Starting A FinTech Company: The Complete Guide in 2026

Last updated:4 April 2025

The number of fintech startups has tripled in the past two years, surging from over 12,200 in 2016 to 26,000 in 2022. 75% of consumers actively use fintech products, and their expectations for these services have never been higher.

They crave swift, cost-effective solutions for their financial needs. The term "fintech,” an abbreviation for "financial technology”, now encompasses startups as well as small and medium-sized organizations (SMEs) that leverage cutting-edge technology to deliver financial services.

Recognizing the importance of digitization in securing long-term prosperity, many financial institutions strive to automate their financial operations, making them more efficient and accessible to end-users. However, the journey towards full digitization often presents challenges for traditional banks. Many of them need external assistance due to the constraints of their existing business models or a shortage of in-house talent. Consequently, they extensively rely on third-party providers to integrate innovative solutions.

The world is witnessing an unprecedented surge in the birth of new unicorns, and this might be the reason you're eager to learn how to kickstart your own FinTech company. Remarkably, many of these startups-turned-disruptors trace their roots back to technology, healthcare, and, not surprisingly, the booming fintech sector. Recent market research reveals that fintech now stands as the second-largest category for unicorn companies, and this trend is far from inexplicable.

The rationale behind this surge is crystal clear. With global markets becoming increasingly interconnected and millions of individuals revolutionizing their work and lifestyle choices, the race to modernize conventional banks and financial institutions is gaining unprecedented momentum.

