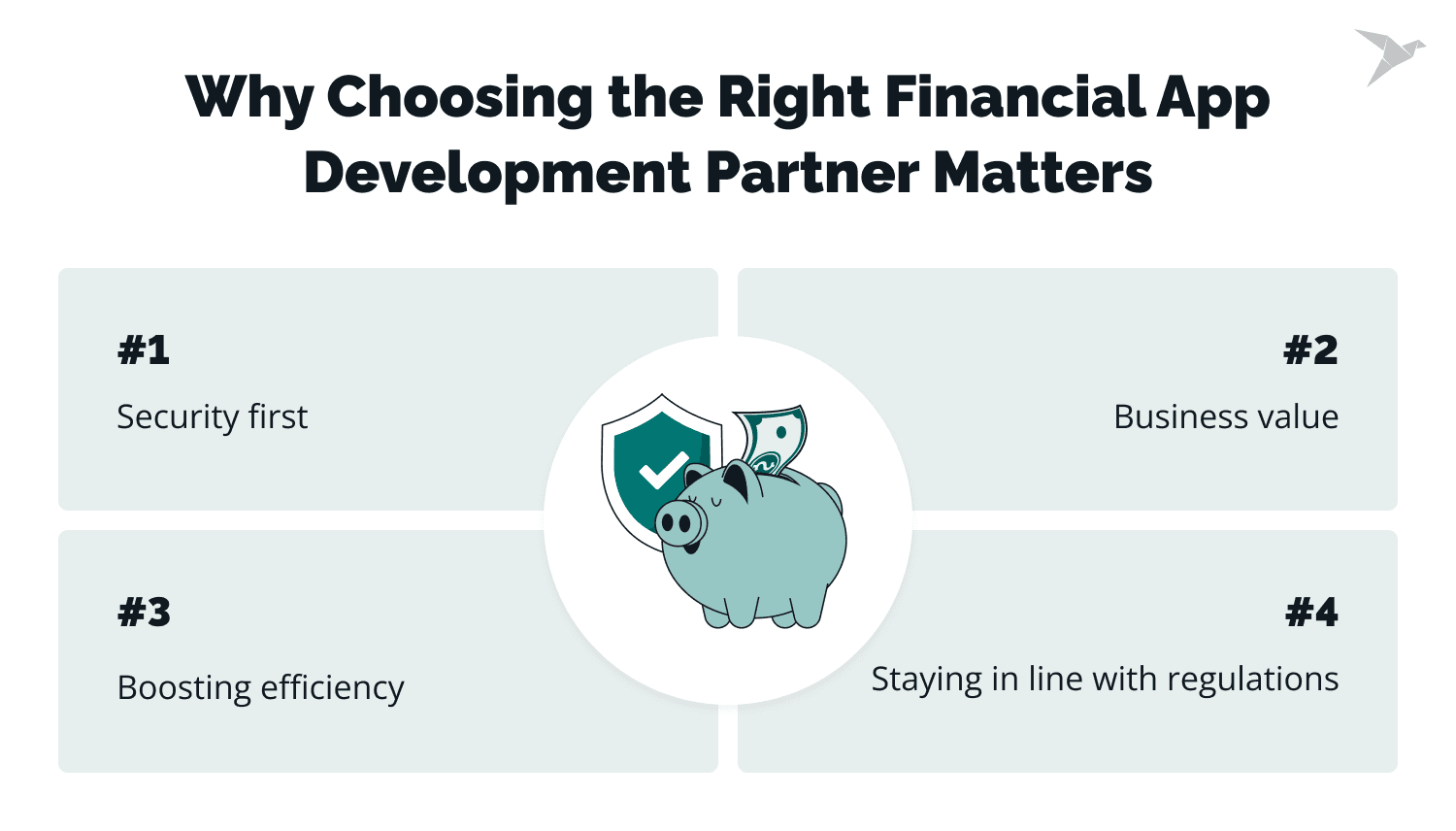

Why Choosing the Right Financial App Development Partner Matters

When it comes to developing financial software, picking the right partner is a make-or-break decision. In the fast-paced, highly regulated world of finance, this choice impacts everything – from security and compliance to operational efficiency and, ultimately, business value. Here’s why it matters and what to look out for:

Security first: No room for errors

In financial services, safeguarding sensitive data is non-negotiable. A single security breach could lead to devastating financial losses and irreparable damage to a company’s reputation. That’s why the right development partner will prioritize security at every turn.

