Core Banking Modernization: Dealing With Challenges

Last updated:3 June 2025

Сore modernization is often a long and complex but necessary process for financial institutions. It looks like the transformation will affect all banks that want to stay afloat.

Experts claim that currently, 90% of banking core software in the US is considered legacy. Therefore, 80% of financial institutions in Europe and 75% of banks specifically intend to replace their core system by 2026.

Today, we will discuss what a core banking system is, its challenges and considerations, and why it is worth upgrading a legacy core system. We will also discuss modernization options and strategies and the benefits they bring, as well as key differences between old and new systems.

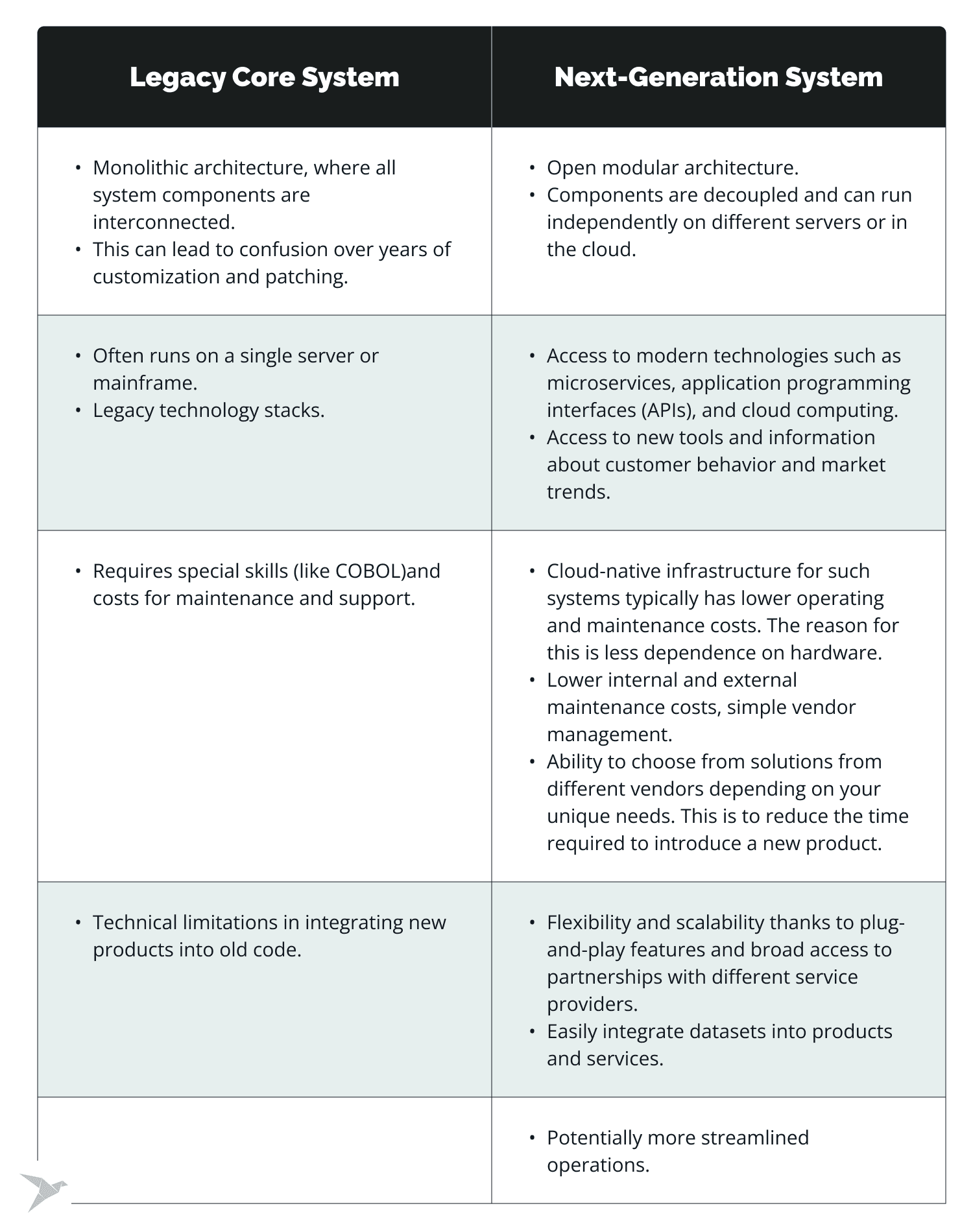

What is a Core Banking System: Legacy vs. Next-Generation

What is a core banking system? It is the back-end system used to manage the most important processes: accounting, real-time transactions and payments, risk management, etc. In other words, it is the foundation of banking operations, and seamless customer experience, security, and regulatory compliance depend on it.

The global core banking software market is growing due to the fact that more and more outdated cores need to be changed. What is the difference between new and legacy solutions? Let's take a closer look.

