Biometrics in Banking: Unlocking Security and Efficiency

Last updated:12 January 2025

It all started with spy movies: fingerprint capture, retina scanning, and facial recognition. It seemed like a fantasy that was only possible on the screen. However, today, all this is called the simple word biometrics and is actively used in the field of security.

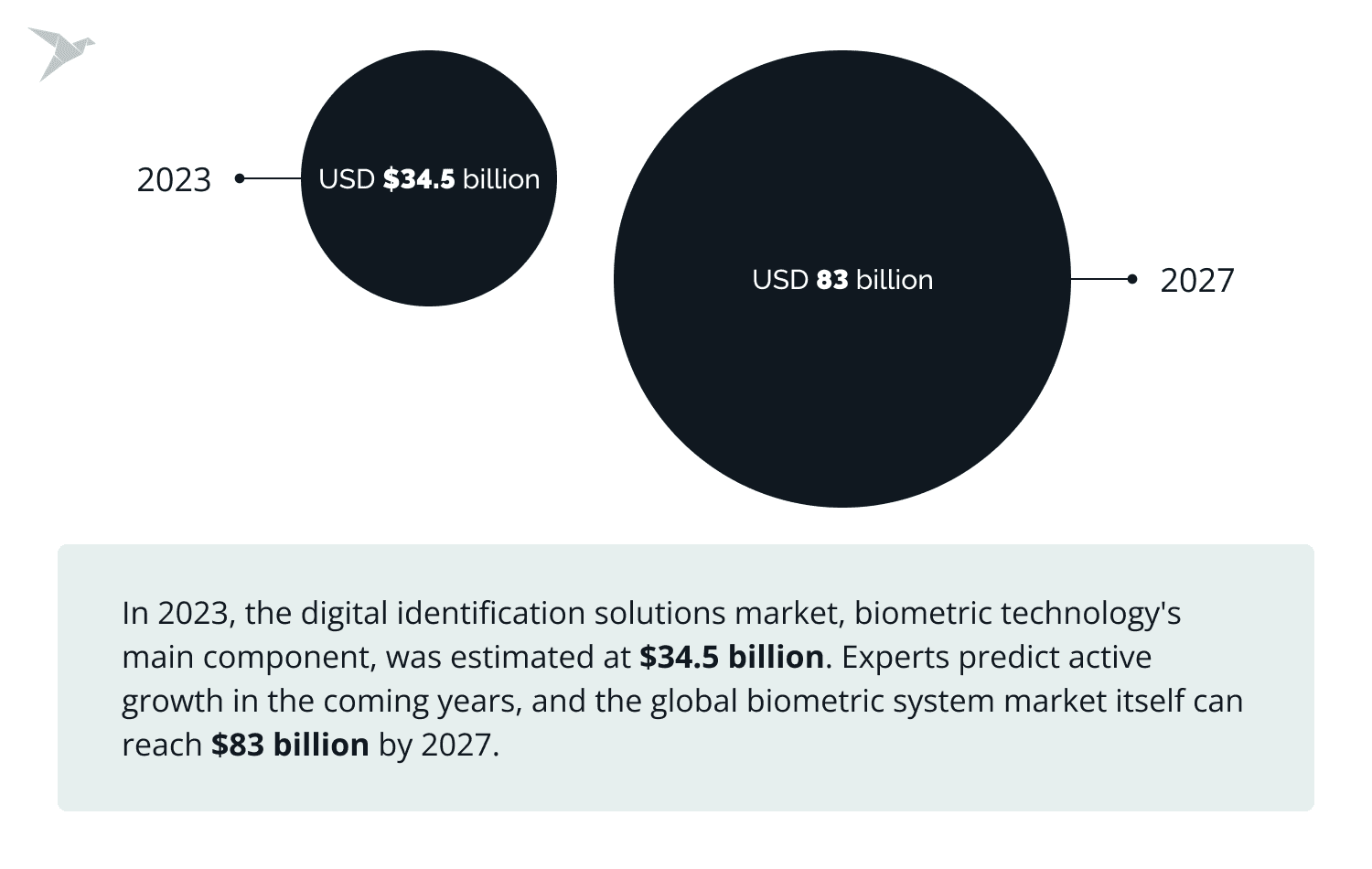

This form of authentication and access control is especially often used in banking and financial services. In 2023, the digital identification solutions market, biometric technology's main component, was estimated at $34.5 billion. Experts predict active growth in the coming years, and the global biometric system market itself can reach $83 billion by 2027.

What Are Banking Biometrics?

Biometrics in financial digital services, in most cases, concerns the protection of users' financial and personal data and the conduct of financial transactions. In this case, the system makes payments by confirming certain bodily attributes, such as fingerprints, for instance.

Biometrics is very popular. It reduces the chances of theft and misuse of financial data due to each user's unique information and its impossibility to copy. Today, all reliable banking service providers use biometrics.

One of the notable examples of using biometrics is Amazon One – a palm-reading system that allows users to securely connect their fingerprints to their bank accounts for faster online transactions.

Here are some statistics:

- The 2023 Statista survey found that nearly half of the businesses in the retail and financial services industries plan to implement passwordless authentication in the next one to three years.