Look for companies that implement top-tier encryption, conduct frequent penetration testing, and stay updated on the latest security measures. After all, an ounce of prevention is worth a pound of cure, especially in finance.

Staying in line with regulations

Finances are one of the most tightly regulated industries out there, and compliance is more than just a checkbox – it’s a necessity. Working with an experienced financial software developer means your app will be built to meet all relevant legal standards.

They’ll know the ins and outs of regulations like GDPR, PCI-DSS, and others, ensuring your software not only meets the mark but keeps you out of regulatory hot water.

Boosting efficiency with smart custom software development services

Efficient financial software doesn’t just make life easier; it boosts the bottom line. The right development partner will help you streamline operations, cut down on costs, and enhance the user experience.

This is especially true with companies skilled in AI-driven solutions, which can make operations run smoother and help you make data-driven decisions. With AI integrated thoughtfully, financial software developers can not only reduce manual tasks but also open up new possibilities for innovation – all without sacrificing security or compliance.

Business value that speaks for itself

When financial software is done right, the benefits extend beyond the software itself. High-quality apps can drive business growth, improve customer satisfaction, and even attract new clients.

Working with a capable development partner means they’ll be thinking about business value from day one, ensuring every feature adds to a smooth, user-friendly experience. A good partner is with you from start to finish, focused on creating solutions that are ready for market, intuitive, and designed for growth.

So, if you’re considering financial software development, remember: the right partner is worth their weight in gold. They’ll bring security, compliance, and efficiency to the table, setting you up for success in every way.