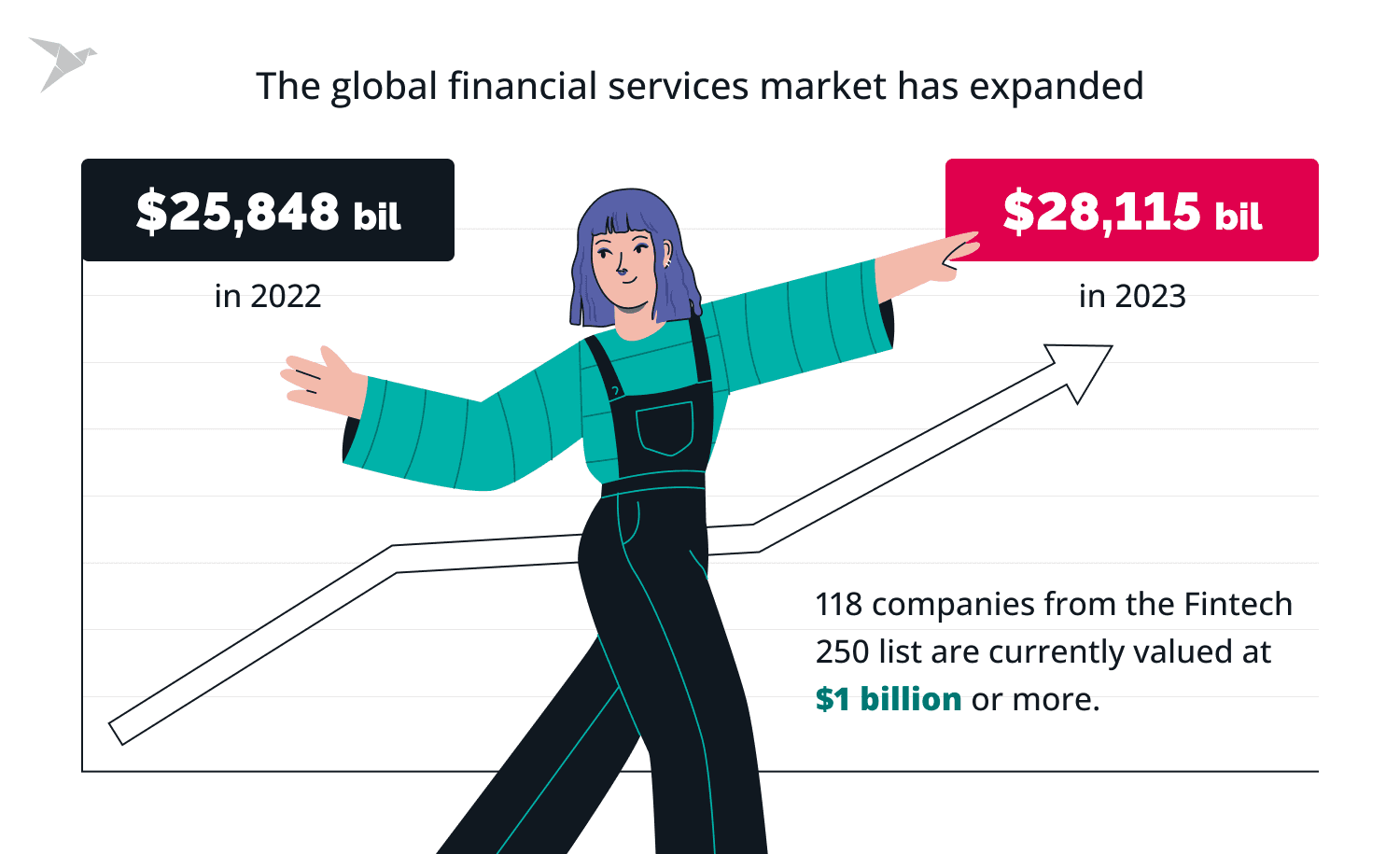

FinTech Expansion

While the fintech industry has seen remarkable growth with a surge in the number of companies, it's important to note that the market is not oversaturated. To emphasize the vibrant dynamics of this sector, let's delve into some noteworthy statistics:

- Stripe, a standout, boasts a valuation of $50 billion, ranking as the second-highest valued private company in the US, surpassed only by SpaceX.

- Klarna has attracted over $3.5 billion in equity funding since 2010.

- From 2017 onwards, an astonishing $115 billion in equity funding has been raised by 250 fintech companies.

- While most fintech stars hail from the US, nearly 40% originate from other regions, including the UK, India, France, Brazil, Germany, Indonesia, and Nigeria.

With a projected growth rate of 20.5% expected to continue until 2027, the future of the financial technology market appears exceedingly bright and promising. There is ample room for innovation, and your fintech venture can thrive by identifying the specific pain points of your target audience and delivering high-quality services that inspire trust and loyalty.

From a software development standpoint, fintech products share similarities with other software applications. They adhere to standard software engineering principles, employ similar technology stacks, and are developed by professionals who create our daily online services. However, there are critical moments to consider when building a fintech startup.