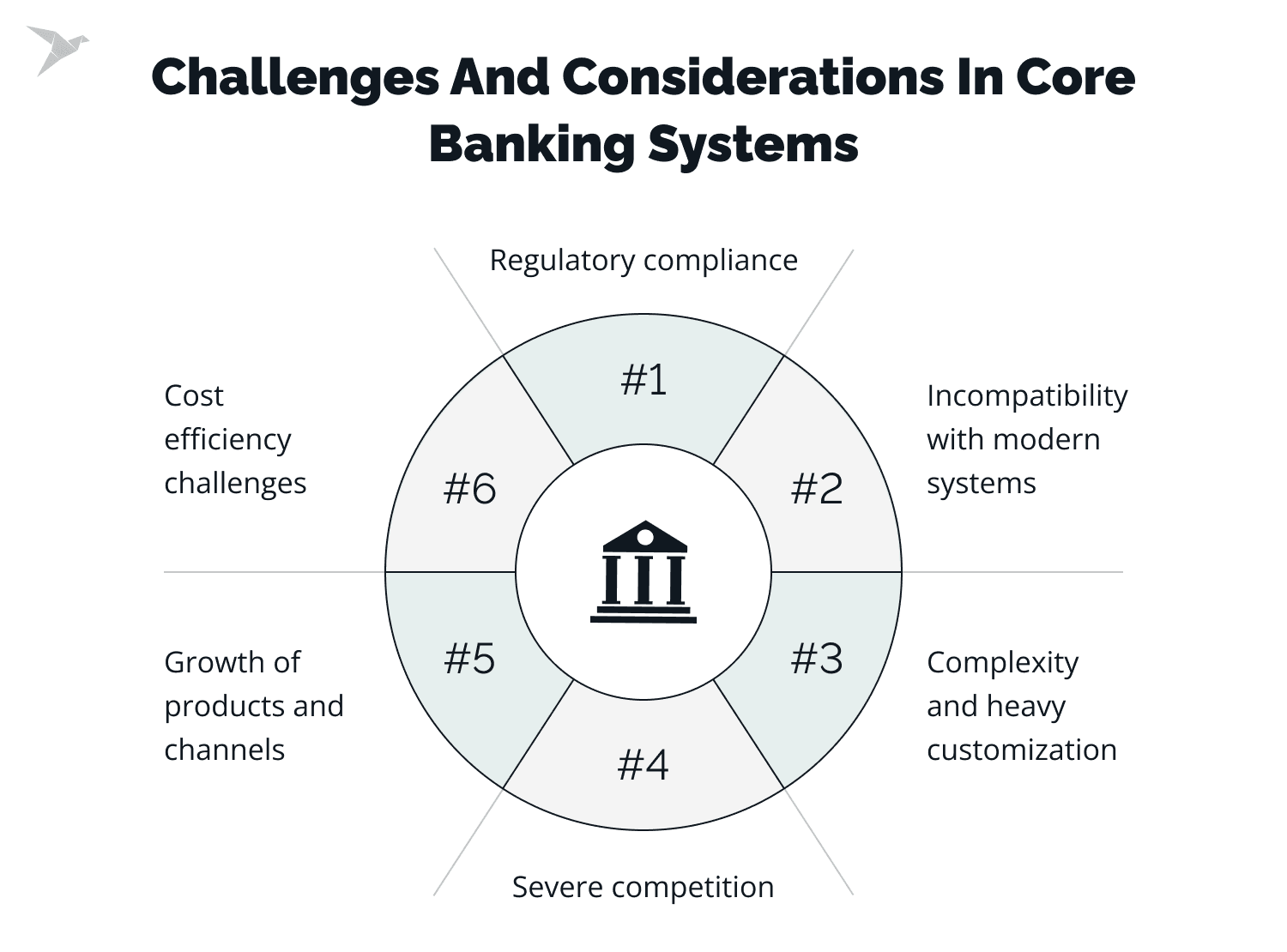

Challenges and Considerations in Core Banking Systems

The banking industry faces significant challenges, mainly due to its reliance on outdated core banking systems. These systems, many of which are built on legacy technologies and outdated programming languages, are increasingly bottlenecking progress. The need for modernization is dire, and here are a few key reasons why.

Incompatibility with modern systems

One of the main concerns is the incompatibility of the legacy banking core platforms with newer technologies. For a long time, the banking industry has moved very slowly in terms of digital progress. Older platforms were developed in an era that did not foresee the rapid changes we experience today.

As a result, core banking systems are difficult to integrate with modern ones. Even with great efforts, this leads to a disjointed and disruptive digital experience for bankers and customers alike.

Complexity and heavy customization

Legacy systems are often heavily customized with hard-coded business rules. This approach was critical in the past but is now a serious liability.

First, such systems are incredibly difficult to upgrade. This applies not only to small changes but also to implementing new mechanisms.

Second, older systems are nearly impossible to overhaul without significant downtime and risk. The problem is compounded by the lack of proper documentation and available skill sets for many of these decades-old systems. They are difficult to manage effectively.

Regulatory compliance

The regulatory environment in the financial sector is probably one of the most complex and tightly controlled. In addition, it is constantly evolving, with new rules emerging to improve risk management, governance, and transparency.

Legacy core systems lack the flexibility to quickly adapt to these changes. Regulatory developments related to consumer protection, digital assets, and climate change are incredibly fast. Accordingly, banks need systems that can keep up with this and ensure compliance.

In this regard, legacy core often falls short, exposing banks to the risk of non-compliance. Unfortunately, this leads to many serious consequences, such as penalties, activity restrictions, security breaches, and data loss.

Cost efficiency challenges

Modernizing the banking core system is not just about keeping up with technology; it is also a matter of cost efficiency. The older the system, the more resources it requires for maintenance and operation. Not to mention third-party integrations and service providers that can stop serving customers.

According to Gitnux research, banks spend about 78% of their IT budgets on maintaining legacy core. The transition to modern systems allows banks to consolidate various stand-alone applications. This also leads to reduced processing hardware costs and streamlines your operational activities.