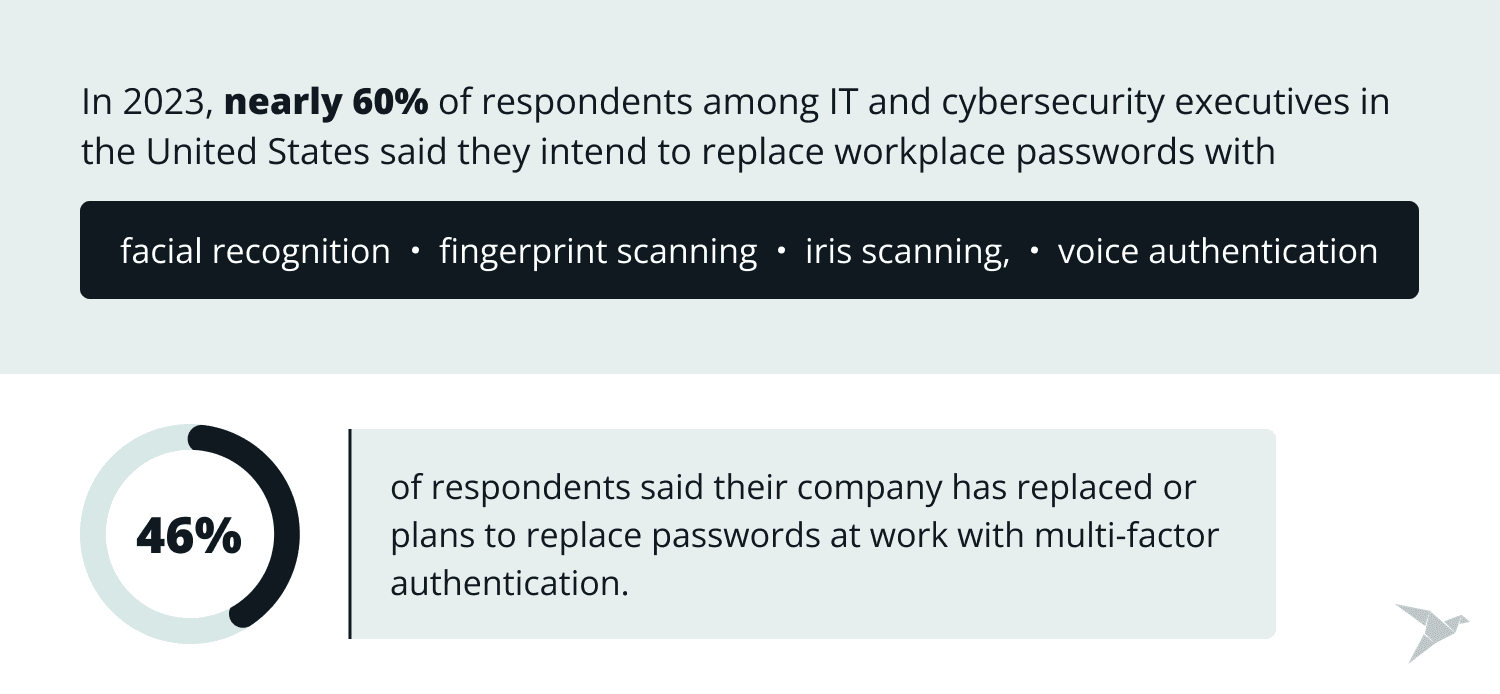

- In 2023, nearly 60% of respondents among IT and cybersecurity executives in the United States said they intend to replace workplace passwords with facial recognition, fingerprint scanning, iris scanning, or voice authentication.

- 46% of respondents said their company has replaced or plans to replace passwords at work with multi-factor authentication.

Main Types of Biometrics in Banking

Biometrics in banking is about convenience and security. What types of biometrics are the most common? Let's take a look at them.

- Finger or palm print recognition. These are the easiest ways for users to authenticate.

- Facial recognition.

- Voice recognition.

- Iris scan. This method is not as popular as the previous two, but the trends are on its side.

- Infrared image. Manufacturers of connected watches are about to introduce such a technique to recognize the veins on the wrist.

