Detailed Guide to Penetration Testing for FinTech Companies

Last updated:10 April 2025

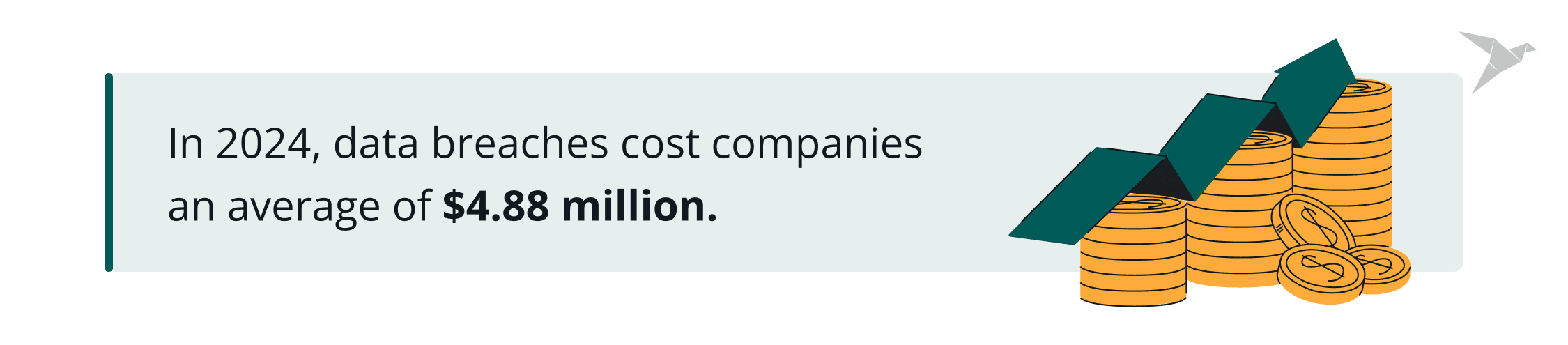

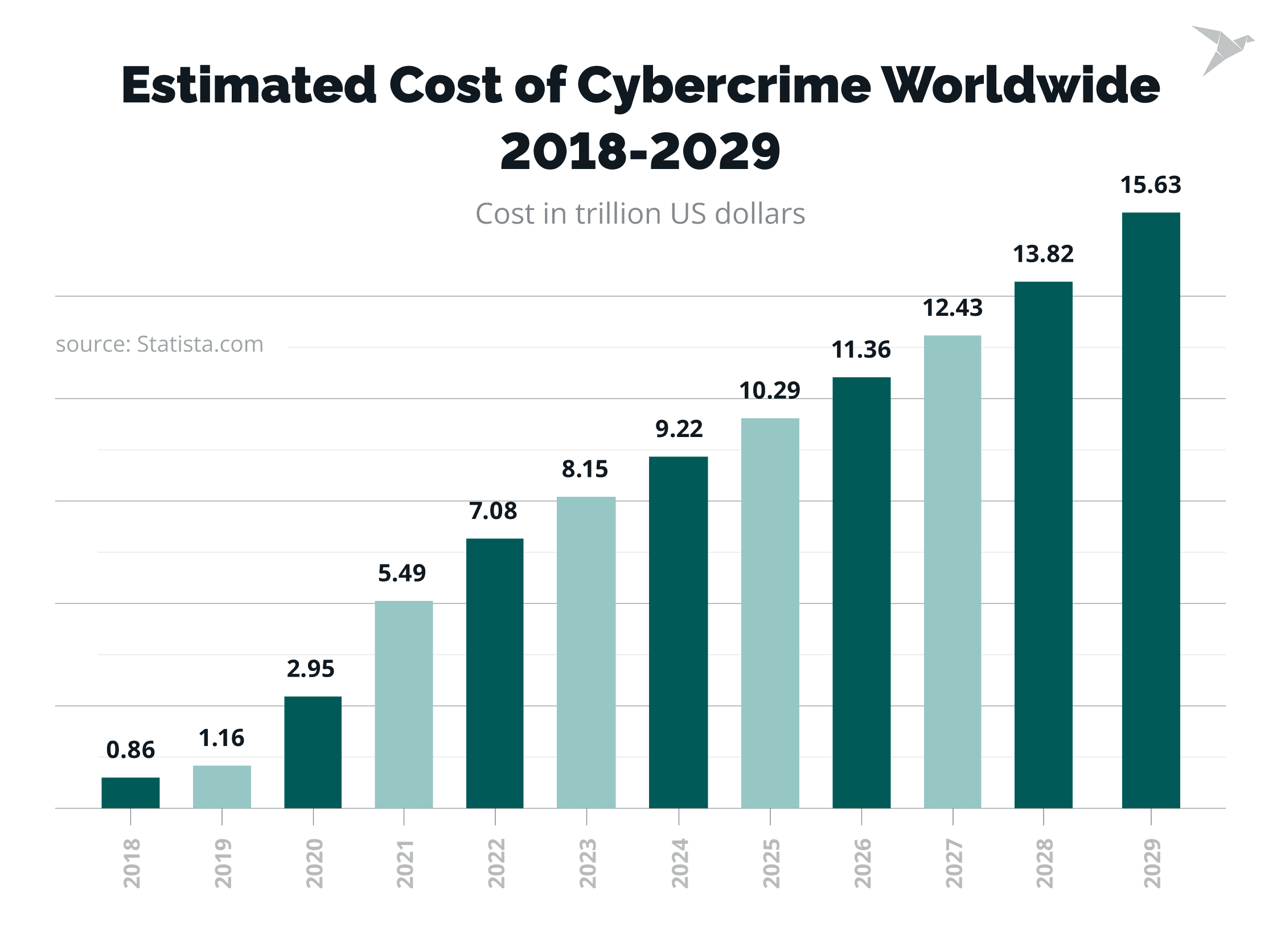

In 2024, data breaches cost companies an average of $4.88 million, with the financial sector taking the biggest hit at $6.08 million per breach. And it’s only getting worse. Cybercrime is set to cost businesses up to $10.5 trillion annually by 2025.

For FinTech businesses, the stakes are high. A data breach means more than just money. It can cost your reputation, trust, and customer loyalty.

Penetration testing is one of the most efficient ways to prevent cybercrime. It’s a smart method to find vulnerabilities before hackers do. In this guide, we’ll break down why FinTech penetration testing is a must and how it can help keep your business safe.

Key takeaways

- Penetration testing simulates cyberattacks to find vulnerabilities before real hackers exploit them, which is crucial for securing FinTech systems.

- Ignoring penetration tests can lead to loss of trust, financial damage, legal issues, and operational disruptions.