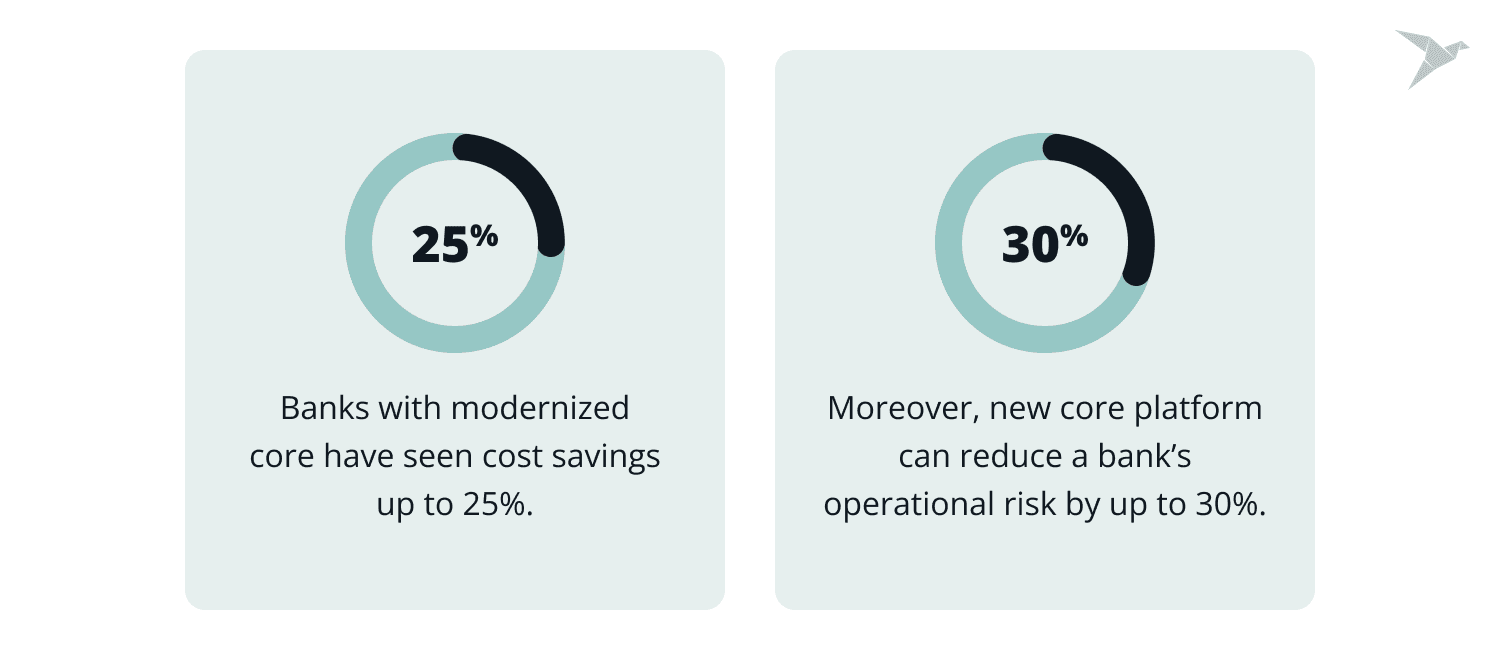

Banks with modernized core have seen cost savings up to 25%. Moreover, a new core platform can reduce a bank’s operational risk by up to 30%.

Growth of products and channels

The diversification of banking products and the proliferation of channels through which customers can interact with their banks have compounded operational complexity. Legacy core struggles to handle this complexity.

Today's core banking systems are more scalable and capable of handling a large volume of transactions across multiple channels. Legacy core often lacks this capability, leading to inefficiencies and potential outages.

All these challenges nullify banks' competitive capabilities, especially in the FinTech environment. Here, they have to compete not only with other banking institutions but also with startups, neobanks, etc. The market is large and diverse, and competition is fierce. Outdated core systems are not able to provide the necessary flexibility and opportunities for the banks to stay afloat.

User Expectations from Banking Core Systems

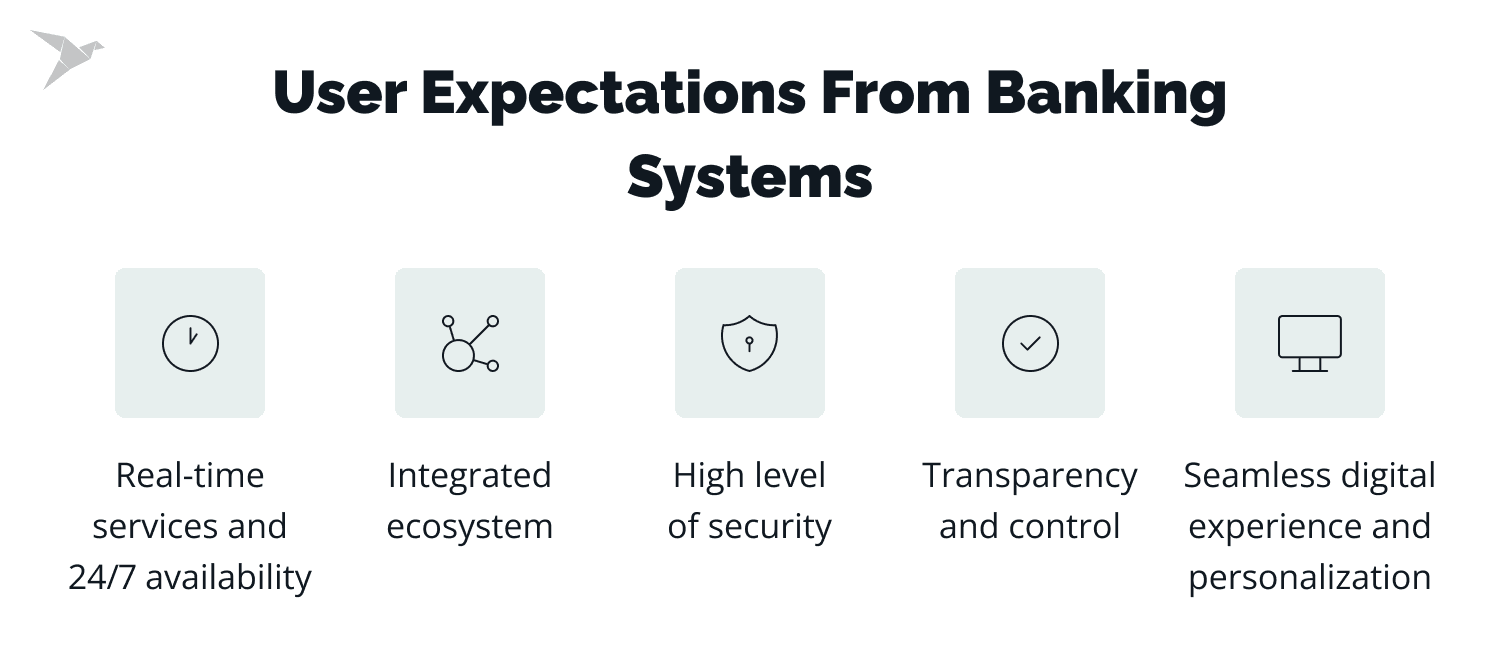

Of course, your target audience may have unique needs, but the basic expectations of banking users are as follows:

- Real-time services and 24/7 availability. Instant transaction processing, real-time account updates, and instant notifications are now standard expectations. In addition, banking services should be available around the clock, at any time and from any place.

- Seamless digital experience and personalization. It is not for nothing that neobanks are so actively implementing personalization using AI and ML algorithms. Banking users expect intuitive interfaces, a smooth experience, and personalized recommendations or financial advice.

- High level of security. Clearly, strong security measures, including multi-factor authentication, biometrics, encryption, and fraud detection, are critical. Your customers have the right to be confident that their personal and financial information is protected from cyber threats.