Biometric Banking Implementation

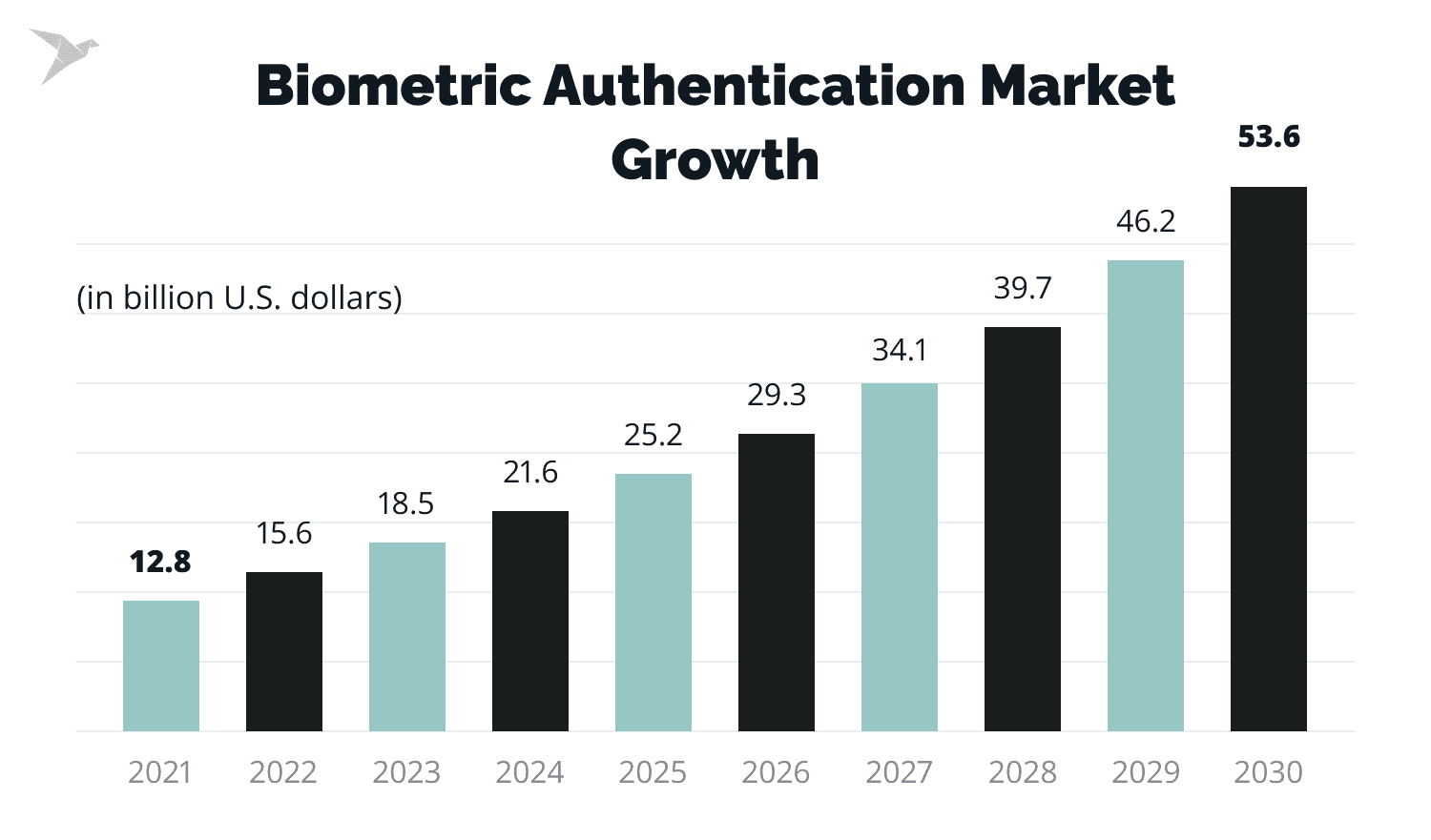

Biometrics is the basis of passwordless authentication, which is actively spreading worldwide. Experts estimated this market at more than $15 billion in 2022. According to forecasts, it will exceed $53 billion by 2030.

Let's take a closer look at how financial institutions implement biometrics.

Biometric authentication for ATM transactions

Self-service ATMs use biometric security means to verify clients. A biometric check can serve as a unique customer identifier in combination with other security means such as a payment card, mobile device, or additional credentials, i.e. a PIN.

Basic biometric measurements in such cases usually involve biometric palm prints or finger veins. They are very precise and difficult to reproduce. Such authentication offers a reliable mechanism for verifying the customer's identity, reducing the risk of unauthorized access and fraud. In addition, some biometric ATMs may contain other features, such as iris recognition.