Learn about our expertise in the industry and what we have to offer

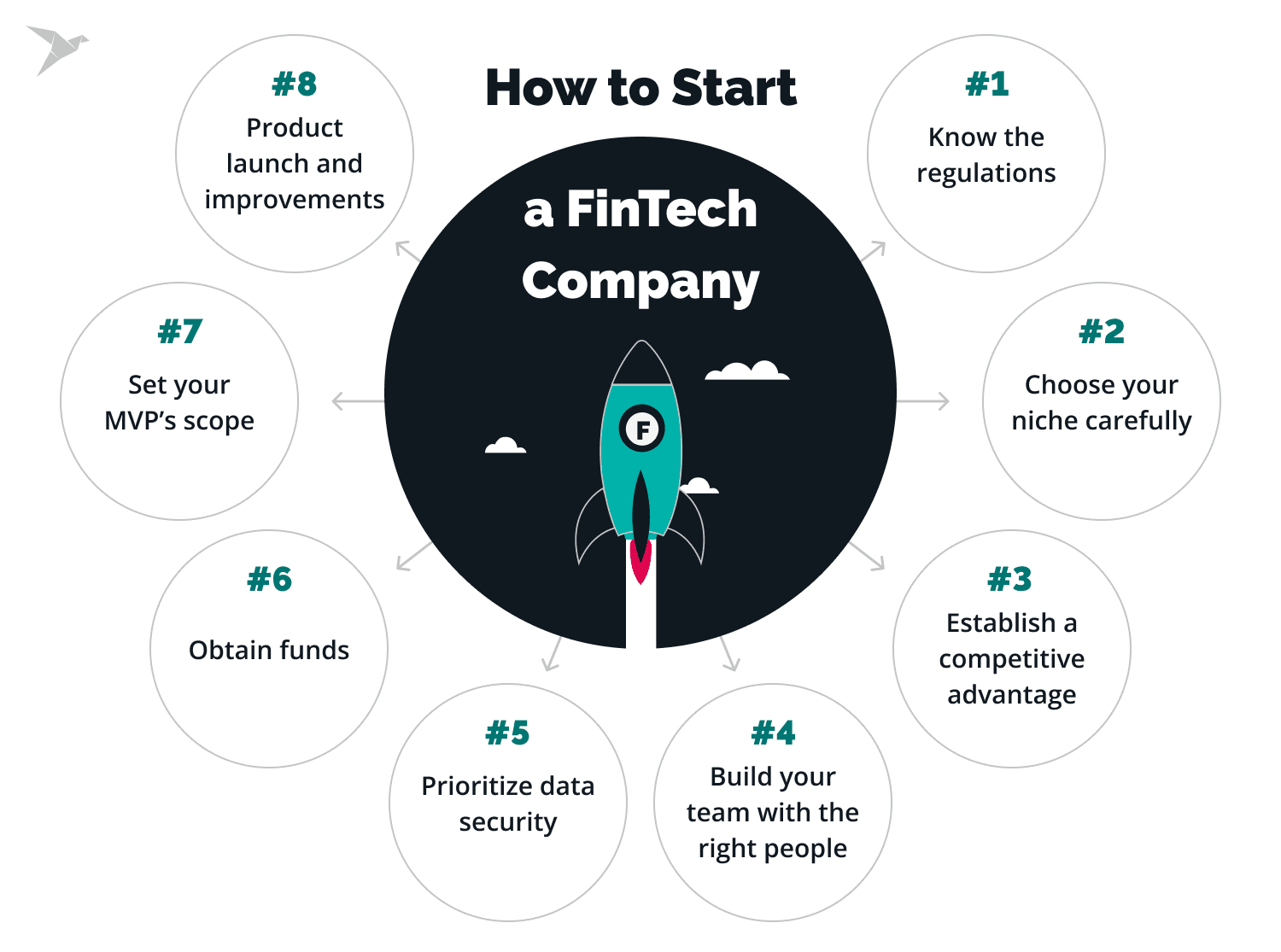

How to Start a FinTech Company

Let's uncover the steps to take when starting fintech companies.

Define Your Fintech Startup Idea

Before launching your business, assessing the market's demand for your product or service is crucial. Take the time to understand your competitors' offerings and thoroughly analyze the strengths and weaknesses of their products to determine if you can offer a superior solution. Additionally, gain insights into your target audience—are they large-scale enterprises or small businesses under SBA?

Once you've created an initial graphic prototype, seek feedback from an impartial focus group to evaluate the viability of your fintech venture. This unbiased group can identify weaknesses and provide valuable suggestions for improvements.

Prioritize understanding your customers' genuine needs and preferences before diving into development. After identifying your potential audience, carefully plan the most effective channels to reach them, develop competitive pricing strategies, outline product delivery processes, and more.

Whether you're developing a personal finance app, trading platform, insurance solution, cryptocurrency exchange, or peer-to-peer lending service, avoid merely replicating standard business models. Set yourself apart by offering unique features and capabilities exclusive to your product.

FinTech encompasses many technology-driven financial products and services catering to individual and corporate finance management aspects. Given this extensive landscape, it's challenging for any single company, especially startups, to offer the entire spectrum of FinTech services comprehensively. Below, we outline some distinct FinTech niches to consider:

- Banking

- Personal Finance Management

- Investments and Trading

- Lending

- Payment Services

- Cryptocurrency Trading Apps

- Currency Exchange

- Tax Services

- Mobile Banking

- Payroll Services

- Credit Reporting and Monitoring

Incorporating microservices, blockchain, AI, and machine learning is now imperative for fintech enterprises. Fintech firms are committed to delivering services that are swifter, more cost-effective, user-friendly, and inherently contemporary in comparison to conventional banking institutions.

Moreover, utilizing modern solutions adds substantial value in terms of marketing communication. Technologies such as AI and blockchain continue to captivate the imagination of clients and customers, endowing the services with a profound sense of modernity.

Knowing your market is crucial because not all FinTech products will resonate with every demographic. For instance, if your startup specializes in retirement finance services, your primary audience will likely be more mature individuals. Conversely, if you offer mortgage rate comparison services, your potential user base might be broader.

Examining prominent FinTech companies nearby to discern their branding strategies and app designs. You can access insights through app store reviews, official websites, marketing tools, or even by downloading and using competitor apps firsthand. This exploration sheds light on your competitors' strengths and weaknesses, providing an overview of what you're up against and the current FinTech trends that potential customers seek.

Sometimes, the most valuable lessons from competitor research are what to avoid. By analyzing user reviews, you can pinpoint areas where competitors fall short and devise solutions to address these gaps. Additionally, you can evaluate competitor pricing strategies and identify opportunities to deliver more value to your customers.

Build a team to realize your idea

You must know WHAT you want to achieve with their innovative financial products or services. However, you often require guidance on the crucial HOW. This is where a trusted technology partner comes into play, a collaborator dedicated to the success of the fintech startup.

Such technology partners offer invaluable advice across various dimensions, including infrastructure, tools, and solution architecture. Their support enables cost optimization, facilitates the development of new features, and aids in selecting the technology stack that expedites the realization of business objectives far more efficiently than attempting to navigate these intricacies independently.