- Integrated ecosystem. Users prefer banking applications that can be easily integrated with other financial instruments and services. These can be applications for budgeting, trading and investment platforms, etc. Outdated core systems are not able to provide this.

It is essential to mention that every bank client expects complete transparency in communication. Users expect the bank to provide clear, precise information about expenses, transactions, account activity, etc. Your customers want complete control over their accounts and settings. This is a critically important aspect.

Why Banking Modernization Is the Only Way Out

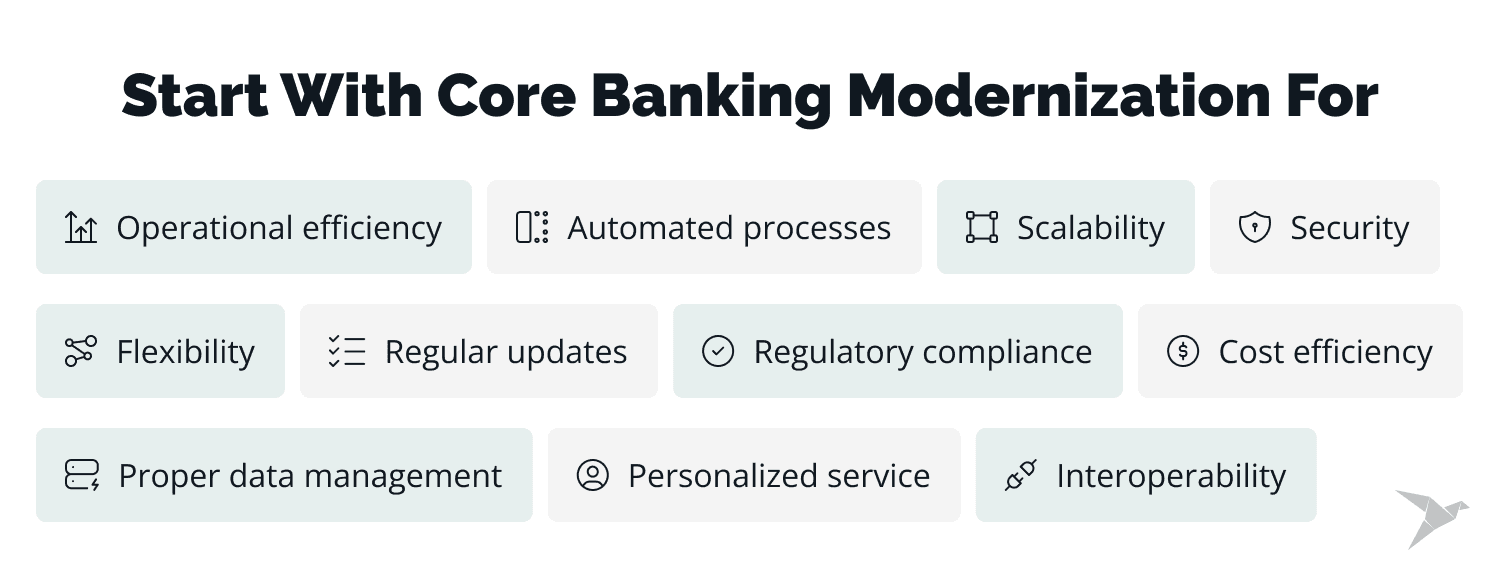

Well, there are some essential points here. Firstly, banking modernization offers significant improvements in operational efficiency. Automation reduces manual errors and operational costs, as well as streamlines banking processes. Additionally, modern systems can easily scale to handle increasing transaction volumes and customer bases without performance issues.

The second important point is security. Outdated systems are also vulnerable to cyber threats. The older the system, the harder it is to maintain its security. Modern systems ensure advanced security with the latest protocols and regular updates, and they quickly adapt to new regulations. This kills two birds with one stone: improves overall security and guarantees compliance.

Moreover, upgrading legacy core banking platforms is expensive. Modernizing your core banking application reduces costs through cloud-based solutions, lowering the need for physical infrastructure and maintenance.

What else?

Modern systems offer great data-handling capabilities. They ensure high-quality, consistent data across the organization. You can also use advanced analytics, including big data and AI, to drive better decision-making and personalized services.

The new core facilitates seamless integration with third-party applications and services. This way, your customers can manage all their financial activities from a single platform.

So, to meet evolving customer expectations, banks must digitize and modernize their systems. This is the only way to enhance user satisfaction through better integration, personalized service, and interoperability.