Some stats

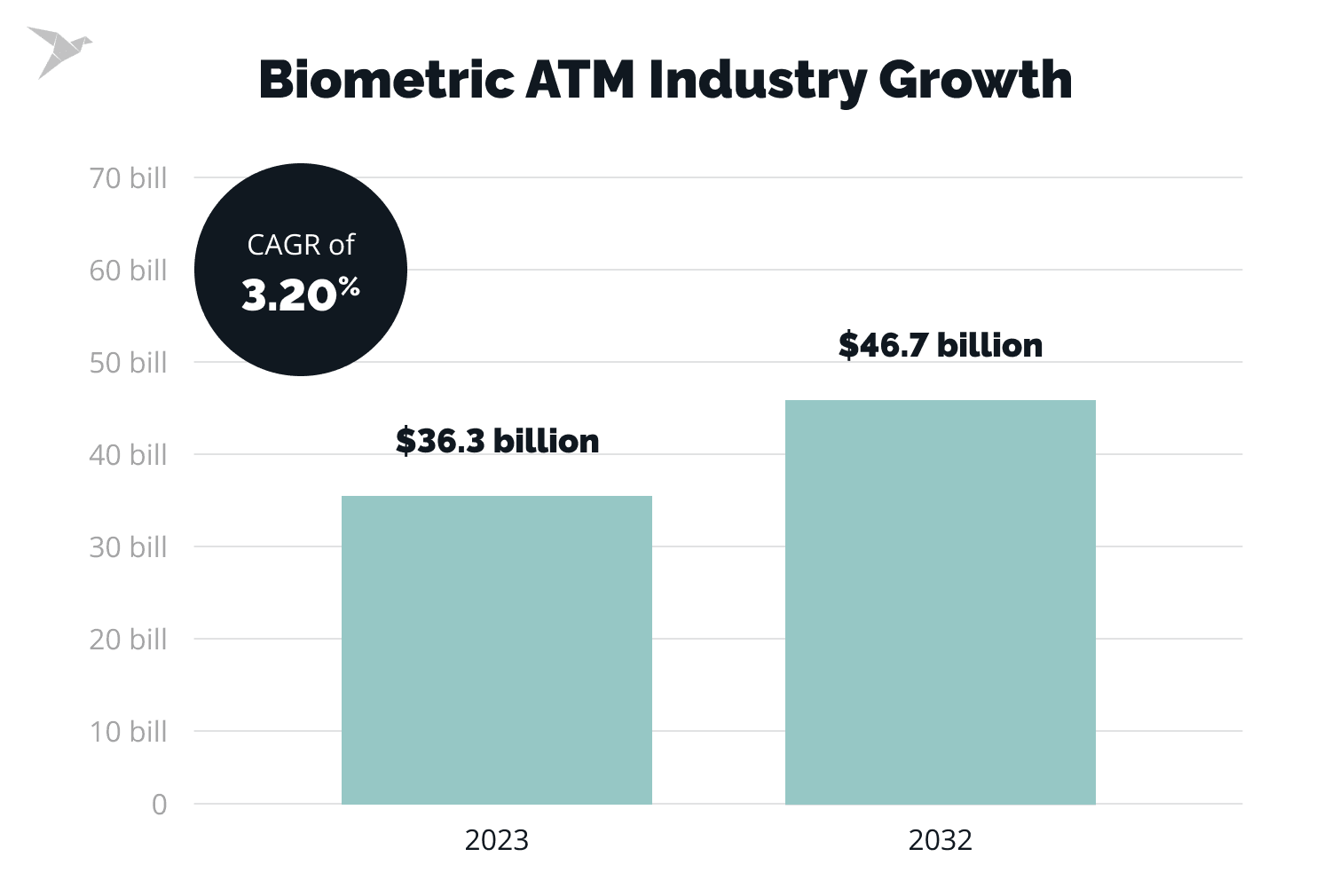

Several well-known companies are actively developing and installing biometric ATMs, including NCR Corporation, Diebold Nixdorf, and Hitachi-Omron Terminal Solutions. According to Market Research Future, the biometric ATM industry will grow from $36.3 billion in 2023 to $46.7 billion by 2032, at a CAGR of 3.20%.

Moreover, in many countries, such ATMs will become a major way to prevent fraud.

Today, such products are expensive and have difficulties with consumer perception. However, experts say that they will become cheaper with the development of technology, which will, in turn, lead to wide adoption. Potential future trends include multimodal authentication on mobile devices, integration with banking applications, and the continued growth of the biometric ATM market.

Voice recognition for customer service authentication

Voice recognition, as the name implies, analyzes voice-related data, such as frequency, speed, etc., to confirm an identity. Based on Artificial Intelligence and Machine Learning, it evaluates speech modulation, accent, and even tones to create a unique voice impression. In essence, this is a reference template for customer identification.

So far, in the banking sector, this technology has come into use in phone customer service. However, in the near future, such biometric verification technology can be useful for conducting transactions through voice assistants.

Accessibility

Voice recognition is part of the approach to accessibility and inclusiveness of banking services. People who cannot visit a bank branch for some reason or have difficulties using mobile apps can confirm their identity. This way, they access information about their products or make one-time transactions.

Safety of use

What should you know about such biometrics? It provides a higher level of security compared to traditional passwords. Voiceprints are encrypted, which makes them difficult to decode even if accessed.

In addition, every interaction with a voice-activated IVR system records the user's voice, helps to identify fraud, and prevents further unauthorized attempts.

Some stats

According to the Statista report, the global voice recognition market will grow steadily in the coming decade. It is projected to reach $50 billion by 2029 at a CAGR of 23.7%.

Facial recognition for mobile banking logins

Facial recognition technology works similarly to how our eyes and brains identify people. We analyze facial features, focus on certain details, compare them with the information we have, and decide whether we know the person.

The technology also checks traits to create a unique mathematical pattern associated with a person's identity. Mobile phone or computer cameras capture images and analyze them based on factors such as the distance between the eyes, the position of the nose, the size of the forehead, etc.

Facial recognition usage

Face authentication in banks is used for various purposes, the main of which are:

- For operations with your bank account. For example, it is enough to take a selfie on your smartphone and take a photo of your ID to open an account without visiting a bank branch.

- Identity verification for changes to accounts or terms of service.

- Mobile banking logins using a smartphone camera.

- Online transactions (including Apple Pay, Google Pay, AliPay, etc. platforms).