Development companies have preferences regarding tech stacks, encompassing programming languages, frameworks, and databases used for website and app creation. Hence, it's crucial to engage a development team well-versed in crafting FinTech applications.

One viable option is building your team through a partnership with a reputable fintech software development company like TechMagic. Prioritize competence and experience, evaluate tech stack expertise, and explore nearshore options when deciding.

As Steve Jobs wisely noted, "Great things in business are never done by one person. They are done by a team of people." Attracting and recruiting top talent for your startup can be a daunting task, especially in the technology sector.

Develop MVP for the fintech app and test

Your top priority must be to minimize the time between coding your first lines and bringing onboard your initial users. To achieve this, meticulously outline your MVP (Minimum Viable Product) scope. Your MVP should balance lean development and offering users sufficient features and tools to experience your service.

Fast-tracking your MVP development saves your budget, reduces time to market, and allows for early experimentation and user feedback, significantly enhancing your chances of long-term success. The journey commences with prototyping, where you lay the foundation of your idea. This blueprint prototype serves as the canvas upon which you'll paint your fintech masterpiece.

An MVP of fintech app represents a product with the bare minimum of features required to discern your customers' desires and pain points.

Unlike earlier steps, iteration isn't a one-time task but an ongoing process:

- Focus on validating your idea and testing your assumptions. Start with a version boasting minimal features to glean insights into your end-users' needs.

- Analyze the results, observe user behavior, and attentively listen to their preferences. Your ability to interpret this feedback will profoundly influence your product roadmap.

- Continuously identify assumptions, devise new methods to test them with your audience, analyze the outcomes, and evolve your product accordingly.

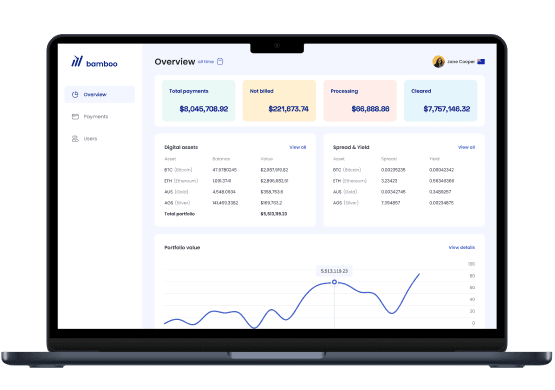

Learn how we built macro-investing app with its own token and reward system

Choose the technology considering the future of your fintech product

Suppose you're seeking technical partners for your fintech startup and lack a deep understanding of the relevant technology. In that case, it's crucial to place trust in your chosen fintech development company regarding technology selection. This decision hinges on multiple factors, including the specific business objectives you aim to achieve with your product. Equally important, they possess insights into the regulatory constraints of each technology choice. Opting for the right technology mitigates the risk of your entire project facing shutdown due to new legislation or the need to adapt to evolving regulations or customer demands.

Once you've determined what you intend to create, the next pivotal choice is how to construct it. This decision profoundly shapes your product's underlying framework, and switching after you've commenced development can be costly.

While some programming languages may tout superior speed and performance, others prove optimal for specific project types. Python, for instance, enjoys a stellar reputation for fintech development, a sentiment corroborated by HackerRank research. With the Django framework, an MVP can materialize in months, expediting your product's launch. Python's flexibility empowers you to make adaptations and refinements to the end product as needed, ensuring alignment with evolving market demands.

Prioritize Data Security

Data protection is imperative to ensure the robust security of your product, safeguarding all sensitive data through encryption and secure cloud storage. The risk of sensitive information leaks, which could potentially fuel theft, blackmail, or other fraudulent activities, is one of the foremost security challenges in fintech.

To fortify your fintech startup's cybersecurity framework, conduct rigorous testing to scrutinize the source code for vulnerabilities. Implement transport layer security (TLS) for all network connections and unauthorized API access, and shield your clients' information through HTTPS SSL certificates.

Furthermore, meticulous attention should be directed toward crafting your infrastructure. Exploring cloud platforms such as AWS, which offer robust protection against DDoS attacks and data backup capabilities for seamless recovery in the event of network disruptions, can be instrumental.

