FinTech and Banks Future: How Financial Technology Affects the Banking Industry

Last updated:17 January 2022

Banks that use fintech get long-term prospects for successful development and high competitiveness. This article talks about top collaborations between famous banks and FinTech vendors and how financial technologies improve the financial and banking industry.

Fintech is an actively developing industry at the intersection of financial services and advanced technologies. It is a powerful engine of technological progress, which increases the global tech influence every year.

And the COVID-19 pandemic, which is actually driving the development of innovative technologies, requires a new level of speed and flexibility from this IT industry. In particular, such giants of the financial market as Visa and Mastercard are active supporters of the arrival of fintech in all business sectors, stimulating the emergence of new technologies and tools for monetary transactions.

As for local businesses and banking institutions, innovations appear less frequently. For this reason, launching your own business software solution can be an efficient way to leave your competitors behind. Let’s talk in more detail about the prospects for developing fintech in the banking niche below.

The Era of Financial Technology for Banks and Financial Institutions

So, how does fintech affect banks exactly? What are the most significant effects of fintech on the banking industry?

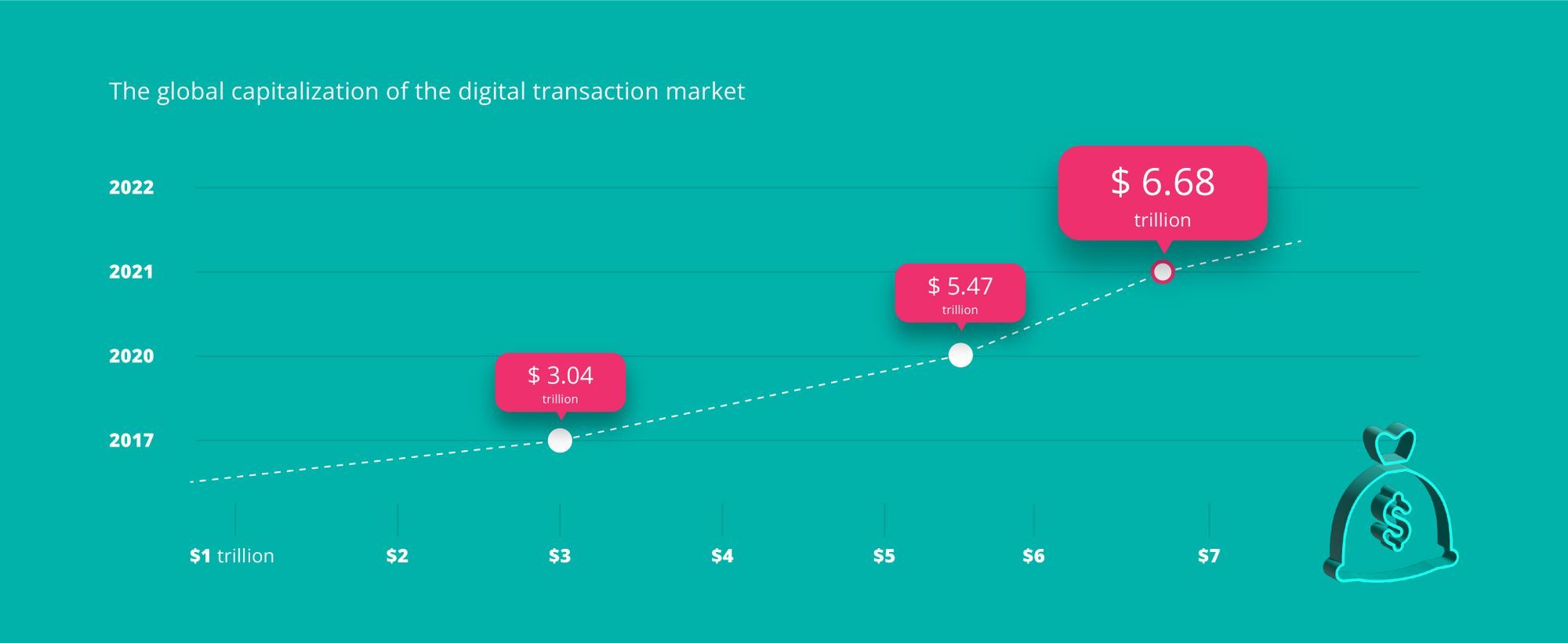

For example, by the end of 2021, the global capitalization of the digital transaction market will make about $6.68 trillion (while in 2020, this figure was $5.47 trillion, and even lower in 2017 — only $3.04 trillion)? This steady growth determines the undeniable value of technologies that stimulate the impact of fintech on banking. Indeed, as practice shows, many financial giants have already integrated financial technologies and innovations into their routine business processes. Let’s learn more about fintech and banks with real examples of fintech solutions below.

Top collaborations between famous banks and FinTech vendors