Core Banking Modernization: How to Plan and Prepare

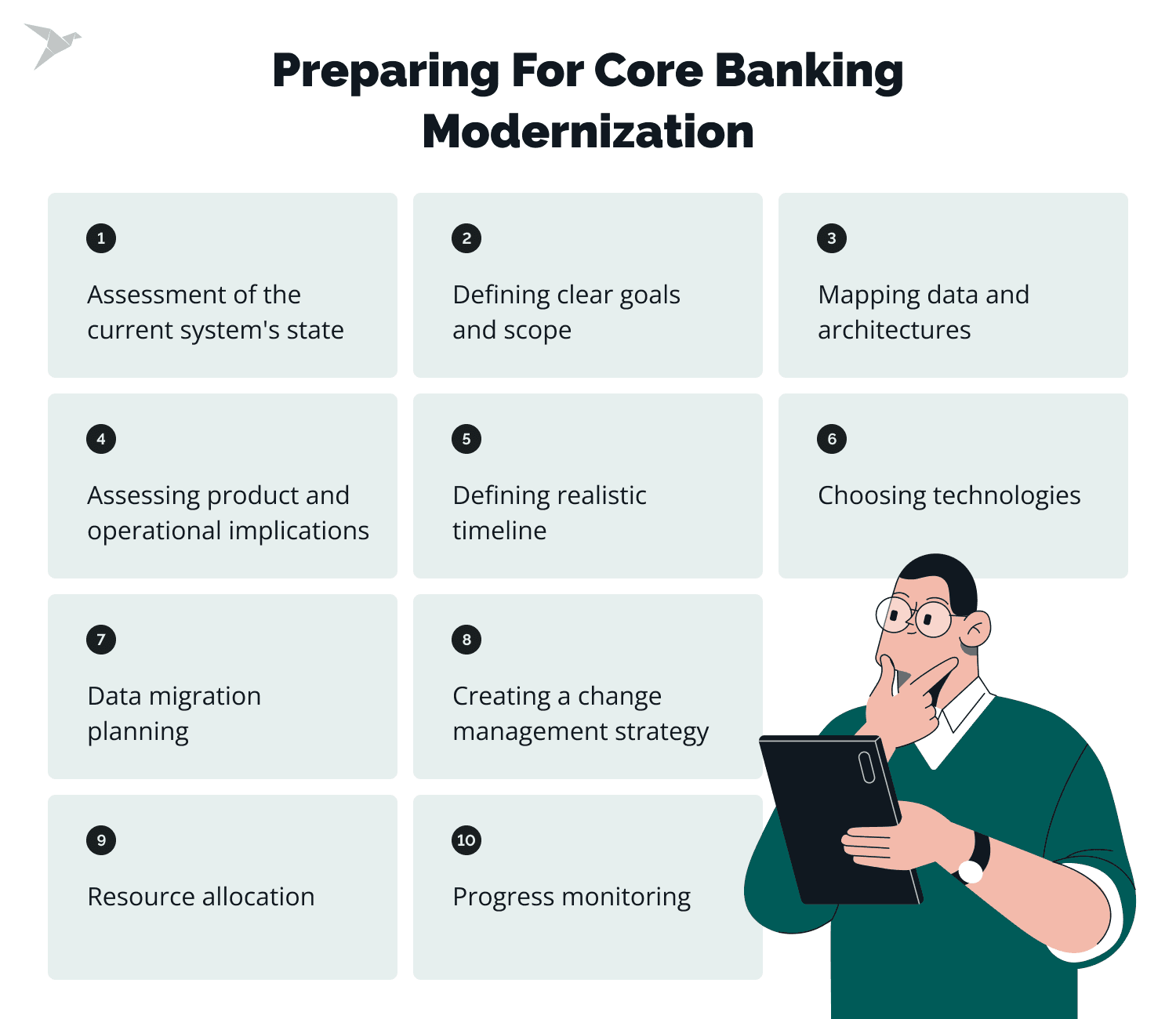

Proper preparation and careful planning are the basis of a smooth core banking platform modernization. For your transition to be truly effective, you will have to take into account various, often not very obvious, factors.

Of course, each organization's preparation largely depends on its system's features, the number of clients, etc. We will consider the main points with you.

1. Assessment of the current state of the system, its features, and nuances

You need to start with a thorough research of your banking system. The better the developers can do this, the more you can tune your modernization plan.

Here, your team should identify all pain points (critical and not so much), inefficiencies, and areas that need improvement.

2. Defining clear goals and scope

The objectives of your modernization project directly affect what features and improvements the product will have and how much money you will need to invest in it.

So, you may need professional help identifying the aspects that need updating. It can be not only infrastructure or security systems but also process automation, user interface, etc.

3. Mapping data and architectures

Data and architecture preparation are also critical, as it is an essential part of the core system. A clear understanding of current data management will lay the foundation for a successful transition and customized features.

Additionally, it can give developers clarity on how to improve data management and what technologies to apply in the future.

4. Assessing product and operational implications

Your team must understand all the connections between your legacy products and the implications of those imperfections for operational processes. Why are they slow and inefficient? How does this affect security and data processing? What actions should be taken to improve and simplify processes?

Defining a clear list of required changes will facilitate the transition to new workflows as well as help create an effective onboarding plan.

5. Timelines must be realistic

Whatever professional development team works on your core system modernization, it is impossible to predict everything. It is crucial that developers not only know how to deal with “surprises” but also have enough time for this.

So, setting a realistic timeframe for each project phase is critical. It should take into account system complexity, resource availability, possible failures, etc. In other words, find a balance between efficiency and thoroughness.

6. Choosing appropriate and future-proof technologies

This is probably one of the most difficult aspects of preparation and planning. Your team needs to choose technologies that not only meet your goals but also support the scalability and flexibility of the solution.

It is also important to consider security and integration with existing systems. This applies to cloud-native solutions, analytics tools, etc.

7. Data migration planning

While your data is being analyzed and prepared, you need to develop a comprehensive plan for its migration. The team should think about data integrity and security and create testing protocols to minimize failures.

Data is one of the most valuable assets, so choose a company that has experienced specialists able to pay enough attention to this aspect.

8. Creating a robust change management strategy

Changing things is always difficult. It is challenging to deal with an outdated core platform and its transformation. That's why the right change management strategy should be your helper and guide in this process so that you have clues on your way, just in case.

Consult with developers and project manager. Consider cases of successful core banking transformation. Make the most of this experience and be flexible.

9. Sufficient resource allocation

Modernization of outdated systems is difficult and expensive. However, with the help of professionals, you will be able to allocate your funds correctly.

Allocate adequate resources, including budget and human resources. Consider outsourcing tasks to specialized vendors for additional expertise.

10. Progress monitoring and adaptivity

There are two options here. You can independently monitor the progress and each stage of modernization. Likewise, you can hire a dedicated team to report regularly to you and your stakeholders to maintain transparency and consistency. Here, everything depends on your experience, free time, and desire.

These are the main steps on the way to a successful banking system transformation. To formulate a more accurate plan and strategy, you need to consult with your development team and analyze the unique features of your banking software.

Strategies for Legacy Core Systems Modernization

Before we get straight to the strategies, let's discuss how to choose the right direction. Certainly, working with a qualified advisor and developing a road map can make the transition easier. However, here are a few points that should be well thought out on your own.

- Motivation and goals. Determine for yourself the main reasons for modernization. A clear understanding of the goals leads to the definition of needs and the most optimal ways of their satisfaction. Not every strategy will be profitable and profitable for your specific case, which is why it is so important to understand why your core platform needs changes.

- Desired results. Clearly define the expected business results and how they can be measured to track progress.

- Financial consequences. Here, you need to think about how modernization will affect the financial condition of your bank. Track relevant KPIs and adapt processes to ensure financial health.

- Technical considerations. Together with the development team, you need to determine the technical merits of upgrading core systems and set priorities.

Also, consider clear performance metrics to measure the success of your modernization efforts. This will help you track progress and make necessary adjustments to the project.