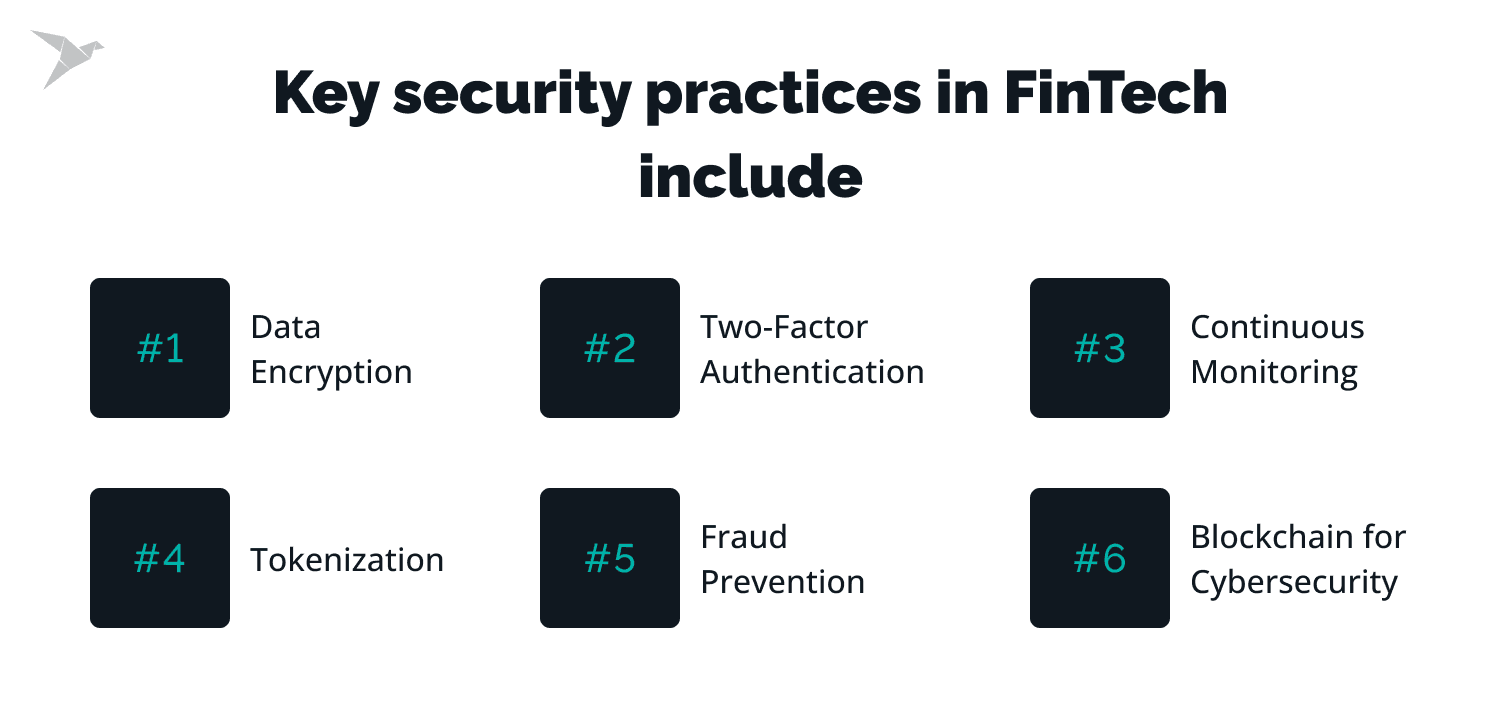

Key security practices in FinTech include:

- Data Encryption: Implement stringent encryption protocols for all transferred data.

- Two-Factor Authentication: Deploy two-factor authentication systems to enhance account security.

- Continuous Monitoring: Maintain vigilant surveillance to detect and mitigate potential data breaches promptly.

- Tokenization: Replace primary account numbers (PAN) with tokens to limit cardholder data exposure and mitigate data breach risks.

- Fraud Prevention: Deploy fraud detection systems empowered by artificial intelligence to scrutinize customer behavior and spending patterns.

- Blockchain for Cybersecurity: Opt for decentralized storage solutions within your fintech product, rendering it impervious to hackers aiming to breach a centralized data repository.

Privacy laws extend beyond data transferred between financial industry stakeholders and payment processors; they also encompass data accessed via web and mobile applications. Consequently, FinTech startups must prioritize robust security measures for any software accessible to the public, particularly web and mobile apps.