Most Requested Financial Software Development Services in 2026: An Overview

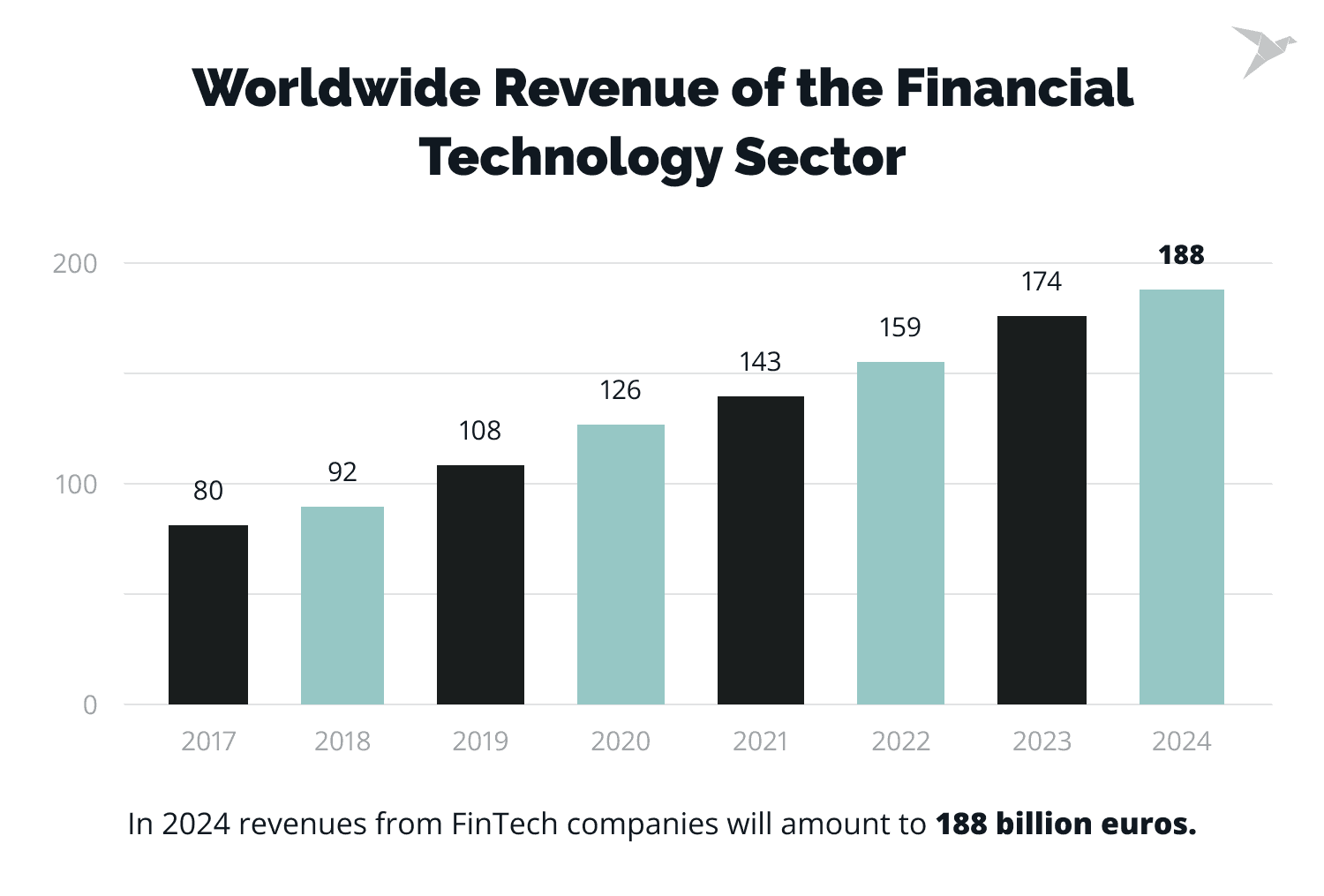

In 2024, we noticed that the demand for financial software development services increased significantly, driven by technological advancements and changing consumer preferences.

To give you an understanding of demand vs proposition, here's a comprehensive overview of the most requested services, along with some pertinent statistics:

Mobile Apps for Banking

Mobile banking apps continue to dominate the financial software development landscape. These apps offer users the convenience of accessing banking services anytime, anywhere. With projected growth in mobile banking usage, developing user-friendly and secure mobile banking apps remains a top priority.

Investment and Trading Platforms

Investment apps that allow users to manage diverse portfolios, including equities, debt, gold, and cryptocurrencies, are in high demand. These platforms provide real-time updates and insights into market trends, helping users make informed investment decisions.

Insurance Applications

Insurance software simplifies operations for policyholders and claimants by offering centralized portals for all insurance-related tasks. Automating claims processing and other tasks helps reduce operational costs and improve user engagement.

Accounting and Budgeting Software

Applications that assist with personal finance management, including budgeting, accounting, and cost tracking, are essential tools for individuals and businesses. These platforms often integrate features like investment tracking, tax advice, and security measures to provide a comprehensive financial management solution.

Cryptocurrency and Decentralized Finance (DeFi) Apps

With the rise of digital currencies, cryptocurrency wallets and DeFi platforms are becoming increasingly popular. These apps facilitate secure transactions and provide users access to a wide range of financial services without the need for traditional financial intermediaries.