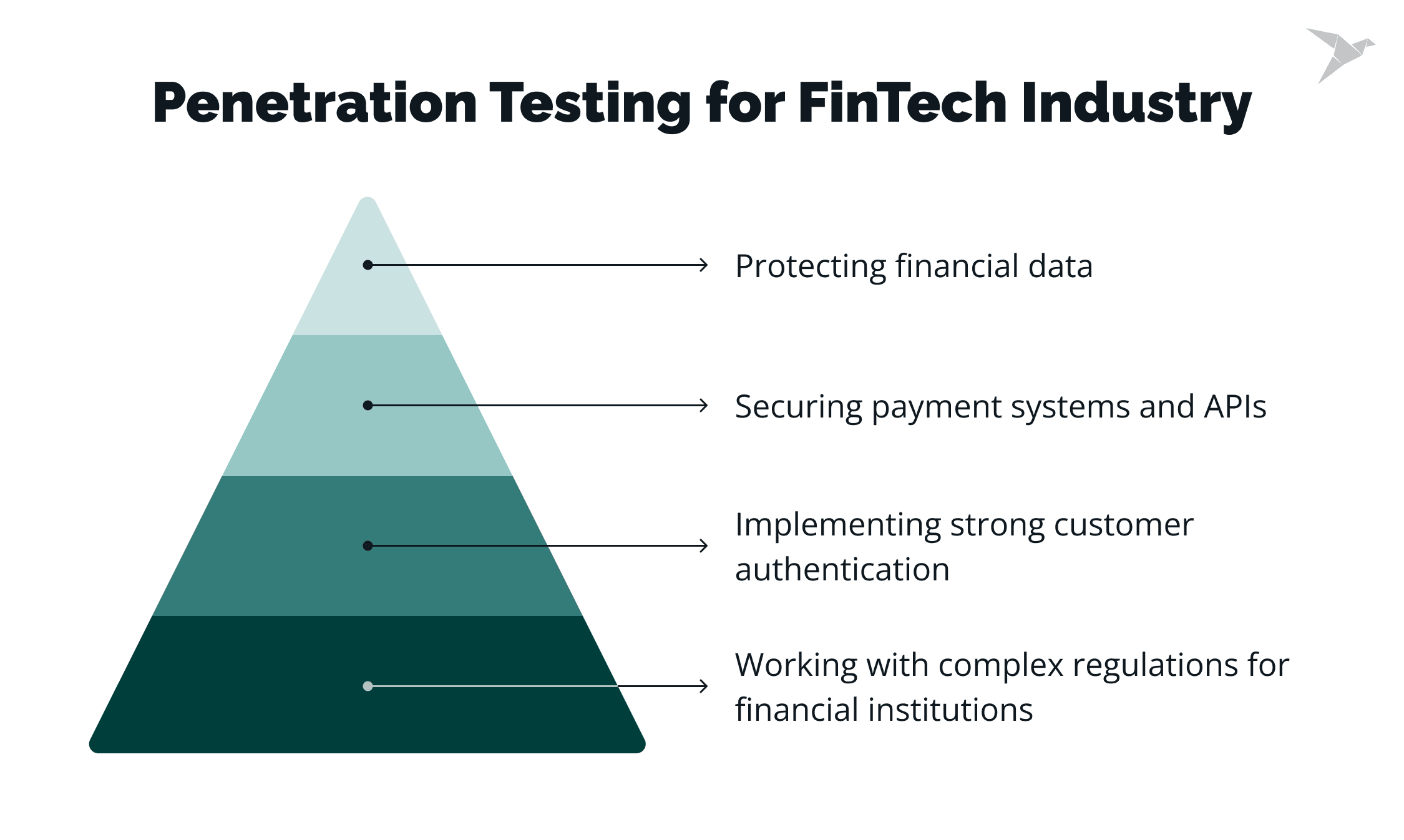

- Pentesting focuses on securing sensitive data, payment systems, customer authentication, and regulatory compliance.

- The penetration testing process in FinTech involves planning, vulnerability assessment, exploitation, and reporting to address weaknesses.

- Challenges are addressed through careful planning and employee training, including scope creep, third-party risks, operational impact, and human error.