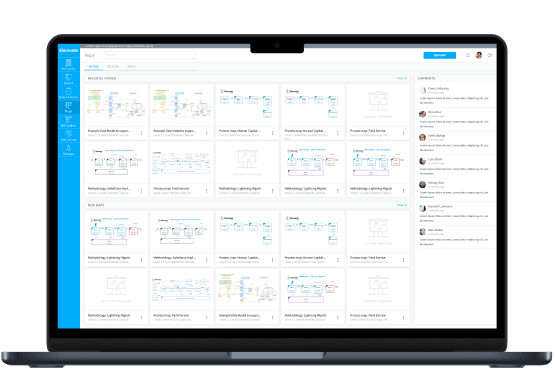

a BPM app using JavaScript stack and Serverless on AWS

Create Partnership

Collaborating with like-minded companies can generate a cross-pollination effect beneficial to all partners, in terms of technology and marketing. Develop APIs for interaction with other services and integrate with various platforms to leverage their data processing capabilities. This strategic approach saves time and expedites your time to market.

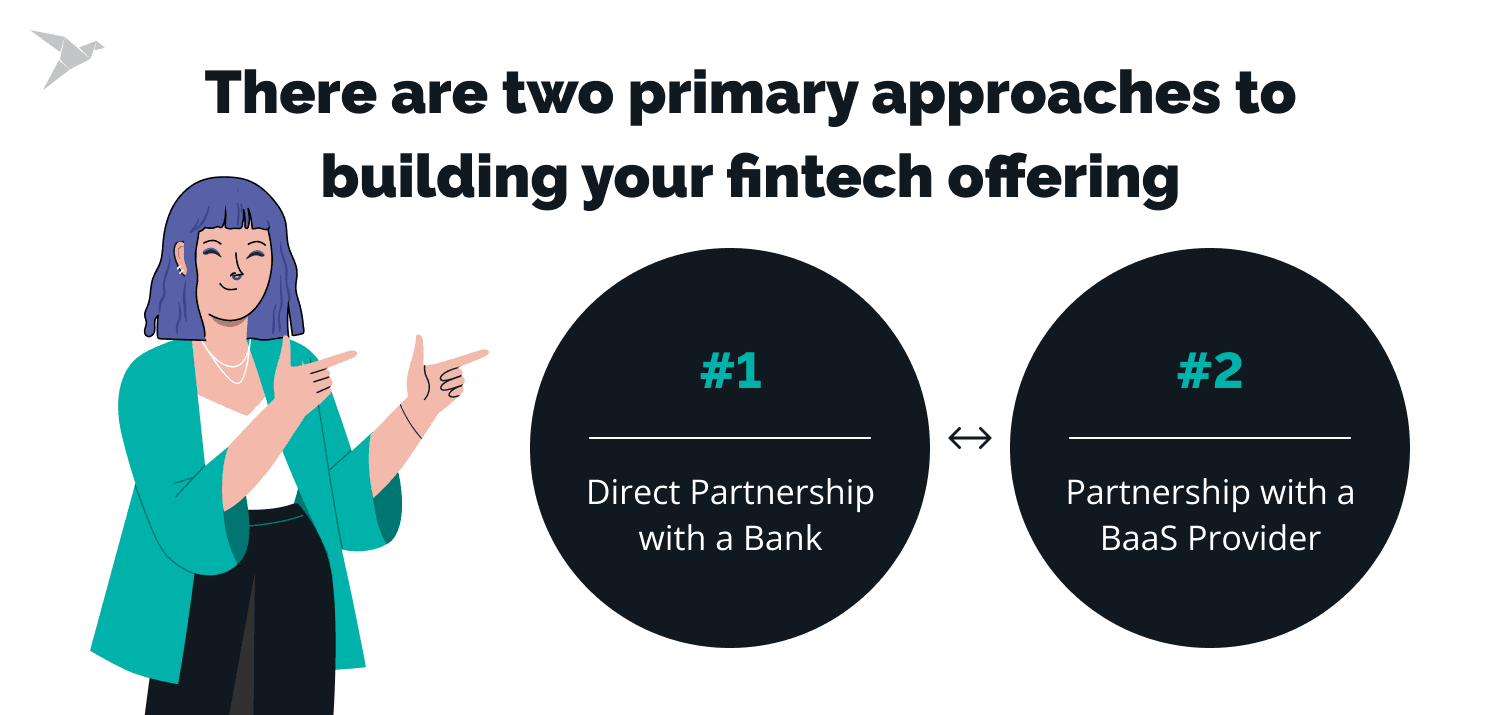

There are two primary approaches to building your fintech offering:

Direct Partnership with a Bank

Collaborating with a bank grants you greater control over your financial offering, as you develop it in-house. Nevertheless, this route demands substantially more resources and investment, both for initiation and ongoing management post-launch. When forging a direct partnership with a bank, you assume full responsibility for building a new financial service. This encompasses managing your relationship with the banking partner, creating core infrastructure for money storage and movement from scratch, addressing compliance and regulatory demands, and more—beyond the actual financial product development.