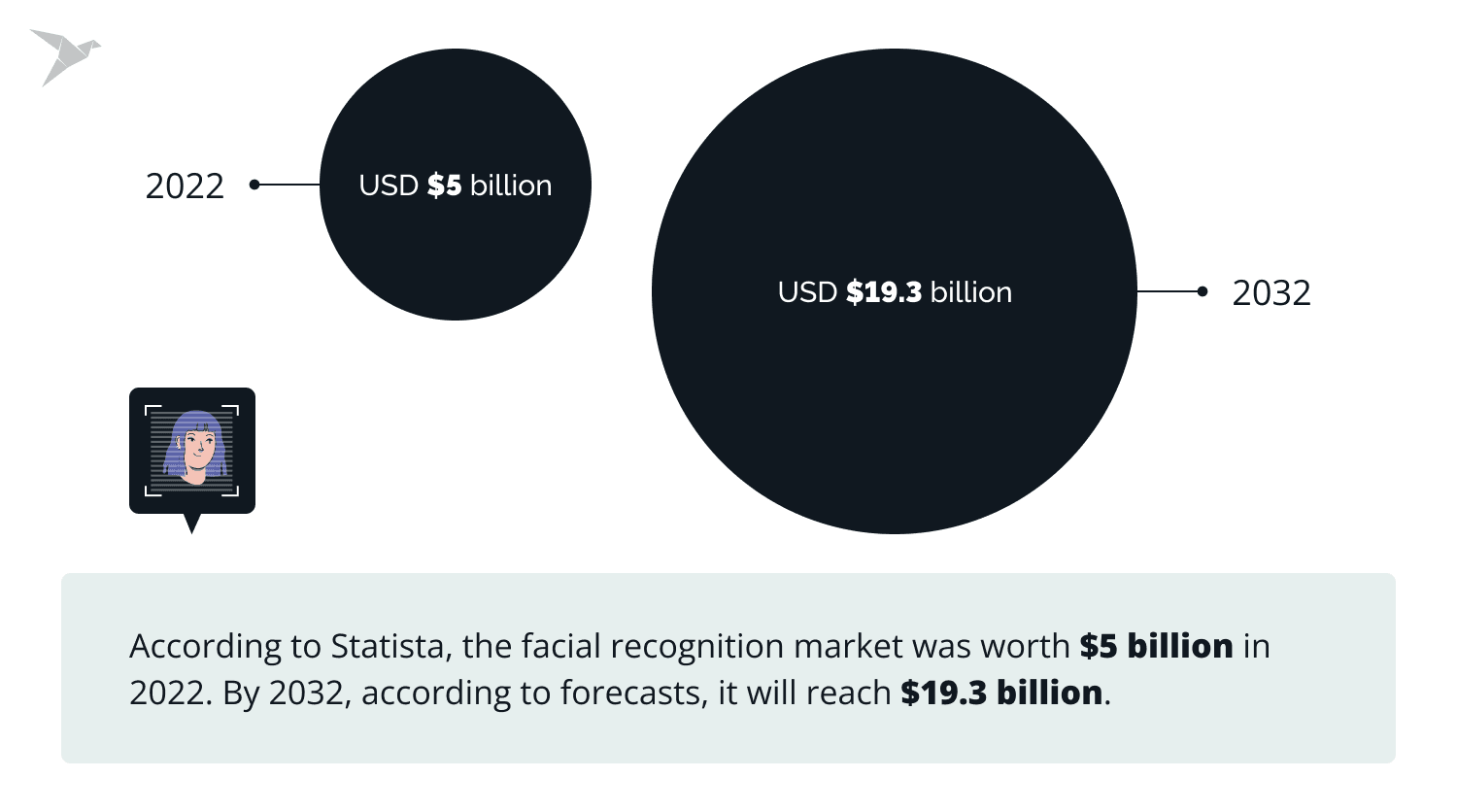

Some stats

According to Statista, the facial recognition market was worth $5 billion in 2022. By 2032, according to forecasts, it will reach $19.3 billion. Experts say AI-based facial recognition technology plays a crucial role in identifying people by reading their facial features.

Benefits of Biometrics in Banking

Let's take a closer look at the main reasons for implementing biometrics in banking.

Enhanced security and fraud prevention

Fraud evolves with technology. Data theft is becoming a growing problem for both financial organizations and banking customers. From this point of view, banking biometrics are a more reliable authentication method since such data are more difficult to forge or steal than passwords.

How biometrics can reduce fraud

Biometric authentication is one way to prevent identity theft or account hijacking. Such systems can detect anomalies in user behavior, signaling potential fraudulent activity. In such cases, banks are instantly notified in real-time, allowing them to take immediate action.