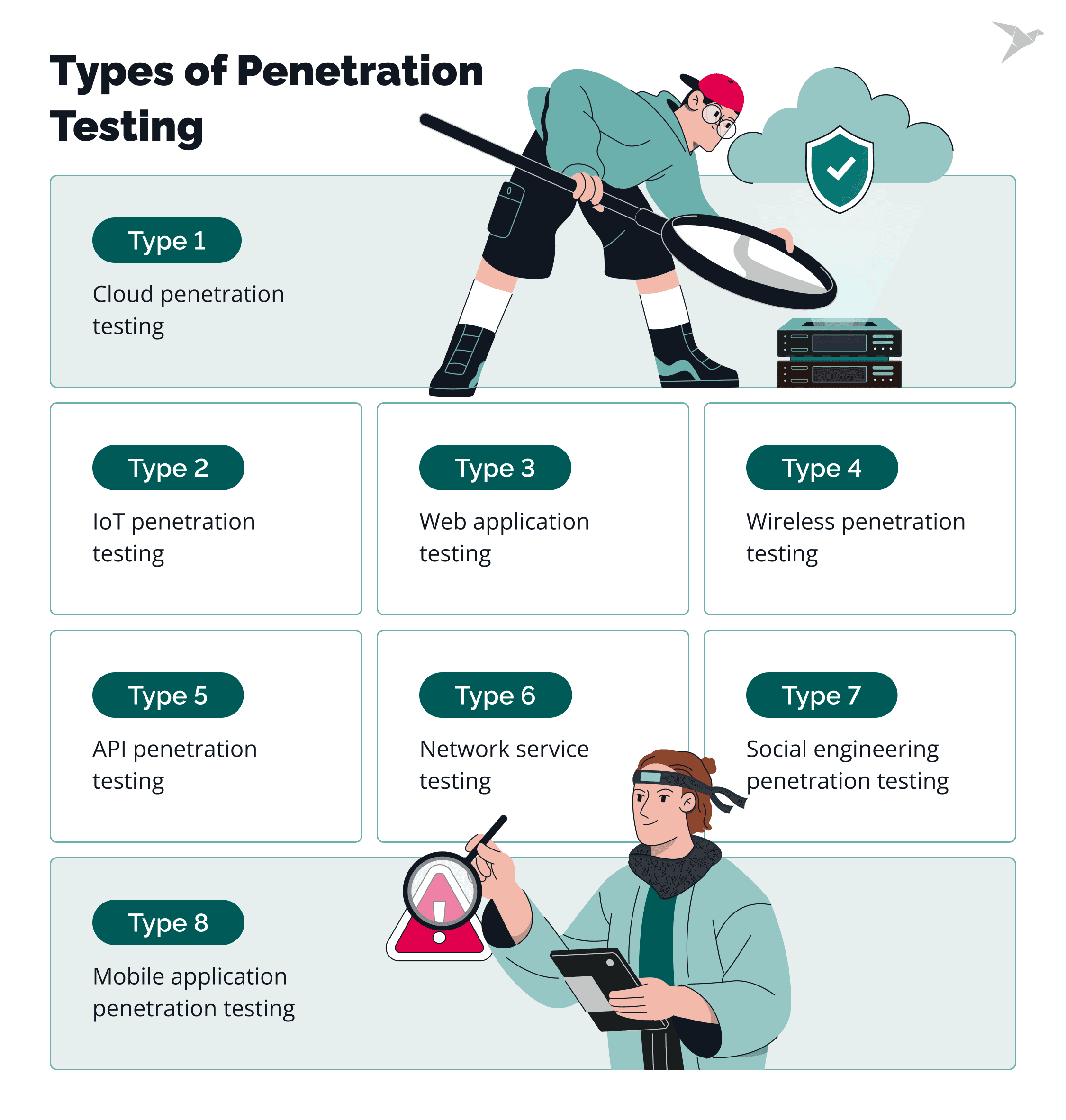

What is Penetration Testing?

Penetration testing, or "ethical hacking," involves simulating cyberattacks on your systems to find weaknesses before real attackers can exploit them. Pentest for FinTech is like a safety drill for your security systems. In this industry, where handling sensitive financial data is key, pen testing helps identify exploitable vulnerabilities and ensure your defenses are strong enough to protect your customers.