Partnership with a BaaS Provider

Alternatively, you can opt for a partnership with a BaaS provider, which offers the fundamental infrastructure required to create a new financial offering, relieving you of much of the product and compliance complexity. Partnering with a BaaS provider significantly accelerates your time to market, allowing you to swiftly identify product-market fit and develop differentiating features atop the core financial offerings.

Follow Regulations

Fintech aims to revolutionize traditional financial institutions by offering more efficient financial solutions. However, these innovations must operate within government regulations. Introducing new financial services, whether in investments, online banking, or other sectors, necessitates compliance with existing legal frameworks.

Before launching a fintech venture, thoroughly research the regulatory landscape of your target country. While unforeseen challenges may arise, adhering to established regulations can minimize risks. Non-compliance may result in governmental resistance, fines, or even business bans. Some countries have established regulatory sandboxes to facilitate testing innovative financial technologies under regulatory supervision. For example, eight countries have implemented such sandboxes to foster innovation within their financial markets.

It's important to note that fintech is not the only sector subject to stringent government regulations. Compliance is crucial to avoid substantial fines, ranging from $50,000 to $1 million annually.

Deeply analyze the regulatory landscape of your chosen sector, and consider enlisting the expertise of a specialist to ensure your startup operates within the confines of the law.

Key regulatory bodies and considerations include:

To illustrate the gravity of the matter, consider the imperative of adhering to the Payment Card Industry Data Security Standard (PCI DSS). This pivotal standard mandates organizations handling credit card data implement robust safeguards to shield sensitive information from multifarious risks. Introduced in 2006, PCI DSS is designed to fortify the security of payment accounts during transaction processing, underscoring its significance in fintech operations.

Equally paramount is the General Data Protection Regulation (GDPR), a regulatory framework that warrants meticulous consideration when laying the foundation for a fintech startup. GDPR stipulates that companies must ensure the security and confidentiality of European citizens' data, encompassing genetic, personal, and biometric information. Violations of GDPR can incur penalties of up to 20 million euros, underscoring the indispensable need for compliance.

Fund for Fintech Startup

Entrepreneurs have various avenues to fund their fintech startups, ranging from crowdsourcing and bootstrapping to seeking venture capital or bank loans. Rather than making impulsive decisions, approach this step systematically and methodically.

Create a list of available funding options and conduct a comprehensive evaluation. Consider the benefits, interest rates, and associated risks for each option, selecting the one that best suits your business. If this process appears daunting, seek assistance from a professional financial advisor to make an informed choice.

While there are exceptions like GoPro and GitHub that achieved success without venture capital, most startups require funding to thrive. This is especially true for banking services and fintech startups, given the intricate nature of financial products. Funding from financial institutions often brings the added advantage of mentorship and guidance for founders:

- Crowdfunding: A popular method that involves donors receiving something in return for their contribution, such as future profit-sharing or VIP privileges in your product.

- Investors: Seek funding in the early stages of your journey and gain valuable insights from industry veterans and experienced advisors.

- Venture Capital: Exchange a portion of your equity for investments at different stages of your company's growth, from the preparatory stage to later phases (Series A-n), when substantial capital is needed for international expansion or product growth.

Diversify your revenue streams

Many fintech companies combine several revenue streams to diversify their income and enhance business profitability. Additionally, they often experiment with different monetization strategies to ascertain their long-term revenue sources and adjust their approach accordingly. There are several ways to fintech revenue streams:

- Capture a portion of the interchange fee from transactions conducted with the Persona Visa card.

- Charge payment processing fees when businesses accept payments on their platform.

- Generate deposit fees from funds held in financial accounts on their platform.

- Facilitate affiliate partnerships with businesses, enabling both Persona and their customers to receive compensation for specific purchases.

- If your fintech product includes a card component, you may have the opportunity to retain a portion of the interchange fees generated for each card transaction.

- Offer loans and levying origination fees and interest can generate revenue.

- If your platform enables customers to store funds, you can earn fees based on a share of the funds held. You may keep the entire revenue, share it with customers, or adopt both approaches.

- Charge customers recurring fees for subscription or membership plans, granting access to your offerings or services, can be a lucrative source of income.

- Increase the costs of various money movement services, such as expedited access to funds, wire transfers, and currency exchange, to generate revenue.

Check out what TechMagic did for cryptocurrency live data aggregator with real-time visualization of the crypto market.