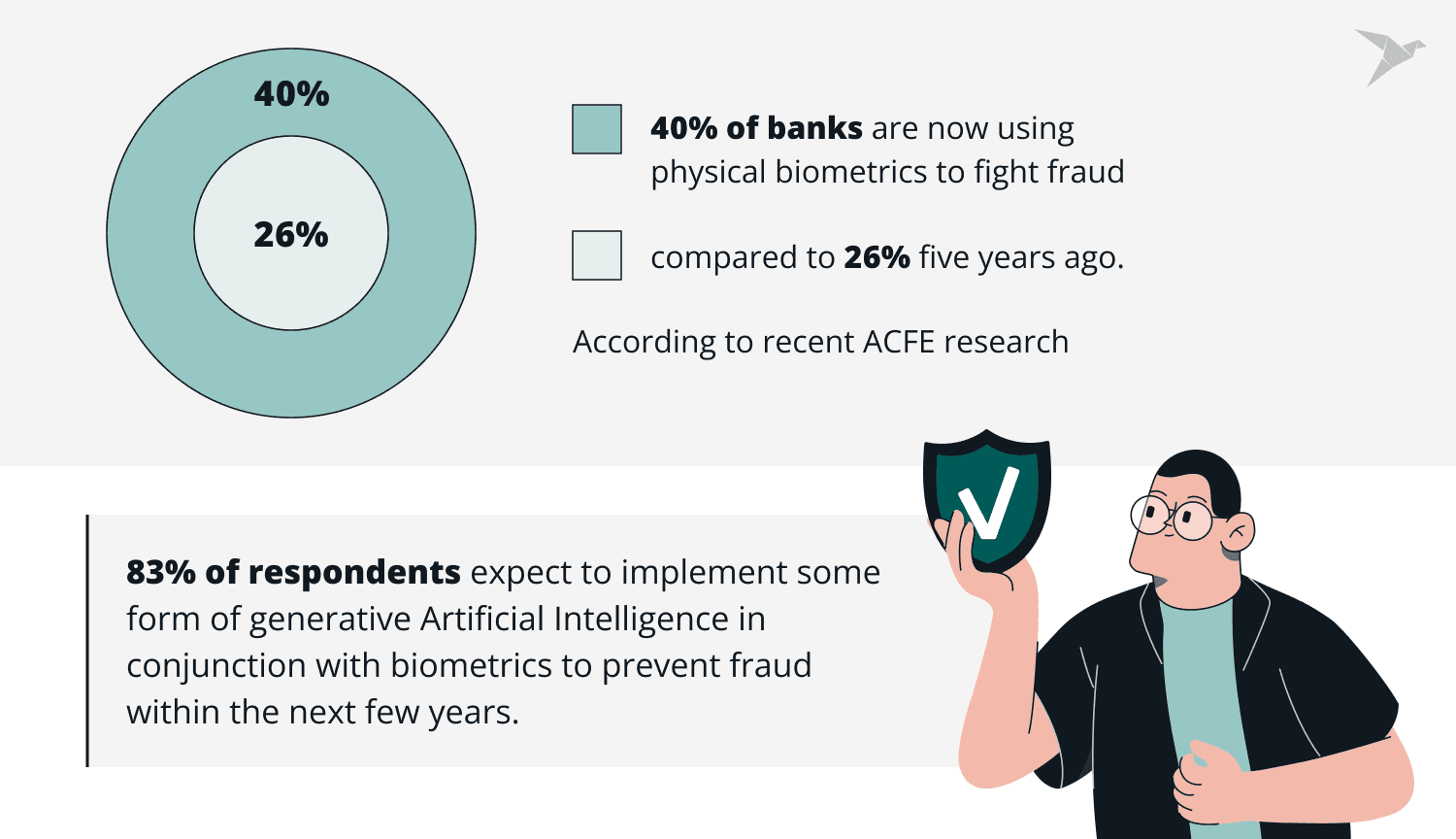

Some stats

According to recent ACFE research, 40% of banks are now using physical biometrics to fight fraud, compared to 26% five years ago.

Also, an important trend is that 83% of respondents expect to implement some form of generative Artificial Intelligence in conjunction with biometrics to prevent fraud within the next few years.

Improved customer experience and convenience

First and foremost, in terms of user experience, implementing biometric authentication in banking offers customers a convenient alternative to remembering complex passwords. This is much faster and easier than managing physical security keys.

However, these are not the only improvements to the user experience.

- Accessibility. Using fingerprints, facial recognition, or voice, customers can seamlessly access their accounts at any time.

- Uniqueness. Because biometric authentication relies on unique physical characteristics, users get a sense of safety and security.

- Convenience. In mobile banking, biometric authentication simplifies account access compared to traditional methods.

- Lower bounce rate. This not only improves convenience but also lowers failure rates when opening an account or making digital transactions, especially when security measures are cumbersome.

- Financial availability. Biometrics enables secure digital transactions for individuals who do not have official identification documents. This technology extends banking services to mobile consumers, protects the assets of vulnerable people, and improves accessibility for people with cognitive disabilities.

Some stats

Statista survey conducted in July 2023 in the United States revealed that approximately 62 % of respondents who had made online purchases within the past 30 days expressed a high likelihood of using biometrics for payments. Moreover, over 52% of respondents were willing to use biometrics if more merchants accepted this payment method.

Operational efficiency and cost savings

Banks that use biometric verification methods can reduce the need for manual checks and investigations, leading to increased operational efficiency. This method of authentication can also significantly increase efficiency due to the following advantages.

- Customers do not have to remember and enter complex login credentials. In this way, biometrics reduces the time and effort required to access banking services.

- With biometrics, financial institutions can significantly reduce the risk of fraud and identity theft. This, in turn, reduces the number of fraudulent transactions and associated operating costs.

- Automate banking transactions such as fund transfers, bill payments, inquiries, etc. Thanks to the integration of biometrics directly into banking applications and ATMs, customers can initiate and complete transactions quickly and efficiently without additional verification steps.

- Biometrics can also help increase customer satisfaction and loyalty, ultimately contributing to higher retention rates and profits for financial institutions.