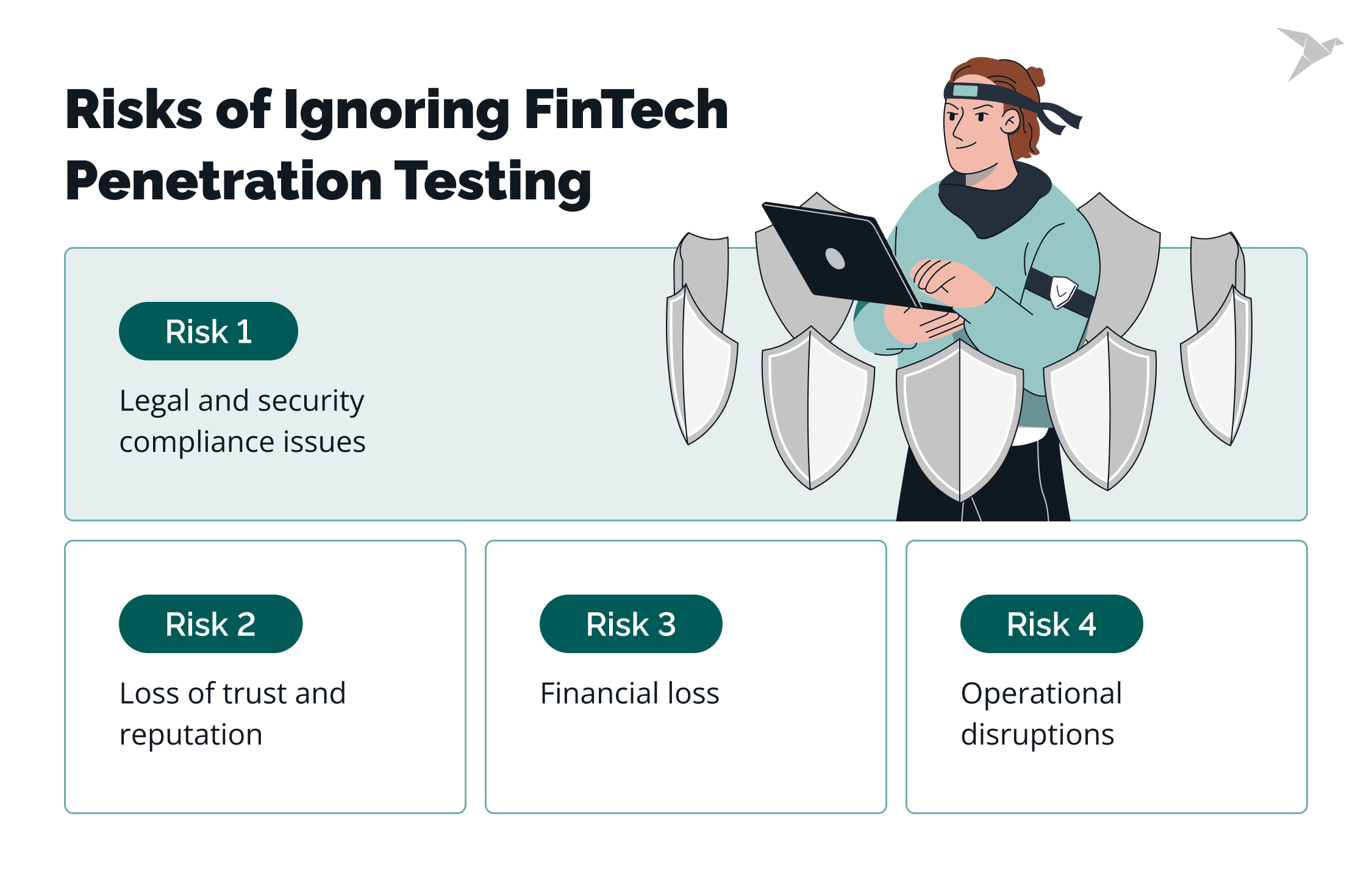

Risks of Ignoring Penetration Testing in the Financial Industry

When a financial system is breached, the impact goes beyond stolen data. It is a loss of customer trust, reputational damage, and a halt in operations. This is the harsh reality for many financial companies that haven’t prioritized FinTech penetration tests.

Loss of trust and reputation

When you deal with a client’s money and data, trust is everything. A single data breach can cause customers to lose confidence in your ability to protect their information. Without regular penetration testing, hidden vulnerabilities remain, exposing your systems and damaging your reputation.

Legal and security compliance issues

The FinTech industry operates under strict regulations like GDPR and PCI-DSS. If your company fails to meet these standards, the consequences can include hefty fines and legal action. Regular penetration testing ensures your systems are secure and compliant so you avoid these risks.

Join our upcoming webinar to get practical guidance before your next audit

Financial loss

The financial impact of a breach is staggering. In 2024, data security breaches cost an average of $4.08 million. Penetration testing helps you find vulnerabilities early, saving you from costly recovery, lawsuits, and fines.

Operational disruptions

A breach can stop your operations in their tracks, disrupting payment processing, halting transactions, and overwhelming your customer service teams. Pentest for FinTech company ensures your systems stay secure and operational, preventing costly downtime and customer dissatisfaction.

Penetration Testing for FinTech Industry: Differences and Specifics

Penetration testing is vital in identifying vulnerabilities before they can be exploited. But penetration testing for FinTech industry isn't the same as in other sectors. It comes with its own set of unique challenges and requirements. Here's how it differs and why it's essential for your business.

Protecting financial data

Financial data is some of the most sensitive information out there. When a breach happens in FinTech, the stakes are even higher.

Penetration testing in this industry focuses on not just security, but on making sure your systems are built to handle the unique risks of storing and transferring highly sensitive data. It’s about keeping financial information safe from prying eyes and potential attackers.

Payment systems and APIs

FinTech businesses rely heavily on third-party payment systems and APIs to process transactions. However these integrations can create vulnerabilities if not properly tested.

Penetration testing must cover all these connections to ensure they’re secure and not exposing your customers’ financial data. Testing your APIs helps prevent breaches that could compromise customer information and damage your reputation.

Strong customer authentication

With the explosion of online transactions, strong customer authentication is more important than ever. Penetration testing evaluates how well your authentication systems hold up against various attack methods, ensuring that fraudsters can’t bypass them.

Whether it’s multi-factor authentication or biometric security, testing these systems ensures that only legitimate users can access sensitive accounts and financial information.

Complex regulations for financial institutions

The FinTech industry operates under a web of complex regulations. Staying compliant is no easy feat, from data protection laws to anti-money laundering rules.