What does fintech mean for banks? Here are the top 5 collabs between big banks and FinTech vendors that, in our opinion, explain how has financial technology changed banking:

- Royal Bank of Canada & Extend. Subsidiary Royal Bank of Canada worked with software development company Extend to create an online credit card application for bank employees.

- ING & Minna Technologies. ING has partnered with Minna Technologies to launch a single digital platform for managing digital subscriptions.

- Bank of America & Zelle. These U.S. companies have teamed up to launch a digital mobile transaction solution, resulting in over 100 million transactions worth $27 billion in the first three months of 2020.

- Barclays & Flux. Barclays Bank has partnered with Flux to provide its customers with an alternative to paper checks in the form of digital receipts to help preserve the environment.

- Lloyds Banks & Publicis Sapient. Although Publicis Sapient is not a fintech company, together with Lloyds, they implemented GDPR policies into existing solutions and optimized traditional banking mechanisms.

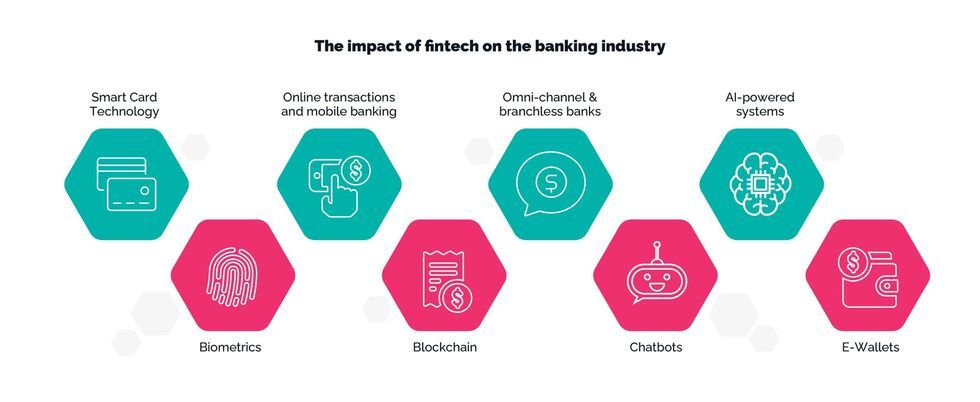

Improving the Financial and Banking Industry Through Financial Technology

Now, we’re going to introduce to you solutions that demonstrate the impact of fintech on the banking industry.

Smart Card Technology

Along with Apple Pay and Google Pay services operating through a smartphone, smart cards gradually appear on the market, combining all your cards digitally in one payment solution.

First, instead of using dozens of physical cards, smart cards owners can combine them into one card. Also, they get an opportunity to pay with a smart card in any store where card payments and transfers are available. Thus, the banking institutions that implement this technology provide their clients with a fundamentally new quality of service and, in particular, the convenience and reliability of their funds.

An excellent example of the use of smart cards in the banking industry is X INFOTECH’s project for Eastern Bank Limited in Bangladesh. The project aimed to migrate the card issuance system from magnetic strip cards to EMV chip cards to make the authentication process more secure and minimize fraud risks.