Statistics and Market Trends

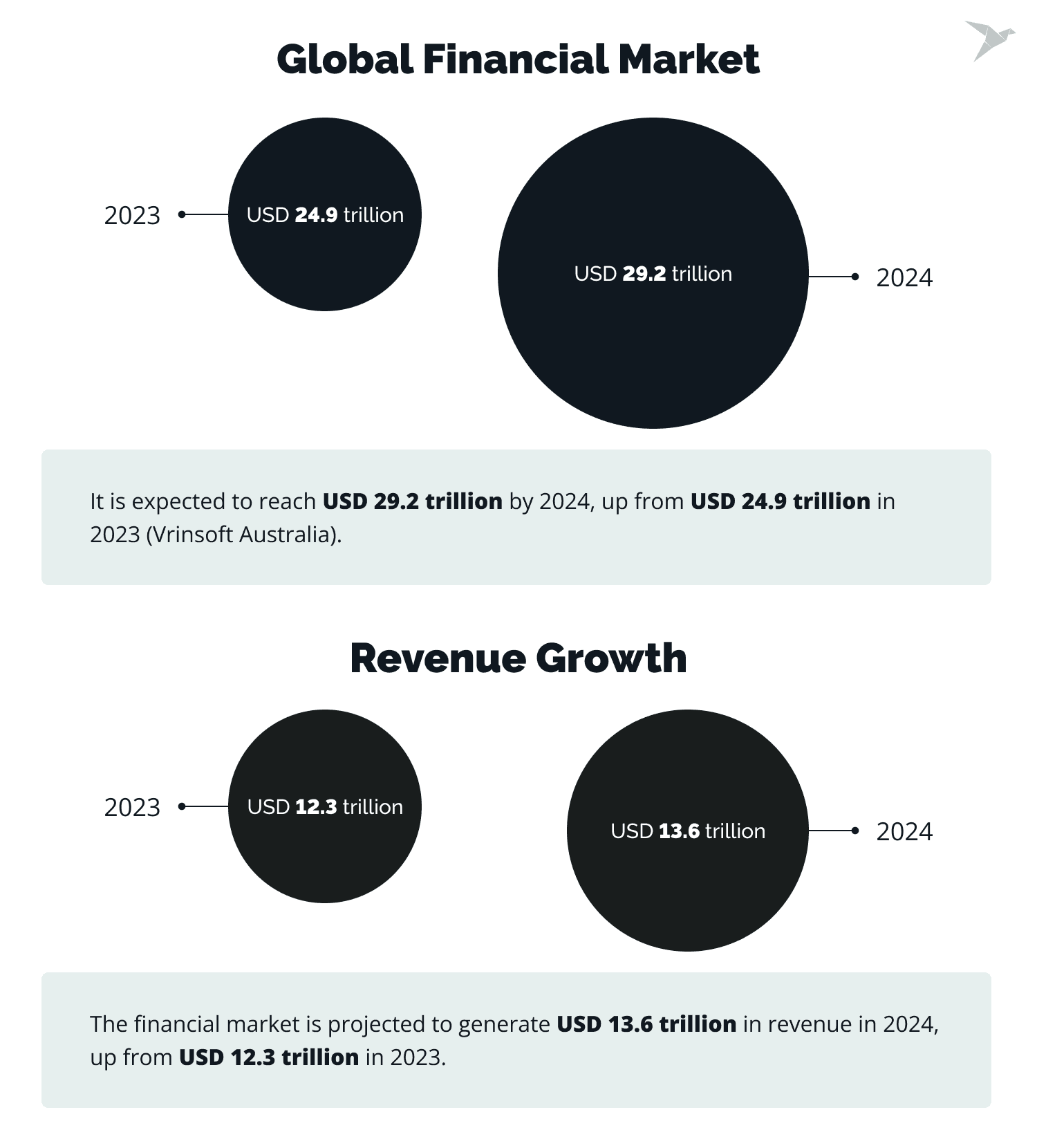

- Global Financial Market: It is expected to reach USD 29.2 trillion by 2024, up from USD 24.9 trillion in 2023 (Vrinsoft Australia).

- Revenue Growth: The financial market is projected to generate USD 13.6 trillion in revenue in 2024, up from USD 12.3 trillion in 2023.

- Investment in Financial Software: Increased investment in technologies like AI, blockchain, and open banking is transforming the financial services industry. AI and machine learning are notable for automating tasks and enhancing customer experience.

How We Crafted the List of Top Financial App Development Companies

Putting together our list of top financial app development companies wasn’t just a quick look-up; it was a deep dive into what truly makes these companies the cream of the crop. Here’s the inside scoop on how we went about it:

Extensive research and data gathering

To start, we left no stone unturned in researching and gathering data on a wide range of financial software development companies and firms. Here’s what we pulled from:

- Industry reports and market analysis: We sifted through credible sources like Gartner, Forrester, and Deloitte to see who’s leading the pack in financial app development.

- Client reviews and testimonials: Real feedback matters, so we checked out platforms like Clutch, Glassdoor, and Trustpilot to gauge client satisfaction and company reputation.

Weighing experience and expertise

Experience matters in finance tech, so we looked closely at each company's background:

- Years in business: Companies with a solid track record and years of successful projects caught our eye.

- Portfolio review: We examined past projects, from mobile banking apps to investment and insurance platforms, to see the diversity and depth of their expertise.