Penetration testing in FinTech must go beyond typical vulnerability checks. It must ensure your systems fully comply with industry regulations like PCI-DSS and others. This makes penetration testing in FinTech more detailed and critical, helping you stay secure while adhering to the law.

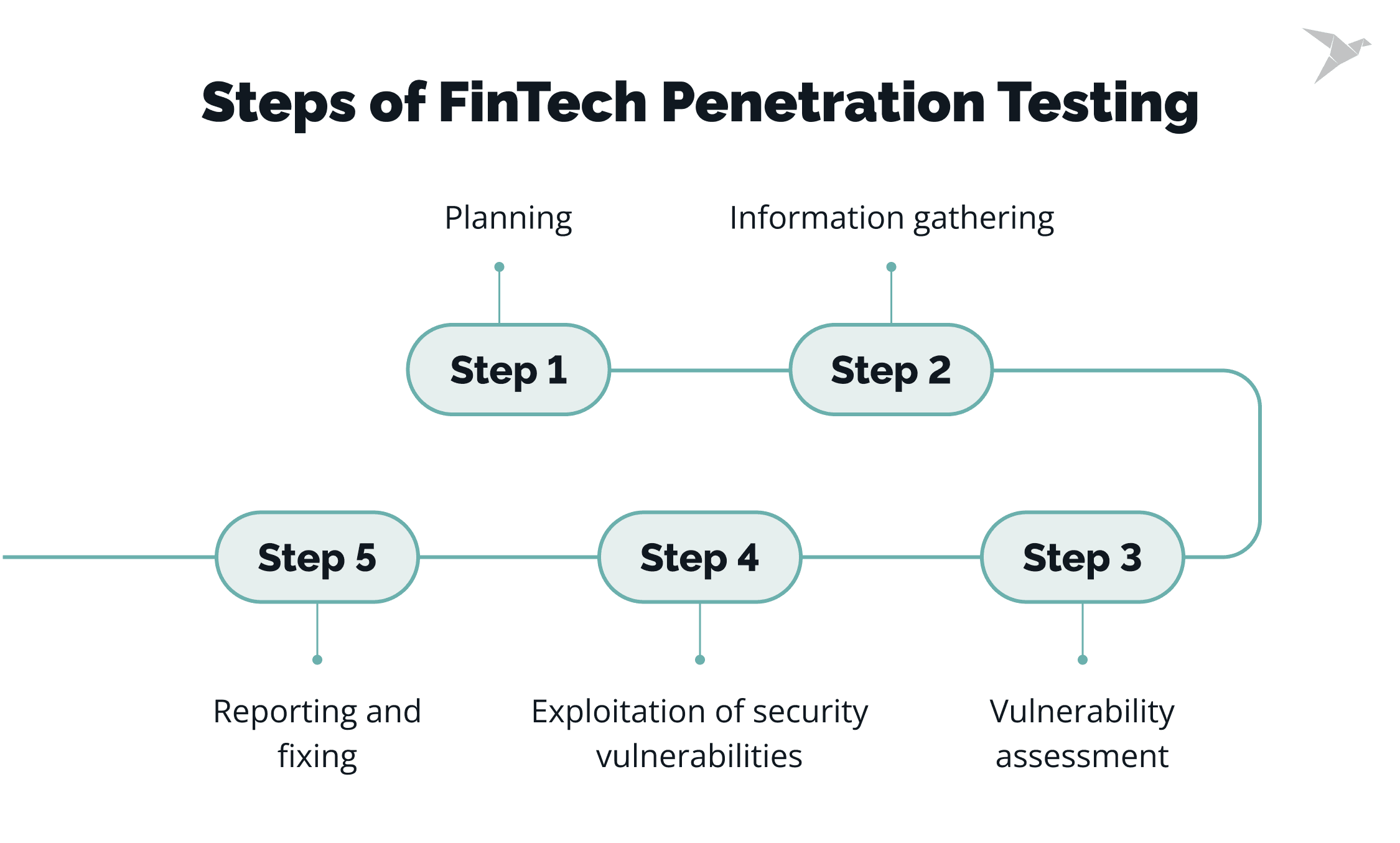

5 Steps of FinTech Penetration Testing

Let’s go through penetration testing for finance industry step by step.

Step 1: Planning

The first step is to set clear goals. What systems need testing? What are the most critical areas of concern? This helps define the focus of the penetration test, ensuring we hit the right targets.