Common Banking Core Modernization Strategies

Now, we can move straight to the strategies.

Option 1. Complete replacement

A full replacement is the best solution when the legacy core system no longer meets business needs. This is quite a time-consuming, resource-intensive, and very risky option. If you do a complete replacement and something breaks, then it is hard to rollback.

Before starting the migration, it is worth considering the downtime of core systems. In addition, you will have to pay a lot of attention to the data migration process and the allocation of resources to support the transition.

The decision to completely replace the core of the system is usually due to the bank's dissatisfaction with the inflexibility and high cost of maintenance and support of the legacy structure. New platforms can provide features such as banking as a service (BaaS) and open banking tools. This expands the functionality, improves security, and significantly lowers the cost of further maintenance.

Option 2. Component-based replacement

Replacing some components is a less risky and cheaper option than a full replacement. This is an excellent solution for banks whose core systems can still perform certain functions, need minor updates, or require time to prepare for a complete replacement.

Such an approach has some pitfalls to consider. Due to the long time without improvements and the numerous layers added to support functionality, disentangling the functions of the core system can be challenging and time-consuming.

However, if you have professionals with enough expertise and understanding of your core system to separate components within it, component-based replacement is your modernization strategy.

Option 3: Augmenting or building a parallel core

Instead of completely replacing the existing core, you can build a parallel core that could handle new requirements and functionality that are unavailable for the traditional one. This approach is also called “building on top or the side.”

In this scenario, the next-generation core can connect to the legacy one through an API. In this way, the bank can expand its product offerings, build partnerships, etc. At the same time, it remains flexible, preserving the integrity of the data and processes of the legacy core system. Also, the additional core can process transactions directly through the legacy core.

This option is best for you if you need to preserve full data integrity and speed up the introduction of new services. However, you still need to consider the costs of supporting multiple systems simultaneously and integrating new services.

Cloud-based migration strategies

Cloud solutions eliminate the need to purchase expensive physical servers and build data centers, significantly reducing initial hardware and infrastructure costs. In addition, cloud providers cover maintenance, upgrades, and management of energy-efficient infrastructure, so banks do not need to spend money on this. We see a similar pattern in other highly regulated industries: examples of cloud computing in healthcare show how compliant cloud architectures can modernize legacy systems without sacrificing security or performance.

On the operational side, cloud computing makes it possible to use a pay-as-you-go pricing model, meaning that banks pay only for the services and resources they need. Automated management tools and integrated disaster recovery solutions reduce the time and effort required for routine tasks, allowing companies to focus on core business and innovation.

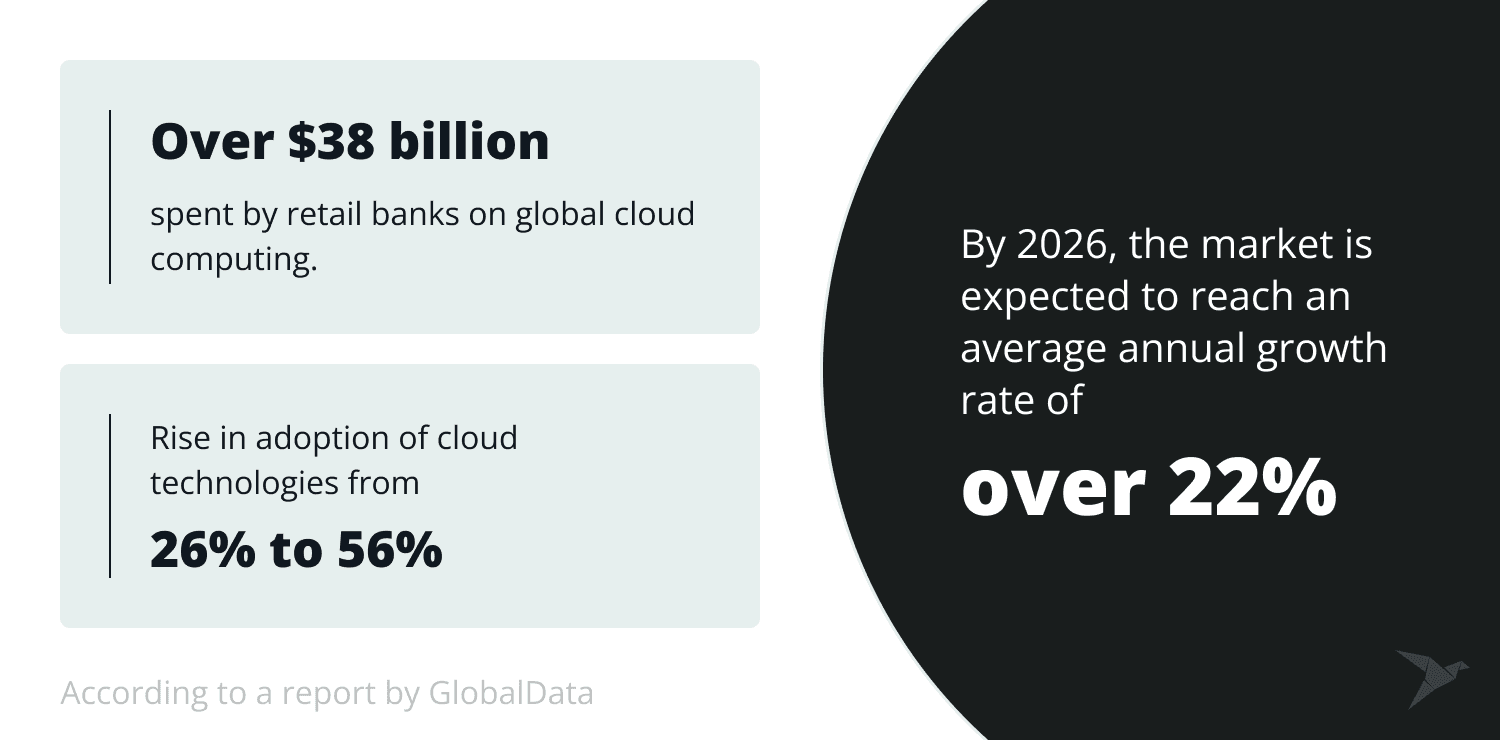

According to a report by GlobalData, retail banks spent more than $38 billion on global cloud computing. The market is expected to reach an average annual growth rate of over 22% by 2026.