Assessing technical skills and innovation

Tech chops are key in this field, so we dug into each company's technical capabilities:

- Technology stack: Companies using cutting-edge tech like AI, blockchain, and open banking APIs scored big points.

- Innovation: We leaned towards companies known for breaking new ground and seamlessly integrating advanced technologies into their solutions.

Prioritizing security and compliance

Security and compliance are non-negotiable in financial app development. We looked for firms that don’t cut corners:

- Security measures: Firms implementing top-notch security, including encryption and regular testing, were prioritized.

- Compliance: Only companies strictly following standards like GDPR and KYC made it to the list.

Emphasizing client satisfaction and success rates

Nothing speaks louder than a happy client, so we rated companies based on client satisfaction:

- Success rate: Companies with high completion rates and rave reviews got a leg up.

- Customer support: We also factored in ongoing support and maintenance to ensure clients aren’t left high and dry.

Balancing cost-effectiveness and value

Finally, we took a hard look at the bang-for-buck each company offered:

- Cost of services: Competitive pricing that didn’t skimp on quality got our nod of approval.

- Value added: We considered how well companies could improve clients' operations and add real business value through their software.

All in all, we made sure only the best of the best earned a spot on this list, keeping reliability, expertise, and innovation at the forefront.

Conclusion

Choosing the right financial software development company is no small task, but with a little digging and some smart thinking, you’ll find the right fit. It’s more than just hiring someone to build an app but forming a partnership that gets your vision and has the top development skills to make it happen.

Here’s what to look for in a potential partner:

- Proven experience in financial app development: Find a company with a solid track record in the financial space. A team that knows the ins and outs of financial software is better equipped to meet the unique needs of your users.

- Advanced tech capabilities: The fintech world is evolving fast, with game-changers like AI, blockchain, and biometric security. Companies that stay on top of these trends can deliver a product that isn’t just relevant now but is built to stay ahead of the curve.

- Commitment to security and compliance: In financial software, security and compliance aren’t just nice-to-haves. They’re non-negotiable. A good partner will make data protection a top priority, following strict standards like GDPR, PCI-DSS, and KYC and implementing the latest security protocols to keep your users’ data safe.

Beyond these basics, consider factors like communication style, client support, and how flexible they are with changes. A reliable partner that offers solid post-launch support can be a lifesaver, ensuring your app stays updated and in tune with evolving user needs.

To make an informed choice, check out detailed reviews and case studies, or even talk to previous clients to get a feel for their experience. Getting insight into their strengths and areas for improvement can give you a big advantage in the decision-making process.

But most importantly - trust your guts! While research and references are essential, sometimes your gut can tell you if a company is the right match. In the end, finding the right financial software development partner is a journey, one that can lead to a strong, lasting collaboration and high-quality fin app engineers that users will love and trust.

FAQ

What should I look for in financial app developers?

Look for developers with extensive experience in the financial sector, a strong portfolio of past projects, and a deep understanding of regulatory compliance and security requirements.

How much does financial software development cost?

The cost varies depending on the app's complexity, the features required, and the financial software development company's experience. It's best to get detailed quotes from multiple providers.

Why is regulatory compliance crucial in financial software development?

Regulatory compliance ensures that your financial app adheres to legal standards, protecting your business from legal issues and ensuring user trust. Non-compliance can lead to hefty fines and damage to your reputation.

What post-development support should a financial software development company provide?

Look for companies offering ongoing maintenance, regular updates, security patches, and customer support to ensure your app remains functional and secure over time.

How do I ensure my financial app handles secure transactions?

Ensure the development company implements the latest encryption technologies, conducts regular security audits, and adheres to industry best practices for secure transactions.

What are the key features of a successful financial mobile app?

Key features include secure login, a user-friendly interface, real-time transaction updates, budget tracking, notifications, and robust customer support.

How important is user feedback in the app development process?

User feedback is crucial as it helps refine the app to meet user needs and improve the overall user experience. Ensure the development process includes stages for gathering and implementing user feedback.

Software Development

Software Development Security Services

Security Services Cloud Services

Cloud Services Other Services

Other Services

TechMagic Academy

TechMagic Academy