Biometrics

The most obvious area of using biometrics in banking is the prompt and reliable identification of a client at different steps and in different scenarios of financial interactions. The second area is security in handling personal information and financial data. This applies to all kinds of payment and transfer systems, banking and personal finance, lending, asset, and investment financial management, and, finally, insurance.

The simplest biometrics is used in the face ID algorithms of modern smartphones and tablets; with their help, you can access Google Pay and Apple Pay systems. Solutions based on algorithms that exclude the substitution of real faces with videos are as safe as possible. Indeed, unlike fingerprints and everything that can be recorded with conventional devices, three-dimensional objects are recognized only with the help of specific 3D markers.

On the other hand, Chase, Bank of America, Citi and Wells Fargo still use simpler biometric ID options, including voice, fingerprint, eye, or facial recognition. The same mechanisms (embedded fingerprint ID) are used by Mastercard and Visa for their innovative payment cards.

Blockchain

Blockchain is a decentralized distributed ledger that tracks digital asset transactions with real estate, money, land, or intangible goods. It can be patents, copyrights, branding. As for the impact of fintech on financial services, the technology reduces risks and costs for all parties of the transaction. In addition, a considerable number of payments are processed fairly quickly.

Usually, transactions in banks and financial institutions, money transfer services, credit processing centers, and other third-party services take at least a day and charge a commission for the service. Blockchain transactions are carried out only after a few seconds, and transaction confirmation takes from a few minutes to several hours. All payments on the blockchain are irreversible, so confirmations are essential to protect against online fraud.

According to the Business Insider, blockchain solutions are used by JPMorgan, Citi, Wells Fargo, US Bancorp, PNC, Fifth Third Bank, and Signature Bank. In particular, JPMorgan uses it to help improve money transfers between banking institutions globally, including payments originating from Taiwan banks to beneficiary banks in other markets.

Online transactions and mobile banking

Online transactions and mobile banking can solve many problems: from endless waiting in line to issuing loans. In addition, mobile banking:

- allow bank clients to control financial flows, connect bonus points, cashback, and other loyalty programs;

- convenient reporting system — clients can track personal and family expenses, as well as expenses on work issues;

- make auto payments according to ready-made templates — bank clients can send money to a savings account or relatives, pay for utilities;

- provide investment opportunities — clients can set up automatic purchase of currencies or stocks that have fallen in price;

- in addition to their services, they also offer partners’ services — for example, bank customers can pay for a table in a restaurant, buy a train or plane ticket, issue insurance policies, etc.

As for particular examples of mobile banking solutions, one of the most famous and well-thought-out is the Bank of America’s mobile app. It has all the essential features: bill pay, the functionality of sending and receiving money, and mobile check deposit.

Chatbots

Today, chatbots in banking, telecom, and online retail solve two-thirds of all customer requests. Chatbots have become a new communication channel for banks and customers. In the modern world, this communication format is natural — with its help, many issues can be resolved quickly, conveniently, and 24/7. Also, many banks offer customers to use their chatbots, which perform several customer support functions.

For banks, chatbots have also become additional value services that do not generate income but help them better serve customers and increase the productivity of the support system.

Today, bots can place an order, advise clients, carry out several financial transactions, and reduce operating costs. Most bank customers use chatbots instead of calling the call center because it is much easier to get the necessary service without leaving the messenger.

As for the prospects for the development of chatbots, there are more and more solutions based on artificial intelligence. They can handle most of the client's requests, completely replacing the work of live staff.

Among the most famous chatbots used by banks are Ally Assist from Ally Bank, Citi Bot SG from Citi, and Erica from Bank of America. For example, Ally Assist functions within the Ally bank app together work like a live bank manager and can be accessed via voice or text.

Omni-channel & branchless banks

Omnichannel is the ability to seamlessly switch between different communication channels (SMS, mail, chats, messengers, voice) and form a single history of requests for a particular client.