Some stats

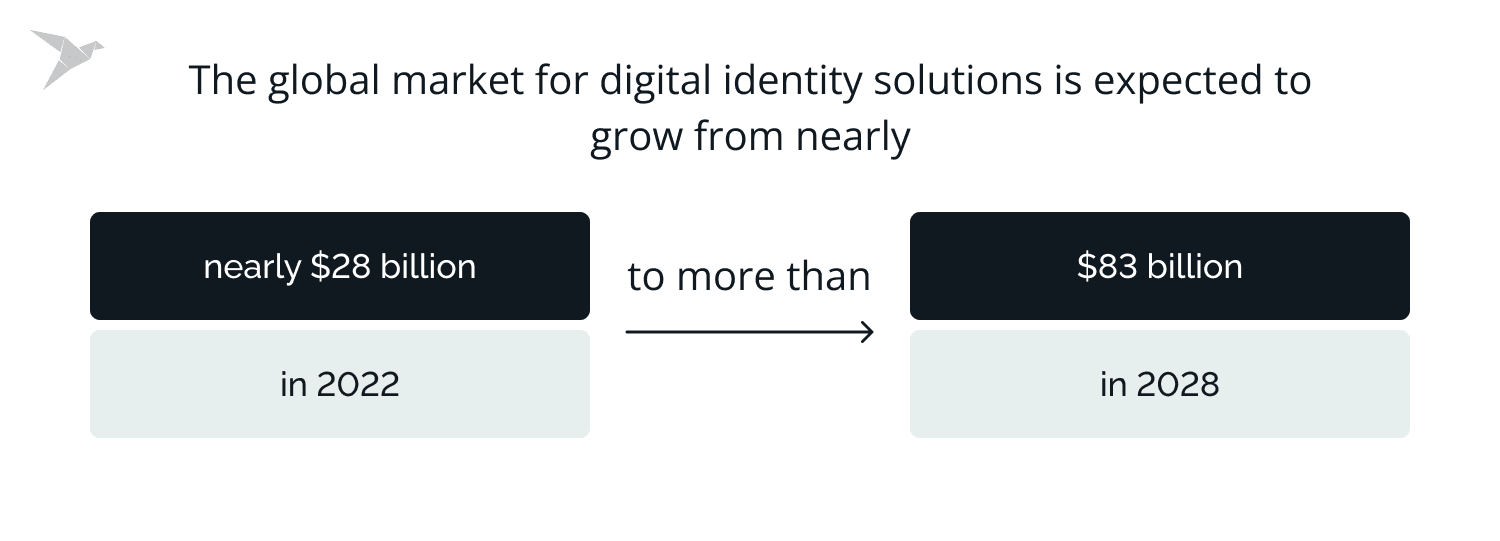

The global market for digital identity solutions is expected to grow from nearly $28 billion in 2022 to more than $83 billion in 2028.

Challenges and Considerations

Bank biometrics offers increased security measures compared to traditional authentication methods. However, despite the benefits, banks must consider significant challenges and considerations.

Privacy concerns and regulatory compliance in bank biometrics

One of the most important challenges in implementing biometric banking systems is resolving privacy issues and ensuring compliance with regulatory standards.

This primarily concerns biometrics such as facial recognition scans or fingerprints. Therefore, as a financial institution, you will have to comply with strict rules regarding the collection, storage, and use of biometric information.

In addition, there are several other critical challenges in this area.

- Despite advances in biometric technology, attackers use vulnerabilities to gain unauthorized access to a user's data.

- Deepfake technology creates a new challenge for biometric systems. Deep fakes can confuse biometric authentication methods, making it difficult for systems to distinguish a real person from a fake one.

- Regulatory requirements regarding collecting and using biometric data vary across countries and legal systems. However, they have one thing in common — they are very strict. Banks must navigate these regulatory complexities and ensure compliance with privacy and data protection laws. This often requires a lot of effort and money.

How to deal with it?

One effective way for a bank to reduce regulatory and security risks is through on-device storage. In this case, biometrics such as a fingerprint or face may be stored on the end user's device.

The system does not store the actual image of a fingerprint or face but a digital code. The smartphone scans the fingerprint and converts this information into a mathematical representation, which it securely stores in a secure area of the device's memory. The device's storage can be used to store biometric data through a chip that keeps the data separate from the device's network.

By storing data on the authentication device itself, you reduce regulatory risk. First, it allows you to avoid man-in-the-middle attacks because biometric data does not go beyond the local storage. Second, you don't store any sensitive data on servers in large databases, which partly waives your responsibility.

Scalability and integration with existing systems

Another important factor to consider is scalability and integration with existing systems. This is incredibly important for banks implementing such biometrics for the first time.

Issues often arise when combining biometric and traditional authentication. Mixing these approaches can reduce the risk of vulnerability and provide robust security measures.

However, you should do it with the help of experienced specialists. They can handle technical debt (if any), prepare your system for integration, create an optimal and scalable infrastructure, and conduct proper testing.

Future Trends

Here are only some of the future trends in biometric authentication, but they are the most prominent.

Passkeys

Passkeys are one of the trendiest authentication methods that use biometric data. Unlike standard passwords, which are based on a string of letters, numbers, and symbols, passkeys use a biometric element unique to each user, such as a fingerprint, face scan, or other biometrics.

How does it work?

Passkeys can be physical, for example, in the form of USB devices or smart cards. In this case, banks provide customers with a card reader that generates a unique access key each time they try to log in or perform actions on their account.

However, a more convenient and promising option is passkeys that use biometric data. They are not only fast but also effective. Only an authorized user can access a protected account or system.

For improved security, passkeys are often integrated into multifactor authentication systems, combining the user's password with his physical token in the form of biometric data.

Passkeys in the finance sector

Tech giants like Apple and Microsoft already use passkeys and support them in their products. This approach is also heavily used by Mastercard, which has joined a technology industry initiative called Fast Identity Online, or FIDO. FIDO standards create encrypted passkeys that are stored on smartphones.