Step 2: Information gathering

Next, we gather all the publicly available info about your systems, like domain names and IP addresses. This gives us a good starting point for identifying potential vulnerabilities.

Step 3: Vulnerability assessment

Now, we dig deep into your systems to find weaknesses: outdated software, poor access controls, or misconfigurations. We find these flaws so they can be fixed before they’re exploited.

Step 4: Exploitation of security vulnerabilities

In this step, we try to exploit your system using the weaknesses we’ve identified. The goal is to see just how far a real hacker could get. This helps us understand the potential damage an attack could cause.

Step 5: Reporting and fixing

After testing, we give you a clear report on the findings, detailing the vulnerabilities, how we exploited them, and what steps you can take to fix them. This report ensures you’re armed with the knowledge to strengthen your systems.

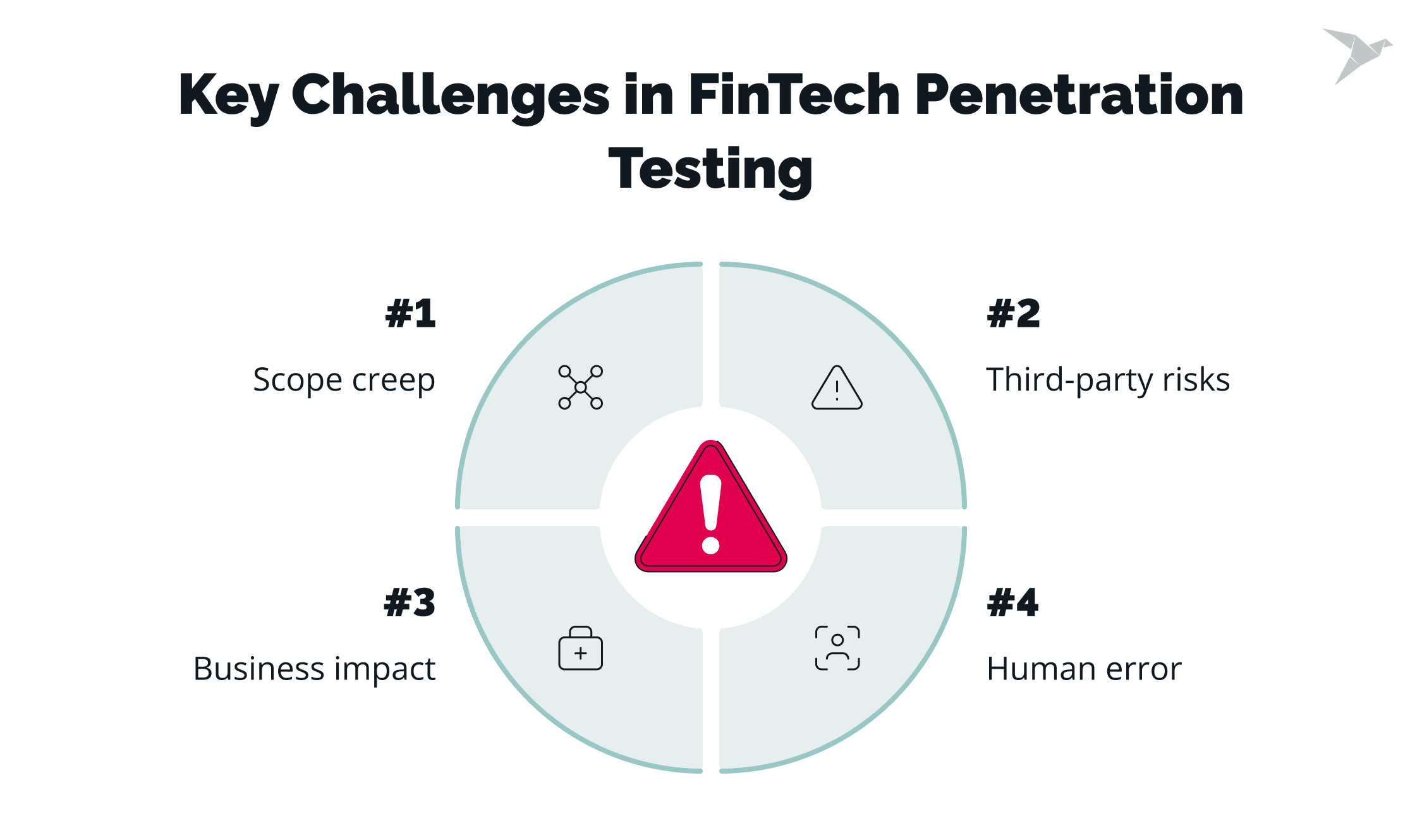

Key Challenges and Pitfalls in FinTech Penetration Testing

There are several challenges that can hinder penetration testing effectiveness. Understanding these pitfalls can help you deal with the complexities of securing your FinTech environment.