Experts also claim that the adoption of cloud technologies in the banking industry will grow from 26% to 56% of the market by 2025, which leads us to common cloud-based core modernization strategies.

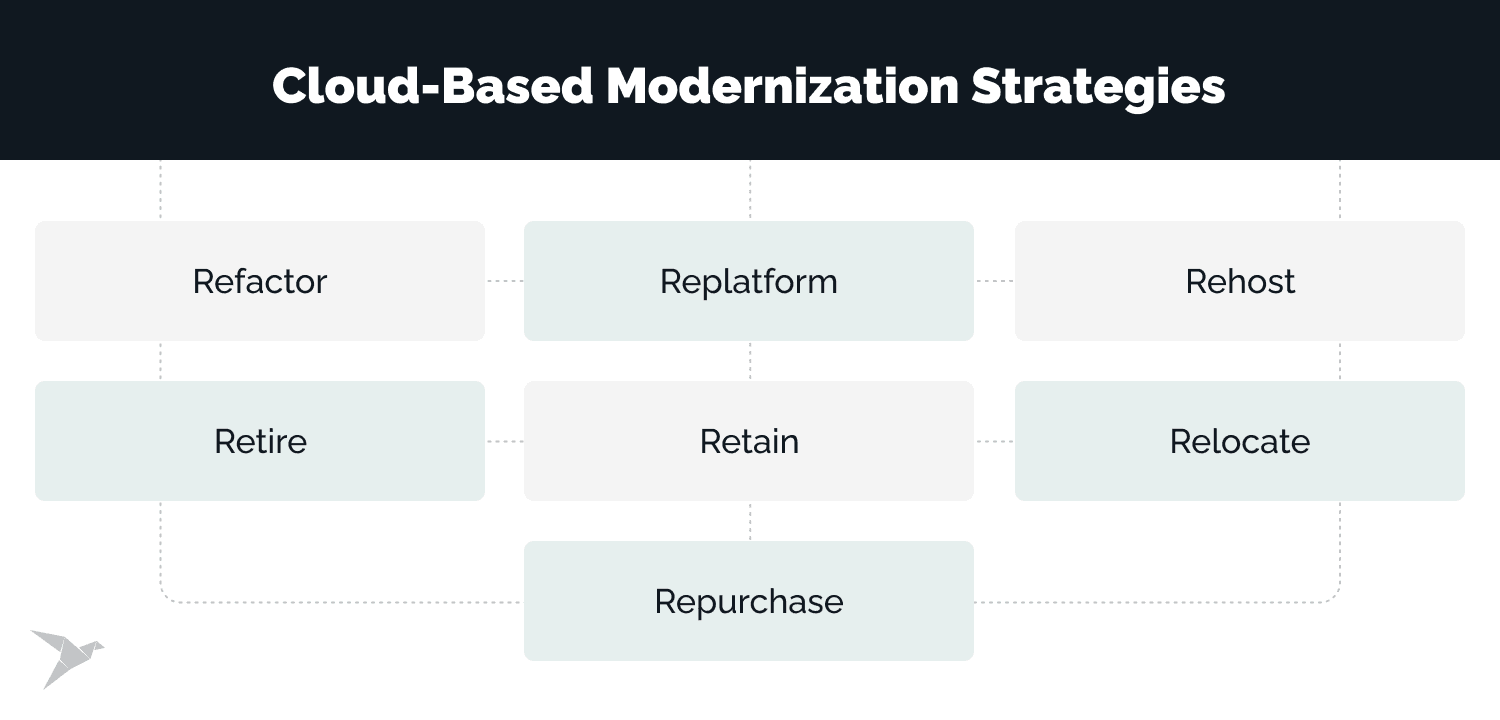

- Refactor

This is one of the most transformative and complex methods. It is suitable for those who need to preserve the benefits of the old core and take advantage of the microservices architecture at the same time. In this case, developers update the codebase without changing the underlying behavior. They can completely rewrite or restructure the underlying code of a legacy system to make it more scalable and suitable for cloud infrastructure.

- Replatform

This approach, also known as “lift and reshape,” often involves relatively minor adjustments that do not affect the core functionality too much. For instance, platform changes can be version updates or database updates.

This option is suitable for banks whose legacy core systems and all their data are in the cloud and need minor adjustments to improve functionality. This is advanced functionality with minimal risk of disruption.

- Rehost

This method is also called "lift and shift" because the developers actually "lift" the entire legacy system and all its data from the local environment and move them to the cloud. As part of his approach, banks can test systems before they go live. The functionality of the core system practically does not change.

- Retire

Sometimes, there is no value in changing your banking system. Moving it to the cloud is also unprofitable. At the same time, you need to eliminate maintenance costs or reduce the security risks of using a version of OS or components that are no longer supported.

In this case, you can use the retiring migration strategy to decommission or archive your application by shutting down the servers within that application stack.

- Retain

This option is relevant for banking applications that you are not ready to migrate but plan to do so in the future. This strategy is useful if you need more time to plan before the transformation or if you need to delay the migration before the next technical upgrade. Retaining is an optimal solution if your system depends on specialized hardware that does not have a cloud equivalent.

- Relocate

The essence of this strategy is to move the data center or its large parts to an equivalent cloud infrastructure. This is also relevant if you need to move your banking application and data from one cloud provider or region to another.

This approach is suitable for you if you need to move your workload to the cloud with minimal disruptions and downtime. This way, you can also reduce the costs of maintaining and operating local data centers.

The benefits obtained from the migration must outweigh the associated costs. Otherwise, especially when the banking system is already optimized for the current environment, this may not make sense.

- Repurchase

This strategy is also called “drop and shop” as it involves replacing banking applications with another version or product. This could be a shift from a traditional license to SaaS to improve infrastructure management. Or you could replace an existing on-premises application with a third-party cloud equivalent to gain access to new features, cloud integrations, and better scalability.

In a repurchase strategy, you need to be sure that the new cloud solution provides more value than the existing on-premises application. This strategy most often makes banking services available from any location and reduces costs related to maintenance, infrastructure, and licensing.