Navigating Fintech Startup Challenges: Avoid the 75% Failure Rate

While success stories like Mint, Stripe, and Revolut shine brightly, the reality is that many fintech startups don't make it. The failure rate for new startups falls within the daunting range of 60 to 90 percent. In simpler terms, only around 3 out of every 10 startups will celebrate their 10th anniversary.

The primary reasons behind these failures include targeting the wrong niche, attempting to serve non-existent or disinterested customers, running out of financial resources, and needing a capable development team to execute the vision.

To steer your fintech venture away from becoming a statistic, focus on:

Product Quality and Market Fit

Few elements are as pivotal as product quality and market fit when venturing into the fintech realm. While customers may perceive your product as a web interface paired with a mobile app, beneath the surface lies a world of intricacies. To potential investors and yourself, it represents meticulous documentation, a modern and scalable architecture, and a well-defined marketing strategy with clear differentiators and significant milestones.

Additionally, fintech services rarely exist in isolation today. They typically integrate with multiple data sources, payment services, bank APIs, insurance providers, etc. Many also incorporate an additional layer of protection in the form of a RegTech provider with its anti-money laundering (AML) database and corresponding tools.

Development

Understanding how to launch a fintech bank or any fintech venture entails recognizing their inherent complexity. These products involve intricate and specialized technologies on both the back- and front-end. Stringent security requirements necessitate comprehensive test coverage and extensive quality assurance efforts throughout development.

Building a fully functional fintech product within a reasonable timeframe is no small feat. It demands the concerted efforts of a diverse team, including app developers, QA specialists, adept project managers, visionary executives, savvy marketing experts, and more. Without this cohesive team, any fintech startup will likely face insurmountable challenges.

Security

Complying with local government regulations is mandatory, and demonstrating the absolute safety of your product is imperative. Drawing from our experience in crafting fintech platforms (such as Webmoney), MadAppGang strongly advises following prevailing security protocols. Additionally, consider implementing two-factor authentication and/or biometric security measures, dynamic CVV2 codes, and registration via phone numbers to bolster your security posture.

Effortless User Journey

Fintech services, by their nature, can be complex, necessitating multiple user inputs and authentication steps. Your goal should be to streamline and simplify the user experience. However, achieving this balance is not always straightforward, as users may deduce internal processes from the information you request.

Focus

Fintech, being a technology-driven field, often tempts entrepreneurs with many new opportunities and ideas. Falling prey to this temptation is a common mistake among fintech startups.

Success hinges on maintaining unwavering focus, tackling one challenge at a time, and having the discipline to decline distractions. Devote your efforts to your primary objectives, and resist the allure of branching out too soon.

Competent Team

Building a capable team is a critical endeavor. If you're fortunate enough to possess a team of skilled app developers and designers within your organization, you're on the right path. However, if not, you face three options to secure the expertise required.

First, the traditional but resource-intensive approach involves building an in-house team. While effective, it can be costly and time-consuming. Second, you could explore the freelance, which may offer cost savings but can be time-consuming and may lack the synergy of a cohesive team.

The third and expedient option involves partnering with an experienced development company like TechMagic. By entrusting us with your startup vision, you offload the technical intricacies. We'll assist in project planning, cost estimation, and seamlessly handle design, development, and rigorous testing of your fintech platform.

If you're searching for a reliable partner with expertise in both fintech and software development, don't hesitate to reach out to us. We're here to help you turn your fintech idea into a reality. Your startup could be the next unicorn in the fintech industry, and with the right approach, you can seize this opportunity.

Contact us now to get started.

FAQ

How much does it cost to start a fintech company?

The cost of starting a fintech company can vary widely depending on factors such as the complexity of your product, regulatory requirements, and geographic location. On average, you can expect to spend anywhere from $100,000 to several million dollars. It's crucial to create a detailed business plan to estimate your specific costs accurately.

What factors should I consider when building a team for my FinTech startup?

When assembling a team for your FinTech startup, consider factors such as technical expertise, industry knowledge, and cultural fit. Look for professionals with experience in finance and technology who can bring complementary skills to the table.

How can strategic partnerships benefit my FinTech company?

Strategic partnerships can provide several advantages to your FinTech company, including access to a broader customer base, complementary technologies, and industry expertise. Partnerships can also enhance credibility and open doors to new opportunities, such as distribution channels or co-development projects.

What are effective user acquisition and growth strategies for a FinTech startup?

Use digital marketing, referral programs, partnerships, user experience optimization, and data analytics for user acquisition and growth.

Software Development

Software Development Security Services

Security Services Cloud Services

Cloud Services Other Services

Other Services

TechMagic Academy

TechMagic Academy