For example, users can start the communication process via phone call and end on a messenger without re-providing the original data. The main feature of omnichannel is the well-coordinated work of all channels involved.

The key advantages of omnichannel banks and credit unions are:

- Fast and effective problem-solving. Interaction on the Internet avoids many unnecessary steps, such as the opening conversation, which is an integral part of offline communication. Therefore, banks can save on customer support costs.

- Personalization. Omnichannel makes it possible to offer clients a solution to their problems, providing a unique customer experience.

- Decrease in the number of physical departments. With omnichannel, banks can reduce the need to open new offline branches because customer service takes place over digital communication channels.

One of the most global omnichannel banking solutions is provided by IBM. Their multichannel strategy allows anytime, anywhere, any device access with a consistent experience across channels relying on big data. Thus, with IBM’s omnichannel, banks can not only fulfill customers’ explicit needs but also anticipate their wants and likes.

AI-powered systems

Artificial intelligence-based solutions such as virtual agents (computer-generated animated characters acting as online advisors), analytical services, and recommendation systems (algorithms for improving goods and services) are today driving the progressive development of the banking industry. Because AI can efficiently process much larger amounts of information, self-learn, and accumulate knowledge at a record high speed, technological solutions based on it provide improved interaction between users and financial institutions.

Also, using artificial intelligence, software developers implement sophisticated network security systems that automatically detect anomalous activity and block threats. For example, recently, CaixaBank partnered with Revelock to develop an innovative AI and biometrics-based security solution for financial data protection. In particular, it detects suspicious alterations in customers’ behavior patterns within online transactions, thus identifying fraud.

E-Wallets

Electronic wallets are electronic means of payment. With the help of an e-wallet, users can send and receive money transfers, pay for goods and services without using cash or their bank account. Although internet banking is a direct alternative to e-wallet, they can still be used by banks and complement existed internet banking apps. The second option may be relevant for making secure payments.

In this way, expanding the current number of services with the capabilities of a digital banking wallet can eliminate the need for branches and provide revenue streams from transactional and non-transactional user actions. A particular example of such a solution is Walletfactory’s MFS Enabler platform. It’s based on a processing center for e-money and enables making payments and transfers via e-wallets. Using this platform, banks can get new revenue streams.

How Fintech Affects the Future of the Banking Industry

And now is the central question: how will fintech affect banks? Summarizing the above, the fintech’s impact on the future of banking will be the most noticeable in such aspects:

- enhancing competitiveness;

- improving the quality of customer service;

- reducing the number of physical branches of the bank and human resources;

- maximizing the efficiency of work processes;

- opening up new investment opportunities;

- providing end-to-end security;

- optimizing risk management processes.

All these prospects of the impact of fintech on banks promise us rapid growth of the fintech industry: according to predictions, in the next year, 2022, the global fintech market will cost about $309.98 billion (in 2018, the same figures were only about $127.66 billion).

Development of Fintech Products with TechMagic

The TechMagic team has deep expertise in FinTech software development and can help you build robust, secure, and competitive financial tools of any complexity. Learn more about our experience via our case studies for existing financial companies.

TIDE

Tide is a B2B fintech and banking solution for small and medium businesses that provides access to basic and advanced financial services through a user account. It was developed for mobile iOS-based devices. As for the tech stack, we used Swift.

TOMATO PAY

Tomato Pay is an API-based self-service software solution for the fintech and banking industry and, in particular, financial partners. It gives users access to customer data, risk assessment, and customer acquisition, as well as the ability to customize product targeting. To implement this project, we used React.

a BPM app using JavaScript stack and Serverless on AWS

Conclusion

We hope we have helped you to understand why fintech is important for banks. As you can see, banks that use fintech app development services are able to provide for themselves long-term prospects for successful development and high competitiveness. If you want to get the same opportunities for your financial institution, contact TechMagic.

Software Development

Software Development Security Services

Security Services Cloud Services

Cloud Services Other Services

Other Services

TechMagic Academy

TechMagic Academy