Challenges in Core Platforms Modernization Implementation

Of course, such large-scale changes are always difficult. However, the whole process can be much smoother and simpler if you know and anticipate common challenges.

Data Security Challenge

Data is the most powerful resource and the most valuable asset. In the FinTech industry, banking in particular, protecting huge amounts of digital customer data from cyberattacks is a severe challenge. Mobile and cloud channels increase the potential attack surface. Thus, small and medium-sized banks become vulnerable due to their limited resources.

Uncertain ROI Challenge

The return on investment (ROI) for core system transformation is often uncertain and long-term. Modernization teams have to make a lot of effort to explain to stakeholders why certain changes are critically important. Banks may find it difficult to justify the initial costs when benefits might not materialize for several years.

The Challenge of Getting Used to Legacy Systems

Despite being outdated, legacy core platforms have proven reliable and stable for decades. Getting a clear understanding of the need for change and finding the best alternative that could combine stability with scalability is very difficult. Explaining everything to stakeholders is even more difficult. After all, bank executives appreciate their predictability and reliability, refined over years of work.

Risk Management Challenge

Banks operate in a particularly highly regulated environment that is also very dynamic and constantly changing. Failures in the core system can lead to significant legal and financial consequences.

The risks associated with renewing these systems may deter banks from implementing modernization projects. Many are faced with the fact that they are unable to develop an effective risk management strategy and determine the advantage of modernization over possible risks.

High Costs and Resource Allocation Challenge

Transformation of core systems is an expensive and resource-intensive process. This requires significant investment in technology, human resources, and change management. In addition, a lengthy implementation process can cause operational disruptions, adding complexity and risk.

Scalability Challenge

The transformation of financial services is an ongoing and dynamic process, and banks often face various scalability issues that can hinder their growth and efficiency. Banking technological solutions must cope with the increasing amount of work and expand in accordance with the deployment of new services, the growth of transaction volumes, and the influx of new customers.

Dependence on inflexible legacy systems is a major limitation in this regard. Therefore, in the process of transforming the core, it is worth choosing scalable digital solutions, such as microservices and cloud services, which would allow innovations to be implemented smoothly and quickly.

How to deal with this?

First, find security experts who can implement robust cybersecurity protocols to protect customer data. For many banks, this includes partnering with an outsourced SOC that can provide 24/7 monitoring, threat hunting, and incident response while internal teams focus on modernization projects. They will help determine the necessary threat detection and response systems. Also, remember to update and patch your system regularly to protect against vulnerabilities.

Second, create a clear business case outlining the upgrade's long-term benefits and potential ROI. You can also hire a consultant with expertise in this area. If you work with a dedicated team, they will help you create detailed forecasts and case studies to justify the initial investment to stakeholders.

The experienced team will also be able to advise you on hybrid approaches that would combine new technologies with reliable legacy systems. So you will keep all the best of the "old" and be able to reduce risks. The optimal approach is also to ensure continuity during the gradual introduction of modernization.

Conducting extensive testing and creating contingency plans is not superfluous. It is good practice to contact regulatory authorities in advance to ensure compliance.

Last but not least, we should take an iterative and phased approach to implementation. Start with pilot projects to test and refine processes before full-scale deployment. This reduces the risk of mass disruption and allows adjustments to be made along the way.

Final Thoughts

As you can see, core modernization is critical to avoid significant increases in operating costs and to stay on top in a strictly regulated and competitive environment. Outdated monolithic architectures cannot provide the necessary opportunities for scaling, and technical debt will only accumulate without changes.

Although replacing the existing core with the next-generation one is the best solution, you don't have to. You may choose the strategy that suits you best. How? Assess your bank's needs and business capabilities realistically and objectively.

We at TechMagic will be happy to help you with this. Our team has extensive experience creating and modernizing FinTech products, including banking platforms.

FAQ

Why is core modernization important for banks?

What is a banking core? This is a critical system that, among other essential features, processes daily banking transactions. So, core banking transformation is the only way to stay flexible and competitive, not to mention security and compliance issues.

Modern core banking platform provides the agility, efficiency, and scalability needed to meet evolving customer expectations. It also facilitates the integration of new technologies, such as Artificial Intelligence and blockchain, which can enhance the efficiency of financial institutions and create new revenue streams.

What challenges do banks face in the future?

Banks face several challenges in the future. Firstly, it’s becoming more difficult to keep up with the fast pace of technological advancements as banking systems are less flexible and more complex than FinTech products. Also, security still remains challenging because of the increasing frequency and sophistication of cyber attacks.

Competing with agile and innovative financial technology companies is another challenge, and proper core banking modernization can help to overcome it.

How does core modernization address future challenges?

First of all, it enhances bank system agility, making it more adaptable to changes. Moreover, modernization improves overall security with advanced features to protect against cyber threats.

Secondly, it streamlines compliance as it allows for easier updates to meet new regulations. And finally, modernization boosts customer experience through better data analytics and AI, providing personalized service. It fosters innovation by using open APIs and modular architecture, which integrate new technologies effectively.

What are the key benefits of core digital transformation?

These are the main advantages of proper core banking modernization.

- Streamlined processes and reduced manual interventions lower costs and errors.

- Improved user interfaces and faster service delivery meet customer expectations.

- Ability to easily scale operations up or down based on demand.

- Easier integration of new technologies and services.

- More efficient adaptation to regulatory changes.

- Better data management and analytics.

What are some common strategies for existing system modernization?

The common strategies for core banking modernization are full core replacement, replacing some components, or building a parallel core. As for the cloud-based strategies, these may be refactoring, replatforming, or rehosting.

What challenges might banks encounter during modernization projects?

Banks may have issues with security and data integrity, as well as with uncertain ROI and resource allocation challenges. They may also get used to the legacy system’s stability, so it will be difficult to implement changes.

How can banks ensure the successful implementation of core modernization initiatives?

It always starts with defining clear goals and creating a road map for the modernization project. Careful planning should include risk assessment, resource allocation, and time frames.

Of course, it is important to choose experienced specialists who have successfully implemented modernization and can assess your banking system's real needs. If you are looking for such specialists, we will be happy to help you and discuss the details of cooperation.

Software Development

Software Development Security Services

Security Services Cloud Services

Cloud Services Other Services

Other Services

TechMagic Academy

TechMagic Academy