Scope creep

Penetration testing needs a clear focus. Testing can become too broad without a solid plan and miss critical vulnerabilities.

Mitigation

We always help our clients define the most important areas of their systems to focus on. We establish an accurate testing scope to identify all potential weak points and security posture vulnerabilities. After testing, we provide precise reports so our clients can implement all necessary changes and improvements based on them.

Third-party risks

Financial institutions often rely on third-party services, but these can introduce hidden vulnerabilities. A full penetration test must include these third-party integrations to ensure security across your entire network.

A 2024 Verizon Data Breach Investigations Report revealed that approximately 15% of breaches were linked to third-party infrastructures, such as software supply chains, hosting partner infrastructures, or data custodians. This marks a 68% increase from 2023.

Additionally, a joint study by the Ponemon Institute and Imprivata found that 47% of global organizations experienced a data breach involving a third-party partner accessing their network over the past 12 months.

Mitigation

After pentesting, we recommend third-party risk management practices, including due diligence, continuous monitoring, and clear contractual agreements outlining security expectations and responsibilities.

Business impact

Penetration testing can sometimes disrupt normal operations, especially when testing critical systems.

Mitigation

We usually recommend using a dedicated test environment that replicates a production system setup. But, if it is not possible, another possible option is to schedule tests during off-peak hours. It helps minimize the impact while still delivering the security insights you need.

Human error

Humans are often the weakest link in cybersecurity. In fact, a 2024 report by Secureframe indicated that 74% of all breaches involve the human element, highlighting the need for comprehensive training and awareness.

Mitigation

Penetration testing for finance company should assess your team’s ability to spot phishing attempts and follow best security practices. You can uncover areas where employees might be vulnerable by simulating real-world social engineering attacks. It improves your overall security posture and reduces the risk of breaches caused by human mistakes.

Let’s test security in your FinTech company with TechMagic

At TechMagic, we have extensive expertise and understand the FinTech industry's unique security needs. That’s why every pentest for finance company is precisely tailored to identify weaknesses in your systems before they become a problem.

With our help, you’ll be confident that your company’s financial operations and customer data are secure.

Final Thoughts

Penetration testing is a crucial part of securing FinTech systems against the growing threat of cybercrime. With breaches in the financial sector costing millions, the risks of ignoring pen testing are too high.

Whether it’s protecting sensitive financial data, complying with regulations, or securing third-party integrations, FinTech companies' pentest is the best way to identify security issues before they can be exploited.

Take this proactive approach, and you can safeguard your operations, maintain customer trust, and ensure their systems remain secure in an increasingly complex sector.

FAQ

What is FinTech penetration testing?

It’s a simulated cyberattack on your systems to identify weaknesses in businesses that provide financial services before hackers can exploit them. It helps protect sensitive financial data and ensures your systems security robustness.

What are the latest trends in FinTech penetration testing?

Key trends include testing for API vulnerabilities, third-party integrations, and compliance with complex regulations like PCI-DSS. There's also a growing focus on testing for AI-driven cyber threats.

Why does a FinTech company need penetration testing?

Penetration testing helps identify vulnerabilities that could lead to data and security breaches, financial loss, or reputational damage. It ensures compliance and strengthens customer trust.

Can a FinTech company ignore penetration testing?

In short, no. Ignoring FinTech penetration testing services increases the risk of data and security breaches, regulatory fines, and loss of customer trust. It’s crucial for maintaining security and compliance in a highly regulated industry.

How to choose a FinTech penetration testing provider?

Look for a provider with experience in FinTech security, a solid track record, and certified experts. They should understand the unique challenges of financial systems and offer tailored testing services and security measures.

What should I look for in a FinTech penetration testing company?

Choose a company with expertise in regulatory compliance, advanced security testing techniques, and a clear process for reporting security vulnerabilities and suggesting fixes.

Software Development

Software Development Security Services

Security Services Cloud Services

Cloud Services Other Services

Other Services

TechMagic Academy

TechMagic Academy