Only the user's biometrics can unlock this access key, giving you access to the app or website. Such authentication can be used on various devices: smartphones, tablets, and laptops. User data is stored on a personal device.

FIDO passkeys are also highly resistant to phishing because they don't share passwords or codes. They are also interoperable, as they can work on different devices in different parts of the world. Experts say more than 4 billion smart devices are ready for FIDO passkey implementation.

When comparing passkey vs password, it's clear that passkeys can offer a more secure and user-friendly alternative to traditional passwords.

Iris scanning

Iris scanning is gaining popularity as a reliable method of identity verification. Its essence is to check people based on the unique patterns found on their irises.

Airports originally used iris scanning for security screening. However, it has now become part of banking security. For example, Bank of America and National Bank of Qatar have implemented iris scanning programs at ATMs to improve security and simplify customer authentication processes.

Behavioral biometric intelligence

AI-based behavioral biometric intelligence involves the analysis of user interaction patterns. It thoroughly checks your typing, swiping, mouse movements, device input, etc. Today, it is one of the most promising and transformative technologies for combating fraud.

Traditional biometrics and BBI

There are some differences between conventional biometrics and behavioral biometrics. Behavioral biometrics technology identifies and recognizes people's unique behavior using all the capabilities of AI and ML.

Unlike physical biometrics, which relies on immutable characteristics, this technology focuses on individual dynamic actions. It meticulously tracks every small detail.

How does it work?

- Analysis of typing speed and keystroke movements establishes a baseline for normal behavior. Any sudden changes may trigger a fraud alert.

- Tracking individual mouse movements and interactions with web or mobile applications reveals unusual patterns.

- Viewing clicks, finger movements, and touch patterns on device screens helps identify consistent user behavior and detect anomalies.

- Monitoring the devices clients use to access their accounts detects suspicious logins from unfamiliar devices.

- AIdetectst login attempts from unfamiliar locations or suspicious IP addresses to activate additional security measures.

Behavioral data analysis creates unique customer profiles, allowing the detection of non-patterned behavior or unusual transactions.

Integration of AI and Machine Learning

Artificial Intelligence and Machine Learning is an absolute trend in many industries. Of course, they will also change the biometrics in the banking sector.

These technologies increase biometric systems' performance due to fast and accurate data analysis. In addition, the evolution of AI in the banking sector is also about adapting to changes in user behavior.

What awaits online banking with the use of AI in the future?

- Systems based on artificial intelligence will more accurately analyze biometrics and better understand user patterns and behavior. This, in turn, should minimize false positives and false negatives.

- AI algorithms that detect anomalies in real time will be more actively used to identify potential security threats quickly.

- Banks will more actively engage AI-based technologies to monitor user interaction and system biometrics continuously. This will enable more effective notification of suspicious activity, rapid intervention, and mitigation.

- Voice and face recognition technologies supported by artificial intelligence have great potential.

As AI and ML continue to evolve, their integration into biometric systems holds immense promise for delivering secure and user-friendly banking experiences.

Wrapping up

Biometrics in banking is an absolute trend and the future of the industry. Financial institutions are increasingly using fingerprints, retina scans, voice or facial recognition as the primary means of customer identification. Such data is much more difficult to steal or copy than a password. However, deepfake technology is a certain challenge for cyber security services.

Nevertheless, the future belongs to biometrics in combination with AI. We at TechMagic have enough experience and expertise to implement the latest developments in this field. So, if you plan to use biometrics and need expert help, we'll happily assist. Just contact us.

FAQ

How do biometrics improve security in banking?

Authentication systems such as biometric fingerprint payment systems or face recognition in ATMs greatly improve banking security. Because biometrics are unique to each person, they cannot be transmitted or shared digitally. Financial organizations use biometrics in addition to traditional means (passwords or PIN codes) or as a separate method of passwordless identification.

What are some real-world examples of biometric implementation in banking?

The simplest example of using biometrics for payments is Google Pay and Apple Pay. As for banks, Japan Seven Bank uses facial scan in its ATMs. Qatar National Bank went further and implemented iris recognition for ATM customer service.

As for the United States, at least 30 banks use biometric authentication for mobile and web applications, including Bank of America, InTrust Bank, and California Commerce Bank.

What benefits do biometrics offer for banks and their customers?

Biometric authentication in banking is highly secure and convenient. It saves time and effort for both clients and banks. It also automates some operational processes and make any financial operations faster.

What are the different biometric technologies used in banking?

The difference may lie in the biometrics banks use for authentication and security purposes. It can be a full fingerprint or facial recognition, retina scan, etc. In addition, some banks already use biometric and behavioral data tracking (swipes, mouse movements, screen movements) to detect anomalies and prevent fraud.

What challenges should banks consider when implementing biometric payment solutions?

Biometrics for banks is an advanced and reliable technology; however, like any improvement, it needs:

- strong security methods;

- updating or replacing outdated software;

- wide scaling capabilities;

- updating the bank's technical capabilities.

In addition, difficulties may arise with integration, so you should always involve experts.

What are the future trends and advancements in biometrics for digital banking?

The most prominent future trends are iris scanning, behavioral biometric intelligence, and AI and ML.

Software Development

Software Development Security Services

Security Services Cloud Services

Cloud Services Other Services

Other Services

TechMagic Academy

TechMagic Academy